US stock market opened mixed today as seen from major index futures ahead of the Federal Reserve’s policy update. Traders will look for clues about the outlook for rates, while the Fed is expected to widely leave interest rates unchanged. Also, the dollar advanced against most major currencies. Treasury yields fell on Wednesday ahead of policy decision.

The S&P 500 index declined 0.21% to 2,649.28, and Dow 30 fell 0.25% to 24,039.75, while Nasdaq inched up 0.07% to 7,135.34. Elsewhere, shares at Asian markets ended mostly lower on Wednesday, while European stocks are trading higher.

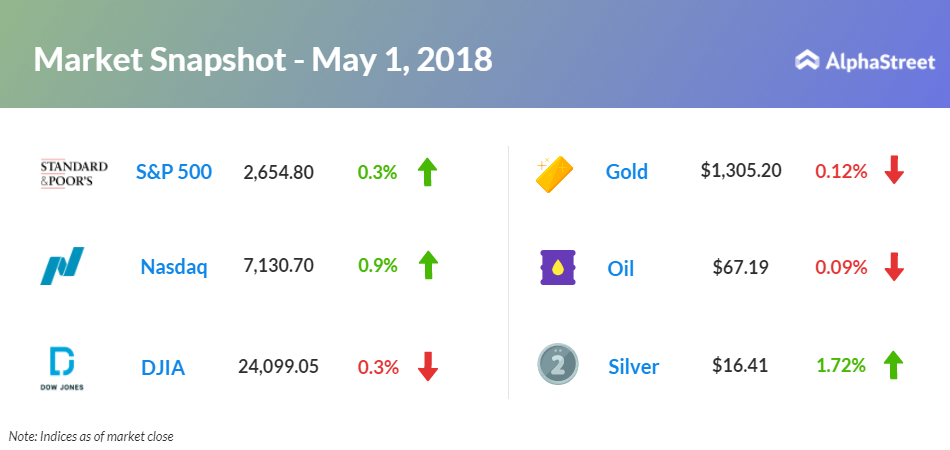

On May 1, US ended mixed, with Dow down 0.3% to 24,099.05. Nasdaq advanced 0.9% to 7,130.70, and the S&P 500 gained 0.3% to 2,654.80.

On the economic front, the Automatic Data Processing (ADP) report showed an increase in the private sector employment in the month of April. Private sector employment grew by 204,000 jobs in April after rising by a revised 228,000 jobs in March, while the national jobless rate currently sits at 4.1%.

The Federal Open Market Committee or FOMC meeting will be announced at 2 pm ET. The market is expecting an increase of 1.625% compared to previous forecast level of 1.50-1.75%.

On the earnings front, Mastercard (MA) stock rose 2.55% after upbeat first-quarter results. CVS Health (CVS) stock slid 2.81% despite better-than-expected first-quarter earnings. Shares of Garmin (GRMN) increased 3% after first-quarter sales and earnings topped estimates. Chesapeake Energy (CHK) stock declined 1.68% after first-quarter revenue missed consensus. Automatic Data Processing (ADP) stock grew 2.61% after lifting fiscal 2018 earnings guidance and upbeat first-quarter results.

Today’s notable after-market earnings announcements include: Sprint (S), MetLife (MET), Prudential Financial (PRU), Marathon Oil (MRO), American International Group (AIG), Tesla (TSLA), Fitbit (FIT), Spotify (SPOT), FireEye (FEYE), Square (SQ), 3D Systems (DDD), Williams Companies (WMB), Rayonier (RYN), Apache (APA) and Hologic (HOLX).

Crude oil future is down 0.09% to $67.19. Gold is trading down 0.12% to $1,305.20, while silver is up 1.72% to $16.41. On the currency front, the US dollar is trading up 0.12% at 109.98 yen. Against the euro, the dollar is down 0.30% to $1.1955. Against the pound, the dollar is down 0.13% to $1.3595.