US stocks are set to open mixed after ending in red on Tuesday, as investors were concerned about the doubts surrounding the US-North Korea summit. Traders also assessed the impact of a jump in bond yields, which went above the 3%. The S&P futures slid 0.03% to 2,708.25, and Dow futures declined 0.04% to 24,649, while Nasdaq inched up 0.05% to 6,893.75 at 8:45 am ET. Elsewhere, shares at Asian markets closed broadly lower on Wednesday, while European stocks are trading mostly higher.

On the European economic front, data from the Croatian Bureau of Statistics showed that Croatia’s consumer price inflation accelerated to 1.3% in April from 1.1% in March. Central Statistics Office report revealed that Ireland’s foreign trade surplus increased to EUR 4.03 billion in March from EUR 3.96 billion in February. Istat data showed that Italy’s industrial orders rose 0.5% on month in March after falling 0.8% in February.

Eurostat report revealed that Eurozone inflation eased to 1.2% in April from 1.3% in March. Turkstat data showed that Turkey’s industrial production growth eased to 7.6% in March from 10.1% in February. Destatis report revealed that Germany’s consumer prices grew 1.6% on year in April, the same rate as seen in March. Central Bureau of Statistics data showed that Dutch retail sales growth eased to 1.5% in March from 2.8% in February.

On the Asian economic front, data from the Cabinet Office showed that Japan’s GDP contracted 0.6% on year in the first quarter after rising 0.6% in the fourth quarter. As per the Ministry of Economy, Trade and Industry report, Japan’s industrial production grew 1.4% on month in March, more than initially estimated 1.2% growth. Australian Bureau of Statistics data showed that Australia’s wages grew 0.5% sequentially in the first quarter, the same rate of growth as seen in the fourth quarter. Thailand’s central bank kept its key interest rate unchanged at 1.50% as it expects the economy to continue to gain further traction.

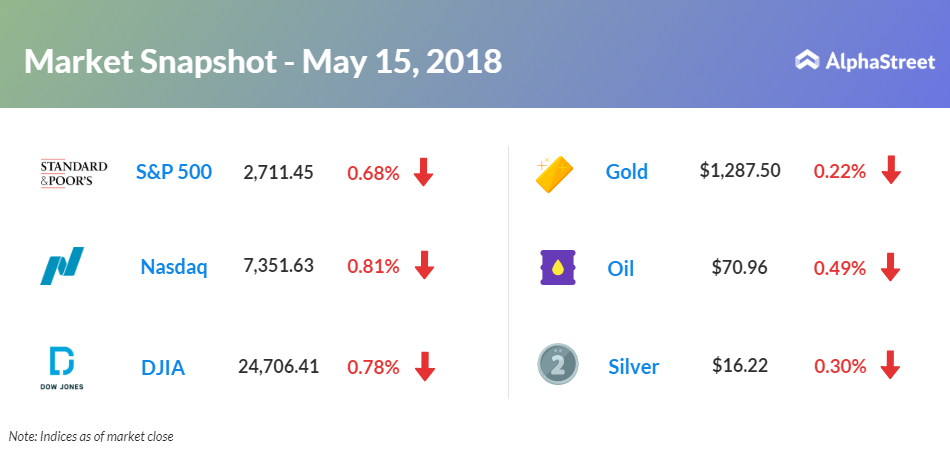

On May 15, US ended lower, with Dow down 0.78% to 24,706.41. S&P 500 slid 0.68% to 2,711.45, and Nasdaq fell 0.81% to 7,351.63. Traders reacted to an increase in US treasury yields that came after a Commerce Department’s retail sales report. Retail sales rose by 0.3% in April after increasing 0.8% in March. National Association of Home Builders report revealed that homebuilder confidence rose to 70 in May from 68 in April.

Meanwhile, key economic events scheduled for today include the Commerce and Housing & Urban Development Department’s housing starts data, Fed’s industrial production data, Atlanta Fed business inflation expectations, and the Energy Information Administration’s petroleum status report. Atlanta Federal Reserve Bank President Raphael Bostic and St. Louis Federal Reserve Bank President James Bullard will be giving speeches today.

Key companies reporting earnings today include Macy’s (M), Cisco Systems (CSCO), Canadian Solar (CSIQ), Take-Two Interactive Software (TTWO), and Jack in the Box (JACK).

On the corporate front, Macy’s stock grew 6.92% in the premarket after lifting guidance for fiscal 2018. 3M Co. (MMM) stock slid 1.05% in premarket trading after brokerage firm Jefferies downgraded the shares to “hold” from “buy”. Abaxis (ABAX) stock climbed 14.91% in the premarket after Zoetis (ZTS) announced plans to buy Abaxis for $83 per share in cash. Boot Barn Holdings (BOOT) stock jumped 16.35% in premarket after upbeat first-quarter results. Verastem (VSTM) stock fell 13.55% before the opening bell, after announcing a $35 million common stock offering.

Crude oil futures are down 0.49% to $70.96. Gold is trading down 0.22% to $1,287.50, and silver is down 0.30% to $16.22. On the currency front, the US dollar is trading down 0.15% at 110.161 yen. Against the euro, the dollar down 0.58% to $1.1769. Against the pound, the dollar is down 0.32% to $1.3462.