The S&P futures gained 0.03% to 2,752.25, Nasdaq advanced 0.03% to 7,048.75, while Dow futures declined 0.06% to 24,892. Elsewhere, shares at Asian markets closed lower on Friday, while European stocks are trading higher.

On the European economic front, data from Eurostat showed that Eurozone inflation eased to a revised 1.1% in February from 1.3% in January. Destatis data revealed that Germany’s wholesale price inflation slowed to 1.2% in February from 2% in January. Statistics Austria data showed that Austria’s consumer prices grew 1.8% on year in February, the same rate as seen in January.

On the Asian economic front, data from the Ministry of Economy, Trade and Industry revealed that Japan’s industrial production fell 6.8% in January after rising 2.9% in December. Business NZ data showed that New Zealand’s performance of manufacturing index fell to 53.4 in February from 54.4 in January. The Cabinet Office report showed that Japan’s economy will continue to recover at a moderate pace, supported by the effects of policies.

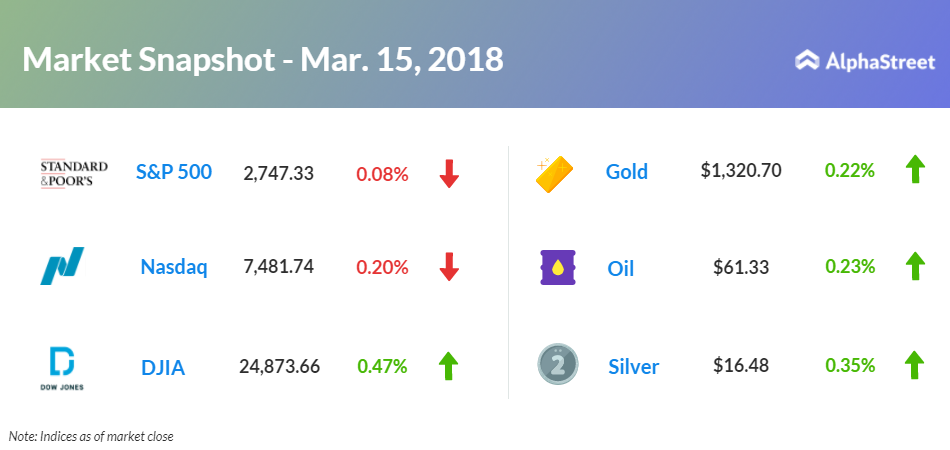

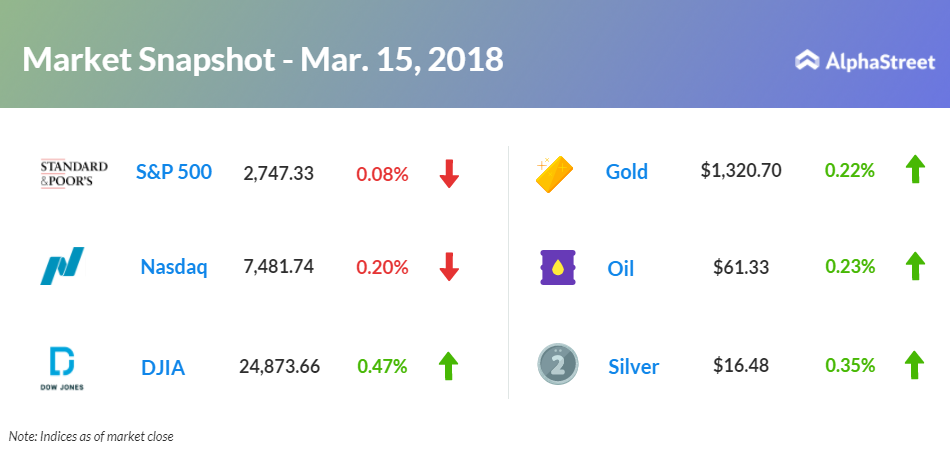

On March 15, US ended mixed, with Dow up 0.47% to 24,873.66. However, Nasdaq slipped 0.20% to 7,481.74, and S&P 500 tumbled 0.08% to 2,747.33. The markets were hurt by Trump’s comments that renewed geopolitical concerns.

The Labor Department data showed that initial jobless claims fell to 226,000 from last week’s 230,000. Another data revealed that import prices rose by 0.4% in February after increasing 0.8% in January, and export prices rose 0.2% in February after climbing 0.8% in January.

Meanwhile, key economic data that will be released today include industrial production, housing starts from the Commerce Department and the Housing & Urban Development Department, consumer sentiment report from the University of Michigan’s Institute of Social Research, Labor Department’s JOLTS report and Baker Hughes North American rig count.

Qualcomm (QCOM) stock increased 2.86% in the premarket after former chairman Paul Jacobs sought funding to take the company private.

On the corporate front, Qualcomm (QCOM) stock increased 2.86% in the premarket after former chairman Paul Jacobs sought funding to take the company private. Adobe Systems (ADBE) stock grew 3.76% in premarket after better-than-expected first quarter results. Overstock.com (OSTK) stock fell 13.28% in premarket after posting a 13% dip in fourth quarter revenue.

On the earnings front, key companies reporting earnings today include Kandi Technologies Group (KNDI), Hibbett Sports (HIBB), Tiffany (TIF), Kirkland’s Inc. (KIRK), Perry Ellis International (PERY), and The Buckle (BKE).

Crude oil futures is up 0.23% to $61.33. Gold is trading up 0.22% to $1,320.70, and silver is up 0.35% to $16.48. On the currency front, the US dollar is trading down 0.66% at 105.624 yen. Against the euro, the dollar is up 0.20% to $1.2328. Against the pound, the dollar is up 0.20% to $1.3967.