The S&P futures advanced 0.18% to 2,727.75, Dow futures gained 0.09% to 24,713, and Nasdaq rose 0.16% to 6,925. Elsewhere, shares at Asian markets closed mixed on Tuesday, while European stocks are trading higher.

On the European economic front, data from the Office for National Statistics showed that UK consumer price inflation eased to 2.7% in February from 3% in January. Destatis data revealed that Germany’s producer price inflation slowed to 1.8% in February from 2.1% in January. ZEW data showed that Germany’s economic confidence fell to 5.1 in March from 17.8 in February. Current conditions index tumbled to 90.7 in March from 92.3 in February.

The State Secretariat for Economic Affairs expects the Swiss economy to grow 2.4% this year, faster than 2.3% rise predicted in December. It also lifted its 2019 GDP outlook to 2% from 1.9%. The Federal Customs Administration data showed that Switzerland’s foreign trade surplus rose to CHF 3.2 billion in February from CHF 1.1 billion in January. The Hungarian Central Statistical Office data revealed that Hungary’s employee gross earnings advanced 13.8% on year in January after rising 13.5% in December.

On the Asian economic front, data from the Australian Bureau of Statistics showed that house prices in Australia rose 1% sequentially in the fourth quarter after falling 0.2% in the third quarter. A survey compiled by ANZ bank and Roy Morgan Research revealed that Australia’s consumer confidence index rose 2.2% to 118.5 during the week ended March 18 from last week. The Cabinet Office data showed that Japan’s leading index fell to 105.6 in January from 106.8 in December and current economic activity tumbled to 114.9 from 119.7.

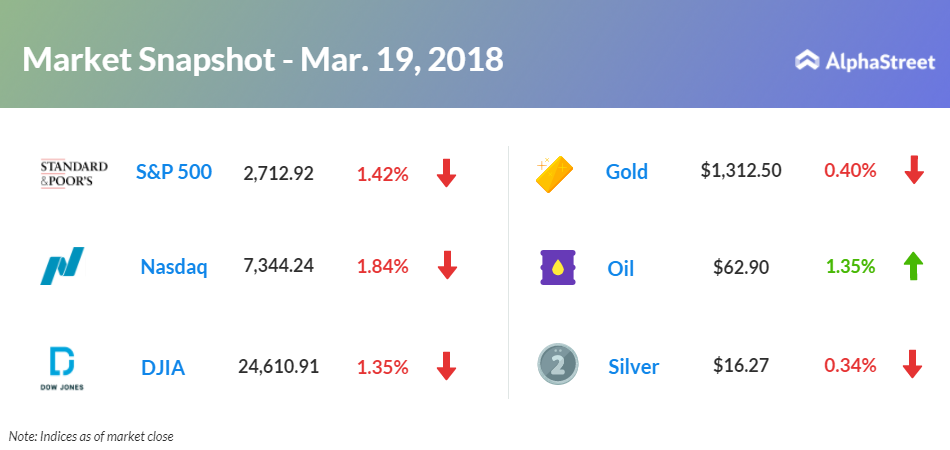

On March 19, US ended lower, with Dow down 1.35% to 24,610.91. Nasdaq tumbled 1.84% to 7,344.24, and S&P 500 fell 1.42% to 2,712.92. The markets remained negative on lingering potential trade war concerns and political uncertainty.

Meanwhile, the key economic events scheduled for today include the Federal Open Market Committee meeting, Redbook data, and Philadelphia Fed manufacturing numbers.

On the corporate front, Oracle (ORCL) stock tumbled 8.76% in the premarket after third-quarter revenue missed consensus and brokerage firm Stifel Nicolaus downgraded shares to Buy from Hold. Arena Pharmaceuticals (ARNA) stock jumped 33.57% in the premarket after its phase 2 Oasis trial for ulcerative colitis treatment met primary and secondary endpoints.

Arena Pharmaceuticals (ARNA) stock jumped 33.57% in the premarket after its phase 2 Oasis trial for ulcerative colitis treatment met primary and secondary endpoints.

BlackBerry (BB) stock advanced 5.90% in premarket following a partnership with Microsoft (MSFT) for allowing Microsoft apps and office programs within BlackBerry dynamics. Children’s Place (PLCE) stock dropped 8.60% in premarket after fourth-quarter sales missed street expectations.

On the earnings front, key companies reporting earnings today include FedEx (FDX), Laureate Education (LAUR), Steelcase (SCS) and AAR Corp (AIR).

Crude oil futures is up 1.35% to $62.90. Gold is trading down 0.40% to $1,312.50, and silver is down 0.34% to $16.27. On the currency front, the US dollar is trading up 0.43% at 106.483 yen. Against the euro, the dollar is down 0.28% to $1.2299. Against the pound, the dollar is down 0.09% to $1.4011.