On the European economic front, data from the Statistics Denmark showed that Denmark’s gross domestic product increased 0.9% sequentially in the fourth quarter after falling 0.9% in the third quarter. Eurostat data revealed that Eurozone retail sales volume moved up 0.1% on month in February after falling 0.3% in January. The Federal Statistical Office data showed that Switzerland’s consumer price inflation accelerated to 0.8% in March from 0.6% in February.

IHS Markit data showed that Eurozone private composite output index fell to 55.2 in March from 57.1 in February. Another IHS Markit data revealed that Italy’s service purchasing managers’ index dropped to 52.6 in March from 55 in February, and Spain’s services purchasing managers’ index tumbled to 56.2 in March from 57.3 in February. Data from IHS Markit/Chartered Institute of Procurement & Supply showed that services purchasing managers’ index in the United Kingdom decreased to 51.7 in March from 54.5 in February.

On the Asian economic front, data from the IHS Markit showed that India’s private sector composite output index rose to 50.8 in March from 49.7 in February. The Department of Statistics data revealed that Malaysia’s foreign trade surplus rose to MYR 9.0 billion in February from MYR 8.7 billion last year. The Australian Bureau of Statistics data showed that Australia’s merchandise trade balance dropped to A$825 million in February from A$1.055 billion in January.

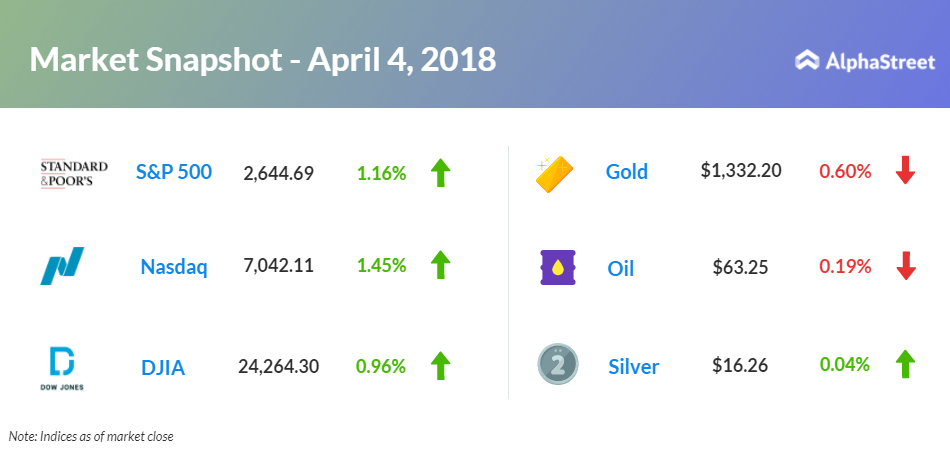

On April 4, US ended higher, with Dow up 0.96% to 24,264.30. Nasdaq advanced 1.45% to 7,042.11, and S&P 500 gained 1.16% to 2,644.69. Traders ignored trade war concerns after President Donald Trump stated the war had already been lost. Trump said in a tweet that there is no trade war with China and he cannot let the intellectual property theft of another $300 billion, apart from the trade deficit of $500 billion a year, to continue.

An Automatic Data Processing report showed that private sector employment grew by 241,000 jobs in March after rising 246,000 jobs in February. Institute for Supply Management data revealed that non-manufacturing index at services sector fell to 58.8 in March from 59.5 in February.

Meanwhile, key economic events scheduled for today include Challenger job-cut report, Commerce Department’s international trade report, Labor Department’ jobless claims, and Energy Information Administration’s natural gas report. Atlanta Federal Reserve Bank President Raphael Bostic and Chicago Fed President Charles Evans will be giving speeches today.

On the corporate front, Facebook (FB) stock grew 3.71% in the premarket after chief Mark Zuckerberg said that there was no meaningful impact on ad sales or usage since the scandal. Wells Fargo (WFC) stock rose 1.21% in premarket after brokerage firm UBS Securities upgraded the shares to “buy” from “neutral”. Advanced Micro Devices (AMD) stock increased 2.97% in premarket after brokerage firm Stifel Nicolaus upgraded the shares to “buy”. Finisar (FNSR) stock jumped 7.07% in premarket after brokerage firm Morgan Stanley upgraded the shares to “overweight” from “equal-weight”.

Facebook (FB) stock grew 3.71% in the premarket after chief Mark Zuckerberg said that there was no meaningful impact on ad sales or usage since the scandal.

Conn’s Inc. (CONN) stock fell 16.29% in the premarket after its fourth-quarter sales missed consensus. Conatus Pharmaceuticals (CNAT) stock plunged 28.45% in the premarket after its clinical study of liver disease treatment did not meet its primary endpoint. Ollie’s Bargain Outlet Holdings (OLLI) stock declined 4.88% in the premarket after issuing weak sales guidance for the full year, despite better-than-expected fourth-quarter results.

On the earnings front, the companies that will be reporting earnings include Monsanto (MON), Schnitzer Steel Industries (SCHN), WD-40 Co. (WDFC), Lamb Weston Holdings (LW), and RPM International (RPM).

Crude oil futures are down 0.19% to $63.25. Gold is trading down 0.60% to $1,332.20, while silver is up 0.04% to $16.26. On the currency front, the US dollar is trading up 0.28% at 107.061 yen. Against the euro, the dollar is down 0.19% to $1.2258. Against the pound, the dollar is down 0.39% to $1.4026.