On the European economic front, data from the Central Statistics Office showed that Ireland’s industrial production fell 3.9% on month in February after rising 2.4% in January. The Hungarian Central Statistical Office data revealed that Hungary’s consumer price inflation accelerated to 2% in March from 1.9% in February. Istat data showed that Italy’s industrial production tumbled 0.5% on month in February after falling 1.8% in January. Insee data revealed that France’s industrial production grew 1.2% on month in February after falling 1.8% in January.

Statistics Denmark data showed that Denmark’s consumer price inflation slowed to 0.5% in March from 0.6% in February. Statistics Norway data revealed that consumer prices remained steady at 2.2% growth in March from last month. Statistics Estonia data showed that Estonia’s foreign trade deficit fell to EUR 93 million in February from EUR 100 million last year. The Central Bureau of Statistics data revealed that Dutch consumer price inflation slowed to 1% in March from 1.2% in February.

On the Asian economic front, data from the Directorate General of Budget, Accounting and Statistics showed that Taiwan’s consumer price inflation slowed to 1.57% in March from 2.19% in February. The ANZ bank and Roy Morgan Research data revealed that Australia’s consumer confidence index fell 0.3% to 115.1 in the week ended April 8 from 115.5 last week. National Australia Bank data showed that Australia’s business conditions index dropped to 14 in March from 20 from February.

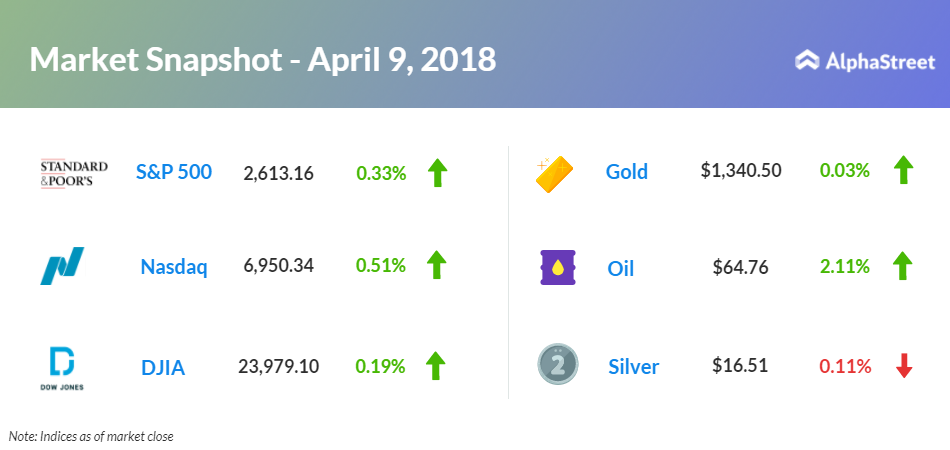

On April 9, US ended higher, with Dow up 0.19% to 23,979.10. Nasdaq advanced 0.51% to 6,950.34, and S&P 500 gained 0.33% to 2,613.16. Traders shifted their focus from trade war concerns to upcoming Federal Reserve meeting.

Meanwhile, key economic events scheduled for today include the National Federation of Independent Business’ small business optimism index, Labor Department’s producer price index, Redbook store sales data, and Commerce Department’s wholesale trade. Atlanta Fed President Raphael Bostic and Dallas Federal Reserve Bank President Robert Kaplan will be giving speeches today.

On the corporate front, shares of General Motors (GM) grew 2.70%, Ford Motor (F) rose 1.60%, Fiat Chrysler Automobiles inched up 1.86%, and Tesla (TSLA) increased 2.62% in the premarket after Chinese president’s comments. Facebook (FB) stock moved up 0.93% in the premarket ahead of CEO Mark Zuckerberg’s testimony before US lawmakers. Nvidia (NVDA) stock grew 3.70% in the premarket after brokerage firm Morgan Stanley upgraded the shares to “overweight”.

VeriFone Systems (PAY) stock jumped 52% in the premarket after agreeing to go private for $2.28 billion.

VeriFone Systems (PAY) stock jumped 52% in the premarket after agreeing to go private for $2.28 billion. Tupperware Brands (TUP) stock tumbled 6.70% before the opening bell, after lowering first-quarter adjusted earnings forecast. vTv Therapeutics (VTVT) stock plunged 69.02% after brokerage firm Stifel downgraded the shares to “hold” from “buy”.

Crude oil futures are up 2.11% to $64.76. Gold is trading up 0.03% to $1,340.50, while silver is down 0.11% to $16.51. On the currency front, the US dollar is trading up 0.23% at 107.008 yen. Against the euro, the dollar is up 0.34% to $1.2363. Against the pound, the dollar is up 0.34% to $1.4177.