Statistics Norway report revealed that Norway’s GDP rose 0.6% sequentially in the first quarter after falling 0.3% last quarter. Destatis data showed that Germany’s GDP rose 0.3% sequentially in the first quarter after increasing 0.6% in the fourth quarter. Insee report revealed that France’s consumer prices grew 1.6% on year in April, the same rate of growth as in March. Eurostat data showed that Eurozone GDP rose 0.4% sequentially in the first quarter after increasing 0.7% a quarter ago.

On the Asian economic front, data from the Ministry of Economy, Trade, and Industry showed that Japan’s tertiary activity index dropped 0.3% on month in March after rising 0.1% in February. ANZ bank and Roy Morgan Research report revealed that Australia’s consumer confidence rose to 120.8 in the week ended May 13 from 119.6 last week. National Bureau of Statistics data showed that China’s industrial output grew 7% on year in April after rising 6% in March.

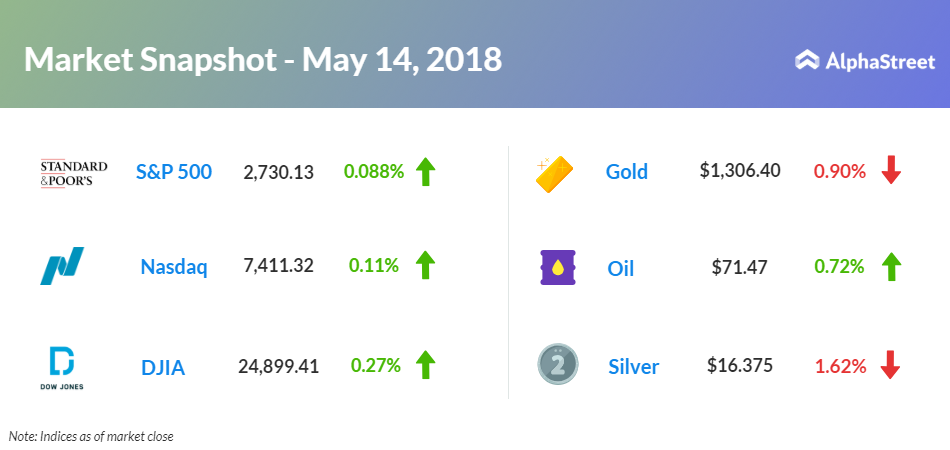

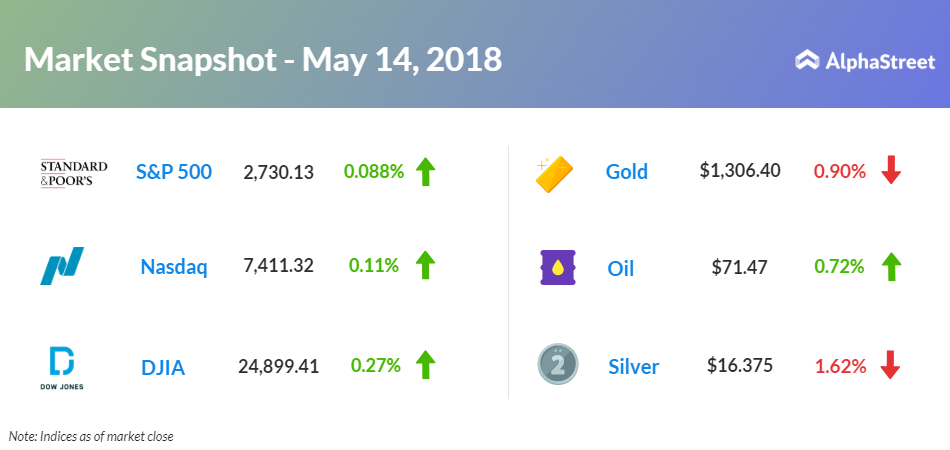

On May 14, US ended higher, with Dow up 0.27% to 24,899.41. S&P 500 rose 0.088% to 2,730.13, and Nasdaq gained 0.11% to 7,411.32. Traders remained positive on hopes that the trade tension would dissolve following the US-China talks scheduled for this week.

Meanwhile, key economic events scheduled for today include the New York Fed’s Empire State manufacturing survey, Redbook data, the Commerce Department’s business inventories, National Association of Home Builders/Wells Fargo’s housing market index, and Treasury International Capital data. Dallas Federal Reserve Bank President Robert Kaplan and San Francisco Federal Reserve Bank President John Williams will be giving speeches today.

Key companies reporting earnings today include Five Star Quality Care (FVE), Eagle Materials (EXP), Corporate Capital Trust (CCT), SORL Auto Parts (SORL), Palatin Technologies (PTN), Parkervision (PRKR), and Sunworks (SUNW).

On the corporate front, Home Depot stock slid 2.42% in the premarket after first-quarter revenue missed Street’s expectations. Agilent Technologies (A) stock fell 7.08% in the premarket after weak guidance. Symantec (SYMC) stock rose 1.87% in premarket trading after its bullish 2020 outlook eased concerns over the impact of an internal accounting probe.

Ford Motor (F) inched down 0.45% before the opening bell after brokerage firm Piper Jaffray downgraded the shares to “neutral” from “outperform”. Pfenex (PFNX) stock jumped 23.77% in premarket after it announced positive top-line PF708 study results in Osteoporosis patients.

Crude oil futures are up 0.72% to $71.47. Gold is trading down 0.90% to $1,306.40, and silver is down 1.62% to $16.375. On the currency front, the US dollar is trading up 0.33% at 110.046 yen. Against the euro, the dollar down 0.36% to $1.1884. Against the pound, the dollar is down 0.27% to $1.352.