The S&P futures tumbled 0.68% to 2,699.75, Dow futures slipped 0.73% to 24,546, and Nasdaq fell 1.05% to 6,811.75. Elsewhere, shares at Asian markets closed lower on Thursday, and European stocks are trading lower.

On the European economic front, data from the European Central Bank showed that euro area current account surplus rose to EUR 37.6 billion in January from EUR 31 billion in December. IHS Markit data revealed that euro area private sector composite output index fell to 55.3 in March from 57.1 in February. The Office for National Statistics data showed that UK retail sales volume grew 0.8% on month in February after falling 0.2% in January.

Insee data revealed that France’s manufacturing confidence dropped to 111 in March from 112 in February. IHS Markit data showed that France’s private sector composite output index fell to 56.2 in March from 57.3 in February. Another IHS Markit data revealed that Germany’s private sector composite output index fell to 55.4 in March from 57.6 in February.

On the Asian economic front, data from the Ministry of Economy, Trade, and Industry showed that Japan’s all industry activity fell 1.8% on month in January after rising 0.6% in December. Nikkei data revealed that manufacturing sector in Japan dropped to 53.2 in March from 54.1 in February. The Australian Bureau of Statistics data showed that jobless rate in Australia rose to 5.6% in February from 5.5% in January. The Directorate General of Budget Accounting and Statistics data showed that Taiwan’s unemployment rate rose to 3.7% in February from 3.68% in January.

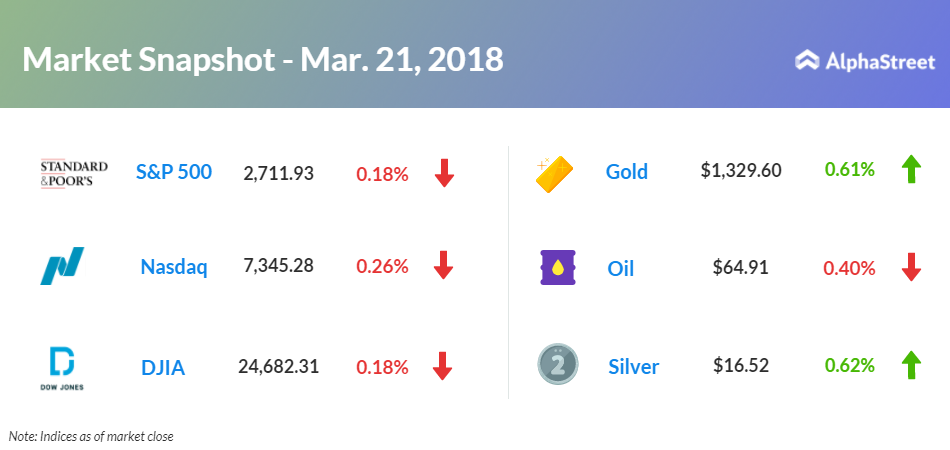

On March 21, US ended lower, with Dow down 0.18% to 24,682.31. Nasdaq tumbled 0.26% to 7,345.28, and S&P 500 fell 0.18% to 2,711.93. The markets turned negative as traders’ focus shifted to three interest rate hikes for next year, instead of two previously predicted.

The Fed based the rate hike to annual inflation, which is expected to move up in the coming months, and economic outlook that will likely grow 2.7% in the fourth quarter instead of 2.5% earlier projected. The Fed sees its benchmark rate to hit 2.9% by the end of 2019 compared to prior expectations of 2.7%.

Meanwhile, key economic events scheduled for today include the Labor Department’s jobless claims, the Federal Housing Finance Agency’s house price index, Energy Information Administration natural gas report, note auction, the Fed balance sheet, and the Fed money supply.

On the corporate front, shares of Facebook slid 1.53% in the premarket after CEO Mark Zuckerberg confirmed on a major breach of trust. Shares of Guess? (GES) jumped 11.47% in the premarket after better-than-expected fourth-quarter results. Commercial Metals (CMC) stock tumbled 3.44% in the premarket after weaker-than-expected second-quarter results.

Shares of Facebook slid 1.53% in the premarket after CEO Mark Zuckerberg confirmed on a major breach of trust.

Darden Restaurants (DRI) stock dropped 3.55% in the premarket after its third-quarter sales missed street expectations. G-III Apparel Group (GIII) stock fell 4.03% in the premarket after weak guidance, despite upbeat fourth-quarter results.

On the earnings front, key companies reporting earnings today include Accenture (ACN), The Cato Corp. (CATO), The Michaels Companies (MIK), Conagra Brands (CAG), Neogen (NEOG), KB Home (KBH), Cintas (CTAS), and Nike (NKE).

Crude oil futures is down 0.40% to $64.91. Gold is trading up 0.61% to $1,329.60, and silver is up 0.62% to $16.52. On the currency front, the US dollar is trading down 0.39% at 105.64 yen. Against the euro, the dollar is down 0.15% to $1.2322. Against the pound, the dollar is up 0.23% to $1.417.