On the European economic front, data from Ifo Institute showed that Germany’s GDP will grow 2.6% this year after rising 2.2% in 2017, and the growth pace for 2019 will likely ease to 2.1%. The Office for National Statistics data revealed that UK jobless rate slowed to 4.3% in the January quarter from 4.4% in the December quarter. The Economy Ministry data showed that Spain’s foreign trade deficit widened to EUR 3.9 billion in January from EUR 3.1 billion last year.

On the Asian economic front, data from the Department of Statistics showed that Malaysia’s consumer price inflation eased to 1.4% in February from 2.7% in January. The Reserve Bank of New Zealand data revealed that credit card spending in New Zealand rose 0.7% on month in February after falling 0.6% in January. The data from Statistics New Zealand showed that New Zealand’s net migration fell to 68,943 in February from 71,333 last year.

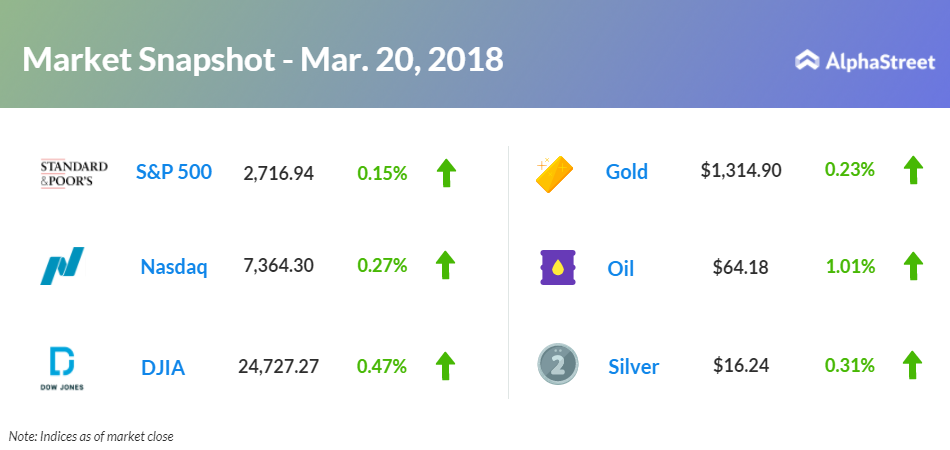

On March 20, US ended higher, with Dow up 0.47% to 24,727.27. Nasdaq advanced 0.27% to 7,364.30, and S&P 500 gained 0.15% to 2,716.94. The markets turned positive as traders’ focus shifted from potential trade war to interest rate hike.

Meanwhile, key economic events scheduled for today include the Federal Open Market Committee meeting, Commerce Department’s current account, National Association of Realtors’ existing home sales, and Energy Information Administration’s petroleum status report.

On the corporate front, Facebook (FB) stock slid 1.50% in the premarket after an investor lawsuit over the controversial data usage hurt the shares for past two days. Salesforce.com (CRM) stock tumbled 2.89% and Mulesoft (MULE) stock advanced 5.45% in the premarket after Salesforce agreed to buy Mulesoft for an enterprise value of about $6.5 billion.

General Mills (GIS) stock fell 6.17% in premarket after lowering its fiscal 2018 earnings guidance, despite an upbeat third-quarter. Winnebago Industries (WGO) stock rose 2.84% in premarket after better-than-expected second-quarter results. Shares of Nordstrom (JWN) slipped 2.74% in the premarket after ending going-private discussions with its founding family. Tesla (TSLA) stock inched up 0.23% in premarket ahead of shareholders voting on executive chief Elon Musk’s compensation arrangement.

General Mills (GIS) stock fell 6.17% in premarket after lowering its fiscal 2018 earnings guidance, despite an upbeat third-quarter.

On the earnings front, key companies reporting earnings today include Actuant (ATU), Pangaea Logistics Solutions (PANL), Scholastic (SCHL), WidePoint (WYY), Guess? (GES), Winnebago Industries (WGO), Herman Miller (MLHR), Altair Engineering (ALTR), and Five Below (FIVE).

Crude oil futures is up 1.01% to $64.18. Gold is trading up 0.23% to $1,314.90, and silver is up 0.31% to $16.24. On the currency front, the US dollar is trading down 0.27% at 106.238 yen. Against the euro, the dollar is up 0.31% to $1.2282. Against the pound, the dollar is up 0.40% to $1.4056.