US futures are pointing to a lower open today after ending lower on Thursday as investors remained cautious ahead of a fresh wave of corporate earnings. Also, a weak semiconductor outlook from Taiwan Semiconductor (TSM) citing softer smartphone demand too lingered as concerns. Traders are closely watching on the geopolitical developments and commodity price movements.

The S&P futures slid 0.06% to 2,691.50, Dow futures tumbled 0.15% to 24,599, and Nasdaq fell 0.19% to 6,767.25. Elsewhere, shares at Asian markets closed mostly higher on Friday and European stocks are trading higher.

On the European economic front, data from the Economy Ministry showed that Spain’s foreign trade deficit narrowed to EUR 2.2 billion in February from EUR 2.6 billion last year. The Hungarian Central Statistical Office data revealed that Hungary’s employee wage growth slowed to 11.9% in February from 13.8% in January.

Statistics Estonia data showed that Estonia’s producer price inflation accelerated to 2.9% in March from 2.6% in February. Destatis data revealed that Germany’s producer price inflation rose to 1.9% in March from 1.8% in February. The Turkish Statistical Institute data showed that Turkey’s consumer confidence grew to 71.9 in April from 71.3 in March.

On the Asian economic front, data from the Ministry of Economy, Trade, and Industry showed that Japan’s tertiary industry activity remained flat in February after falling 0.4% in January. The Ministry of Internal Affairs and Communications data revealed that Japan’s consumer prices rose 1.1% on year in March after increasing 1.5% in February.

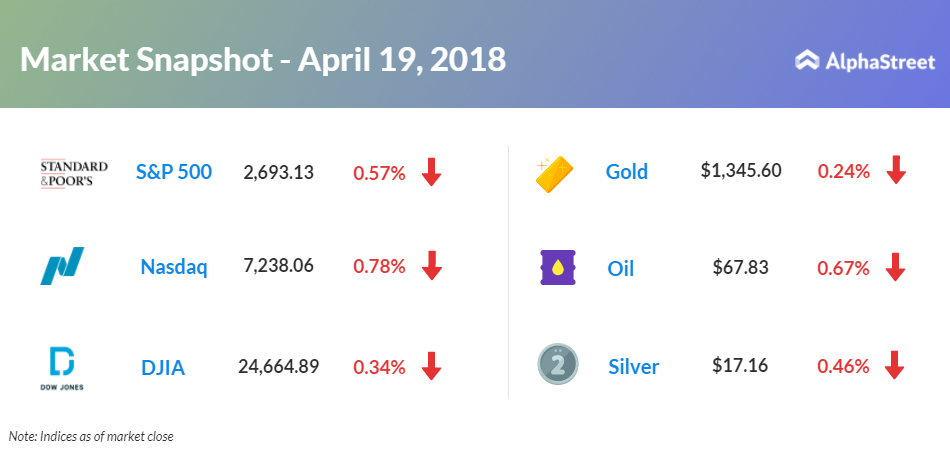

On April 19, US ended lower, with Dow down 0.34% to 24,664.89. Nasdaq fell 0.78% to 7,238.06, and the S&P 500 tumbled 0.57% to 2,693.13. Traders reacted negatively to the quarterly earnings news from Procter & Gamble (PG) and the weak forecast from Taiwan Semiconductor. A Labor Department report showed that jobless claims tumbled 1,000 to 232,000 from previous week’s 233,000.

Meanwhile, key economic events scheduled for today include Baker-Hughes rig count. Chicago Federal Reserve Bank President Charles Evans and San Francisco Federal Reserve Bank President John Williams will be giving speeches today.

On the earnings front, key companies reporting earnings today include Baker Hughes (BHI), Regions Financial (RF), Stanley Black & Decker (SWK), Roper Technologies (ROP), Mobile Mini (MINI), Gentex (GNTX), ManpowerGroup (MAN), Kansas City Southern (KSU), State Street Corp. (STT), Cleveland-Cliffs (CLF), Waste Management (WM), SunTrust Banks (STI), and Schlumberger (SLB).

Atlassian Corp. (TEAM) stock fell 11.35% in premarket after weak third-quarter forecast.

On the corporate front, General Electric Co. (GE) stock advanced 5.72% in the premarket after better than expected first-quarter earnings. Honeywell International (HON) moved up 0.92% in premarket after lifting fiscal 2018 outlook and upbeat first-quarter results.

Skechers USA (SKX) stock plunged 23.36% in premarket after weak second-quarter outlook. Stanley Black & Decker (SWK) stock tumbled 3.06% in the premarket after weak 2018 guidance. Atlassian Corp. (TEAM) stock fell 11.35% in premarket after weak third-quarter forecast.

Crude oil futures are down 0.67% to $67.83. Gold is trading down 0.24% to $1,345.60, and silver is down 0.46% to $17.16. On the currency front, the US dollar is trading up 0.17% at 107.571 yen. Against the euro, the dollar is down 0.29% to $1.2309. Against the pound, the dollar is down 0.28% to $1.4046.