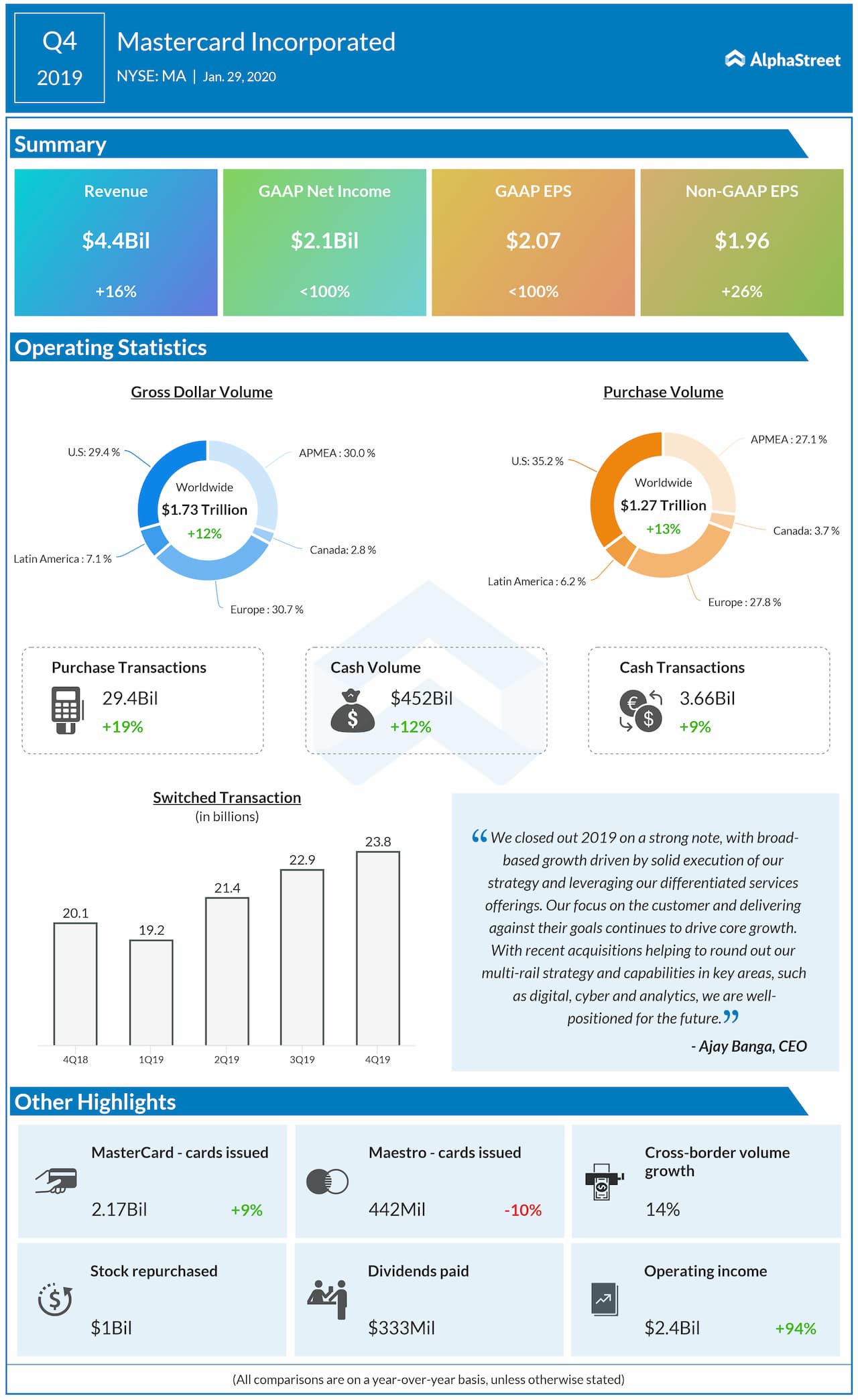

The top-line growth was spurred by a 19% increase in switched transactions and a sharp increase in cross-border volumes. The gross dollar volume rose 12% during the quarter, while purchase volume moved up 13%.

The positive factors were partially offset by an increase in rebates and incentives, primarily due to new and renewed agreements and increased volumes. The company’s partners had issued 2.6 billion Mastercard and Maestro-branded cards as of December 31, 2019.

Looking ahead into the full year 2020, the company expects net revenue in the low-teens and operating expenses in the high end of the high single-digits range. The effective tax rate is predicted to be in the range of 17-18% for the full year.

For the first quarter of 2020, the company sees net revenue in the low double-digits range and operating expenses in the mid-teens range.

As of December 31, 2019, the company had $8.97 billion of cash, cash equivalents, restricted cash, and restricted cash equivalents.

Mastercard’s competitor Visa Inc. (NYSE: V) is set to report its first-quarter 2020 earnings results on Thursday, January 30, after the market closes. Analysts expect Visa to report earnings of $1.46 per share on revenue of $6.08 billion for the first quarter.