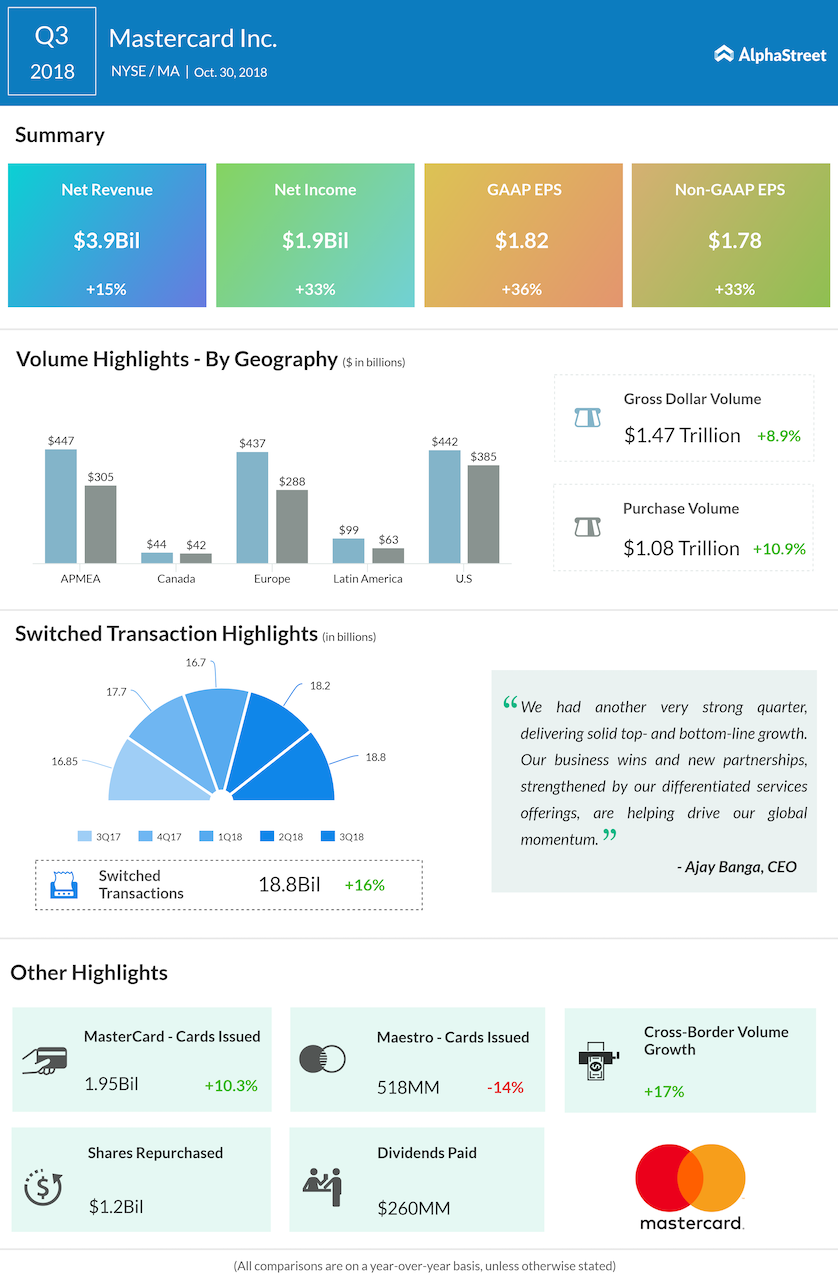

Revenues increased 15% to $3.9 billion, surpassing the forecast. The underlying revenue growth was driven mainly by double-digit growth in switched transactions, cross-border volumes and gross dollar volume. Overall, operations continued to benefit from investments in digital technology and the management’s initiatives to broaden the bank’s co-branding partner network. Meanwhile, rebates and incentives weighed down on the bottom-line performance.

The results benefitted from investments in digital technology and the management’s initiatives to broaden the co-branding partner network

“We had another very strong quarter, delivering solid top- and bottom-line growth. Our business wins and new partnerships, strengthened by our differentiated services offerings, are helping drive our global momentum,” said CEO Ajay Banga.

During the September quarter, Mastercard repurchased about 5.6 million shares for $1.2 billion and paid $260 million in dividends.

The payment industry, which remains largely unaffected by the tariff-induced trade disruptions and political uncertainties, witnessed hectic activity this year owing to the improving economic conditions and positive consumer sentiment – factors that brighten the prospects of credit card service providers.

Last week, industry leader Visa (V) reported above-consensus profit and in-line revenues for its fourth quarter. Earnings jumped about 30% to $1.23 per share and revenues gained 12%. Amex (AXP) posted a 22% earnings growth for the most recent quarter when revenues rose 9% to around $10 billion.

Shares of Mastercard rose 2% after Tuesday’s earnings report, recovering from the loss suffered in the previous trading session. The stock has registered a 20% growth since the beginning of the year.