Sales

The company believes customers are holding back on their purchases at present in order to be able to spend more during the holiday season. It anticipates positive demand for its products for the full year and expects sales to see a pickup during the second half of 2023.

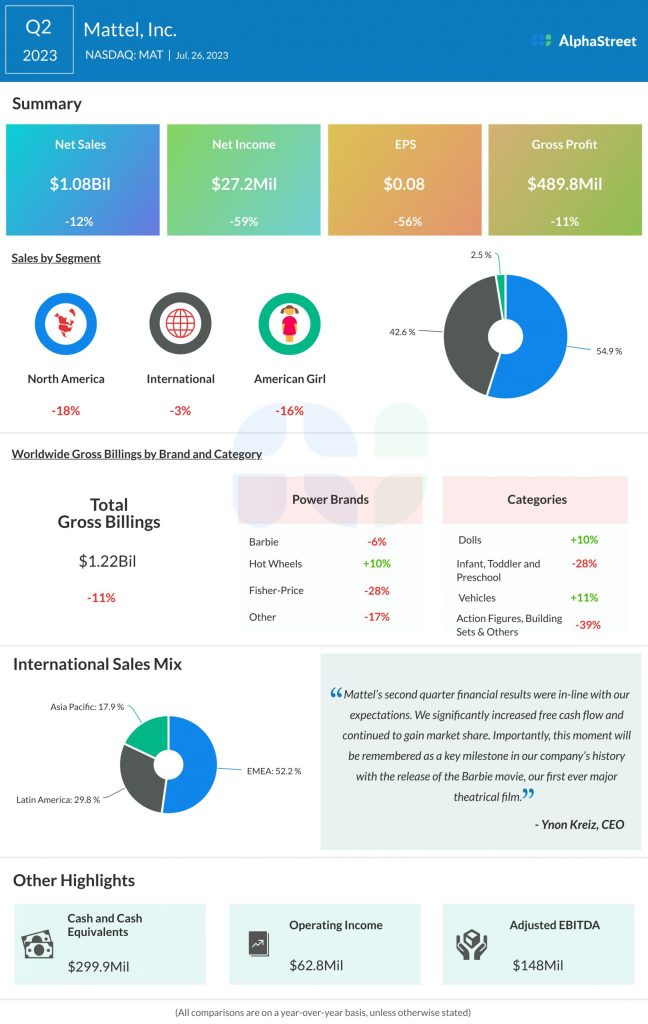

For the full year of 2023, the toymaker expects net sales to be comparable to the previous year in constant currency. Net sales were $5.43 billion in FY2022.

Profits

Mattel delivered adjusted EPS of $0.10 in Q2 2023, which was down 44% from the prior-year period. The company expects adjusted EPS to range between $1.10-1.20 in FY2023. This is lower than the adjusted EPS of $1.25 reported in FY2022.

Reported gross margin in Q2 increased to 45.1% from 44.4% in the year-ago period while adjusted gross margin remained flat at 44.9%. Mattel expects adjusted gross margin of approx. 47% in FY2023, which is higher than the 45.9% reported in FY2022.

Brands

Mattel has a diverse brand portfolio which provides an advantage despite short-term headwinds. The success of the Barbie movie is viewed as a significant win for the company. Mattel launched a wide range of toys and products related to the movie which are likely to drive further gains.

In Q2, gross billings in the Dolls and Vehicles categories increased 10% and 11% respectively while Infant, Toddler and Preschool, and Action Figures, Building Sets, Games and Other saw double-digit declines. Gross billings for the Hot Wheels brand were up 10% in Q2 while Barbie and Fisher-Price saw declines of 6% and 28% respectively.

For the full year of 2023, Mattel expects to see growth in the Dolls and Vehicles categories, offset by declines in the Infant, Toddler and Preschool, and Challenger categories. In Power Brands, Barbie and Hot Wheels are expected to grow while Fisher-Price is expected to decline.