Revenue

Earnings

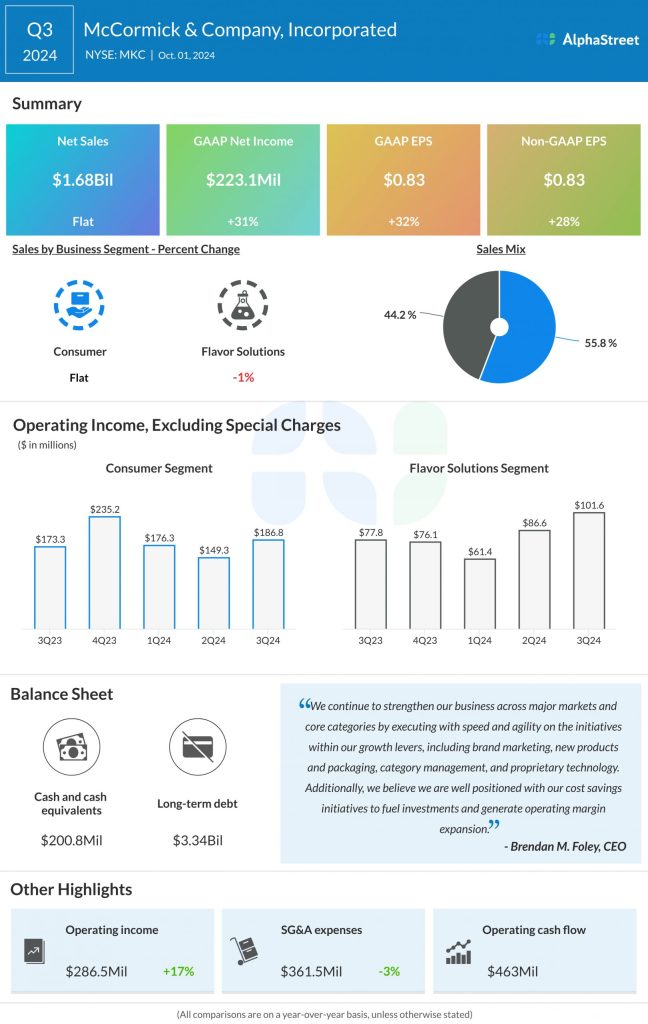

The consensus target for earnings per share in Q4 2024 is $0.77, which compares to adjusted EPS of $0.85 reported in the year-ago quarter. In Q3 2024, adjusted EPS increased 28% YoY to $0.83.

Points to note

In an uncertain economic environment, consumers continue to seek value on their purchases. They are shopping only according to their requirements and they are focused on reducing waste and stretching their budgets. These trends have led to a rise in cooking more meals at home.

McCormick is benefiting from this trend as it is driving demand in categories like spices, seasonings, condiments and sauces. There is a rising demand for seasoning blends that make cooking easy and convenient and also on the gourmet line as some consumers try to recreate restaurant-style meals. The company’s investments in strengthening its portfolio and in product innovation are expected to drive yields.

In the third quarter, McCormick achieved total positive volume growth, along with sequential improvements in volume across its Consumer and Flavor Solutions segments. The company expects to see volume growth in both its segments in the fourth quarter along with sequential improvements from Q3.

McCormick’s Consumer segment continued to benefit from volume growth in the Americas and Europe, Middle East, and Africa (EMEA) regions in Q3. In Asia-Pacific, volumes were impacted by slow demand in China, but outside China, volumes helped drive sales growth. The company expects headwinds in China to continue in the fourth quarter.

Meanwhile, the Flavor Solutions segment is being impacted by a slowdown in foodservice traffic, mainly in quick service restaurants. However, strength in the branded foodservice and flavors categories is helping offset some of this softness.

In Q3, gross margin expanded 170 basis points YoY to 38.7%. For the fourth quarter, MKC expects gross margin to improve sequentially from the third quarter and to be flat compared to the previous year.