Positive Outcome

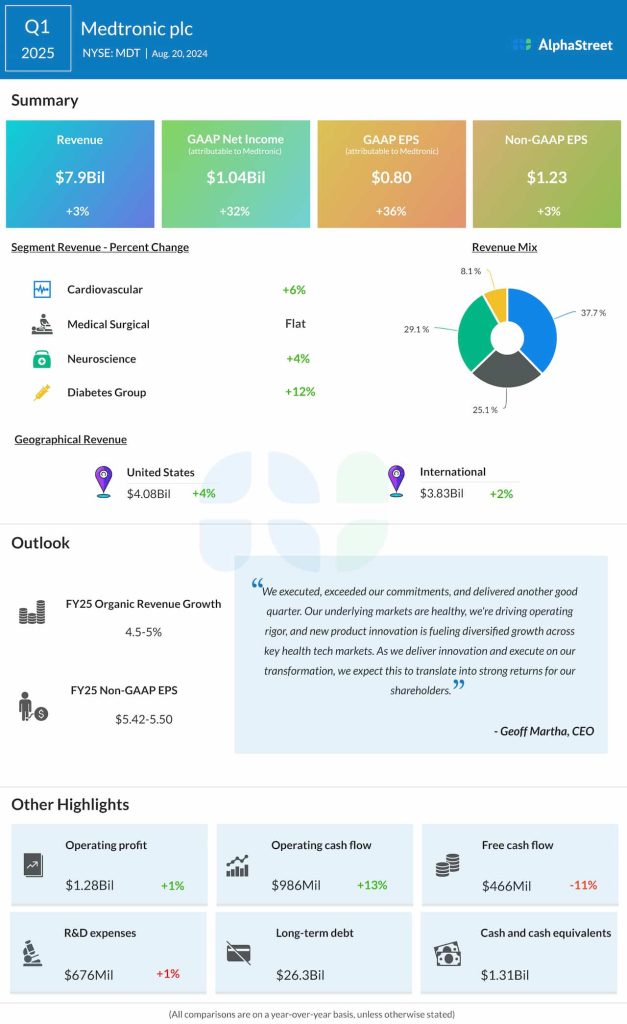

Earnings, excluding special items, rose 3% year-over-year to $1.23 per share in the first quarter. On an unadjusted basis, net profit climbed to $1.04 billion or $0.80 per share in Q1 from $791 million or $0.59 per share in the same period of 2024. Lifting total revenues to about $7.9 billion, Cardiovascular and Neuroscience revenues increased 6% and 4% respectively. Sales increased both in the US market and the international market. First-quarter results topped expectations in almost every segment. Interestingly, the company’s quarterly earnings beat estimates consistently in the past two years.

The management raised its organic revenue growth guidance for fiscal 2025 to 4.5-5.0%. The guidance for full-year adjusted earnings per share is between $5.42 and $5.50, up from the prior range of $5.40 to $5.50 per share. In the second quarter, the top line is expected to grow in mid-single-digit, with organic revenue growth of about 4.5%. The estimate for second-quarter adjusted earnings is between $1.24 per share and $1.26 per share. The positive guidance reflects an estimated improvement in foreign exchange rates, especially in the back half of the year.

In Growth Mode

Medtronic sees diversified growth across the healthcare technology market, reflecting continued product innovation. It expects ongoing investments in the pipeline to translate into revenue and operating margin growth in the medium-term and long term. Currently, a key priority for the management is to launch new technology in areas like cardiac ablation solutions, which is causing a rapid shift in treatment procedures.

The turnaround of the Diabetes segment, which registered 12% revenue growth in Q1, is driven by continued technological innovation in that area over the past two years. The company is building an AI platform to transform surgical procedures by integrating artificial intelligence in devices, in partnership with Nvidia.

Commenting on the Q1 outcome, Medtronic’s CEO Geoffrey Martha said at the conference call, “We’re at the front end of many new product cycles in markets like diabetes, pulsed-field ablation, TAVR, neuromodulation, hypertension, and robotics. We’re focused on driving scale across our manufacturing, technology, and commercial organizations and making progress on our ongoing portfolio management work. Now, as we deliver innovation and continue to execute on our transformation, this will lead to strong returns for our shareholders.”

This month, Medtronic’s stock traded above the 52-week average price. It traded at $87 on Wednesday afternoon, up 2%.