Medtronic plc (MDT) topped consensus estimates on revenue and earnings for the third quarter of 2019 and raised its earnings guidance for fiscal year 2019. Shares were up 0.79% in premarket hours on Tuesday.

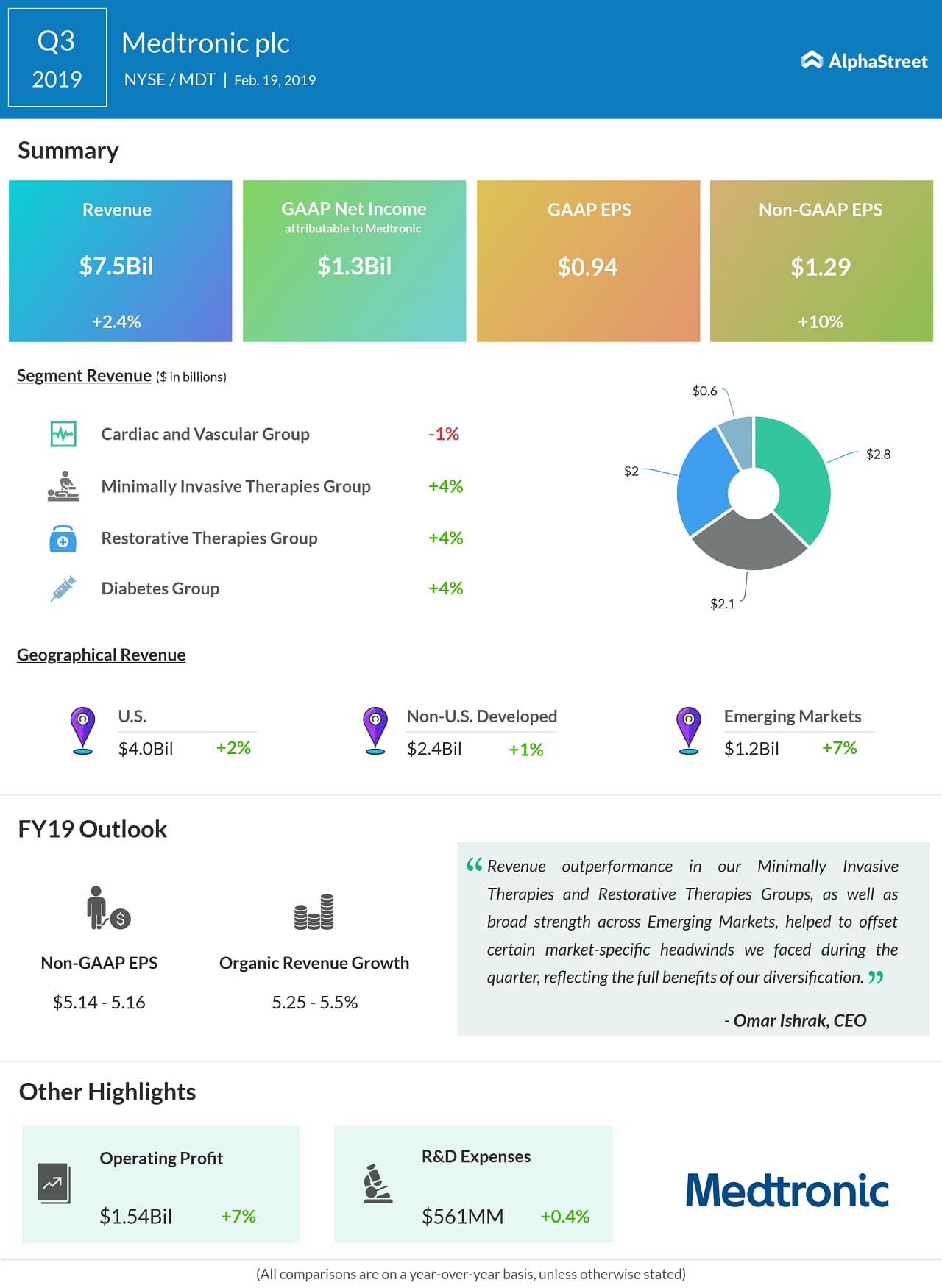

Worldwide revenues totaled $7.5 billion, up 2.4% from the same period last year. On an organic basis, revenues grew 4.4%.

On a GAAP basis, the company reported a net income of $1.26 billion, or $0.94 per share, compared to a net loss of $1.38 billion, or $1.03 per share, in the year-ago quarter. Adjusted net income rose 10% to $1.75 billion, or $1.29 per share.

US revenue, which made up 53% of company revenue, grew 2.3% on a reported basis during the quarter. Non-US developed market revenue grew 0.6% on a reported basis and 3.6% on a constant currency basis. Emerging market revenue rose 6.8% on a reported basis and 13.9% on a constant currency basis.

During the quarter, revenues in the Cardiac and Vascular Group (CVG) dropped 0.5% on a reported basis. On a constant currency basis, revenue grew 1.6%, driven by mid-single digit growth in the Aortic, Peripheral & Venous and Coronary & Structural Heart divisions, offset by low single-digit declines in the Cardiac Rhythm & Heart Failure segment.

Also see: Medtronic Q3 2019 Earnings Conference Call Transcript

In the Minimally Invasive Therapies Group, revenues grew 4.1% as reported and 6.6% on a constant currency basis, driven by strong performance in all divisions. In the Restorative Therapies Group, revenues rose 4.2% as reported and 5.5% on a constant currency basis, driven by growth in all business units, except Spine. Revenues in the Diabetes Group increased 4.5% as reported and 6.5% in constant currency.

For fiscal year 2019, Medtronic expects organic revenue to grow 5.25% to 5.5% versus the prior outlook of 5% to 5.5%. The company raised its adjusted EPS guidance to a range of $5.14 to $5.16 from the previous range of $5.10 to $5.15. The outlook for free cash flow was also raised to a range of $5 billion to $5.2 billion from the previous range of $4.7 billion to $5.1 billion.