Like many of its peers, Merck has been pushing its oncology portfolio aggressively with focus on Lynparza, Lenvima and Keytruda

In the next two years, the Kenilworth, New Jersey-based company will be expanding its production capacity, mainly in oncology and animal health, with an estimated investment of about $16 billion. It is expected that there will be an increase in R&D expenses in the fourth quarter, reflecting the management’s initiatives to revive research and development activities in the core areas of the business.

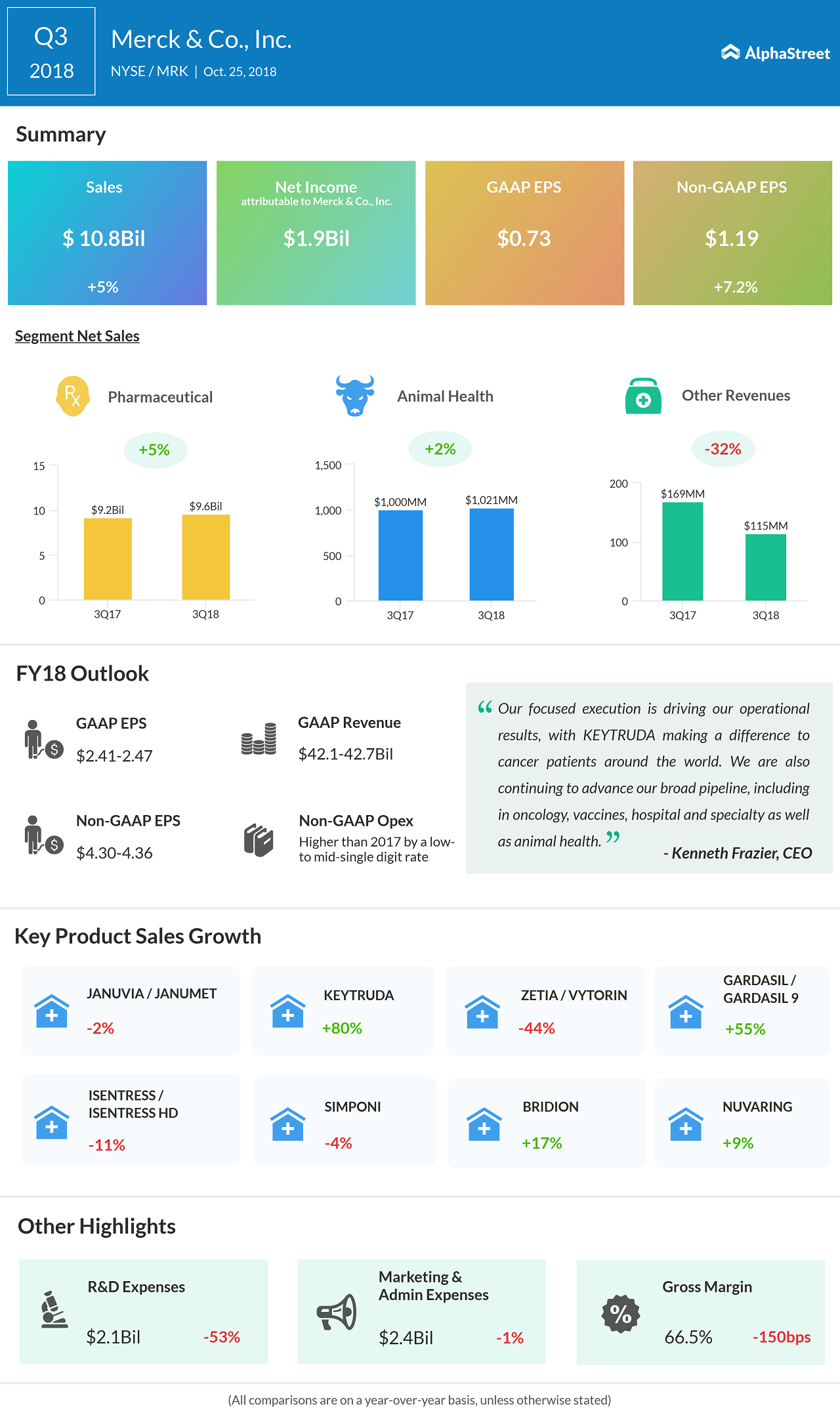

In the third quarter, the pharma giant’s revenues moved up 5% year-over-year to $10.8 billion but came in below expectations. Meanwhile, adjusted earnings climbed 7.2% to $1.19 per share, beating estimates. Revenues from the vaccine business grew 13% mainly due to the growing demand for Gardasil in the overseas market.

Currently, the average analysts’ rating on Merck is buy. The positive recommendation and the increased price target of $81 make the stock an investment option worth considering.

Related: Merck & Co. Q3 2018 Earnings Conference Call Transcript

Among Merck’s peers, Eli Lilly (LLY) is scheduled to release its fourth quarter results on February 13 before the market opens. Last week, AbbVie (ABBV) reported weaker than expected earnings for the most recent quarter – despite a marked increase in revenues – hurt mainly by acquisition-related charges.

Merck’s stock climbed to a seven-year high last month, after rising steadily throughout 2018. The stock, which gained about 25% in the past twelve months, traded slightly lower during Wednesday’s regular session.