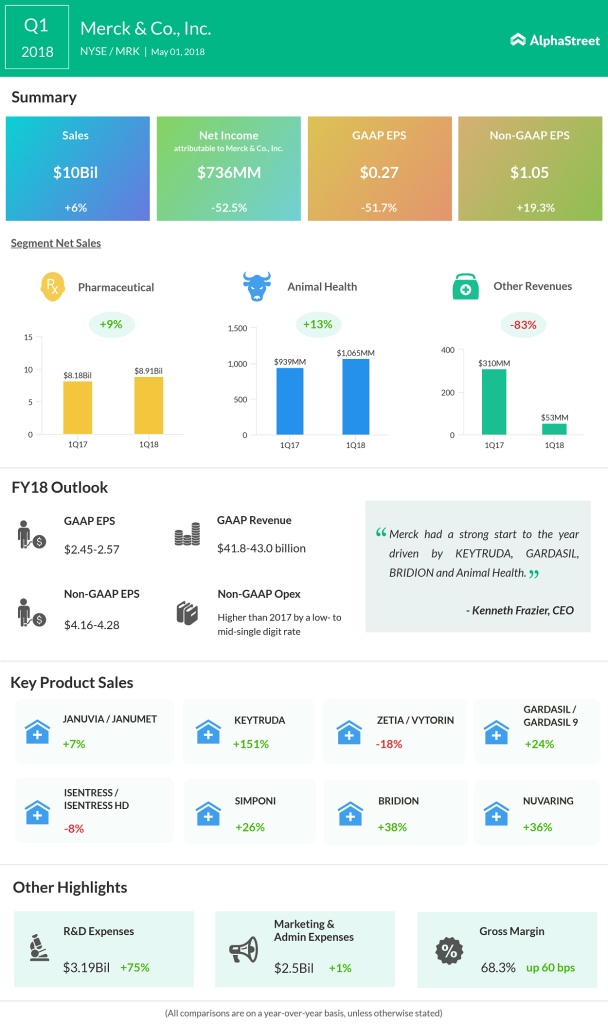

Animal Health sales increased 13% to $1.1 billion fuelled by higher sales of livestock and companion animal products.

For the full year of 2018, Merck narrowed its revenue outlook to the range of $41.8 billion to $43 billion. GAAP EPS target is trimmed down to a range of $2.45 to $2.57 while non-GAAP EPS outlook is lifted to a range of $4.16 to $4.28.

Merck also announced positive results for its Phase 3 trial, which involves Keytruda drug for the treatment of a type of lung cancer. Also, Merck noted that the FDA would review the biologics application for Keytruda before September 23, 2018.

Meanwhile, Merck’s rival Pfizer (PFE) also reported its first-quarter results today. Sales missed Street’s estimates, hurt by lower than expected breast cancer drug sales. Despite a rise in the profit, Pfizer shares dipped about 3% in the first hour of the trading.