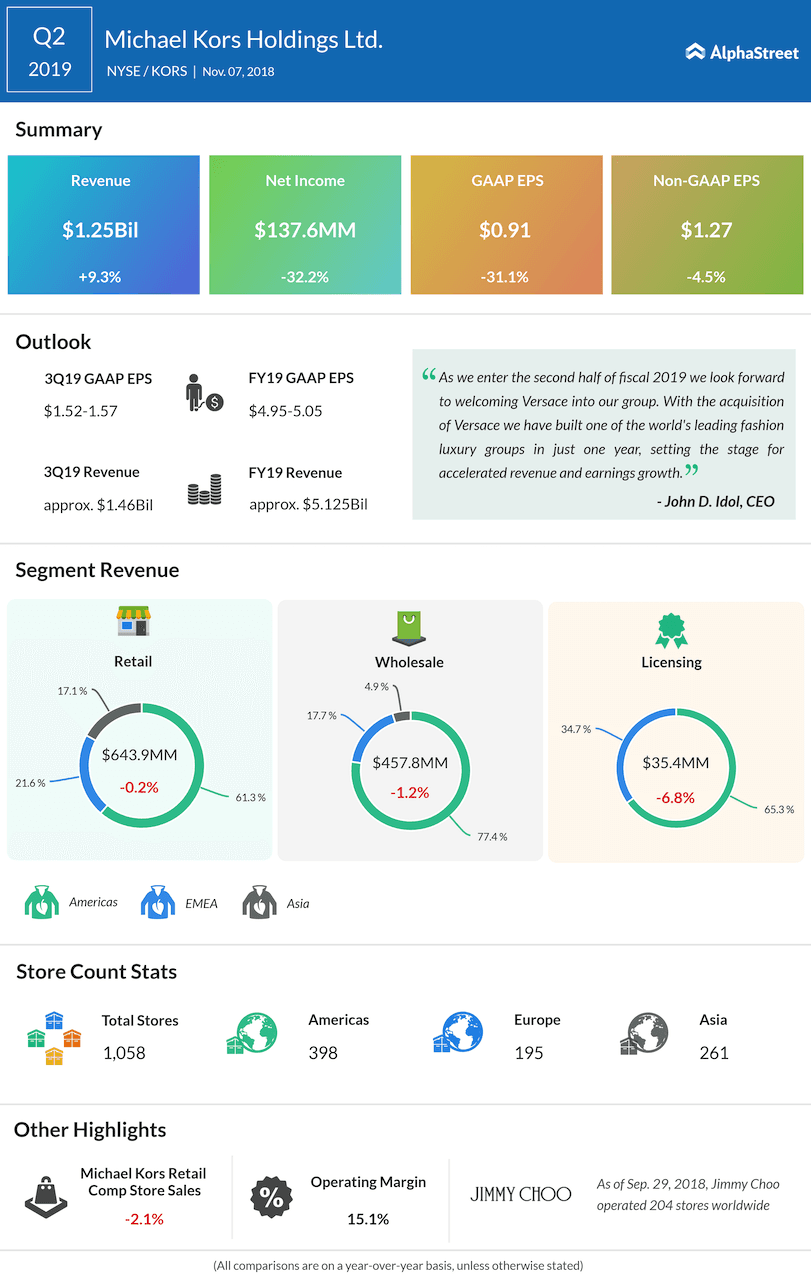

Reported net income dropped to $137.6 million or $0.91 per share from $202.9 million or $1.32 per share in the prior-year period. Adjusted net income was $192.5 million or $1.27 per share. Analysts had estimated earnings of $1.10 per share.

Michael Kors brand revenues fell 0.8% but came in line with the company’s expectations. Comparable store sales, which were down in the low single digits, were also in line with the firm’s expectations.

Jimmy Choo posted better-than-expected revenues, which were helped by strength in footwear. The company saw revenue declines across its Retail, Wholesale and Licensing segments. Inventory dropped 11% compared to the prior-year period.

During the quarter, Michael Kors announced an agreement to acquire Gianni Versace SPA for $2.1 billion. The transaction is expected to close in the fourth quarter of 2019 and following the acquisition, Michael Kors will change its name to Capri Holdings Limited and operate under the ticker CPRI.

Michael Kors to continue shopping spree with Versace, after Jimmy Choo

For the full year of 2019, Michael Kors is raising its outlook for adjusted EPS by $0.05 to a range between $4.95 and $5.05, reflecting better-than-expected Q2 performance for the Michael Kors and Jimmy Choo brands. Revenue is expected to be around $5.12 billion, including between $580 million and $590 million of incremental Jimmy Choo revenue.

For the third quarter of 2019, Michael Kors expects total revenue to be about $1.46 billion, including approx. $165 million of incremental revenue from Jimmy Choo. Diluted EPS is expected to be $1.52 to $1.57, which includes approx. $0.04 to $0.06 of accretion from Jimmy Choo.