In March, Micron (NASDAQ: MU)

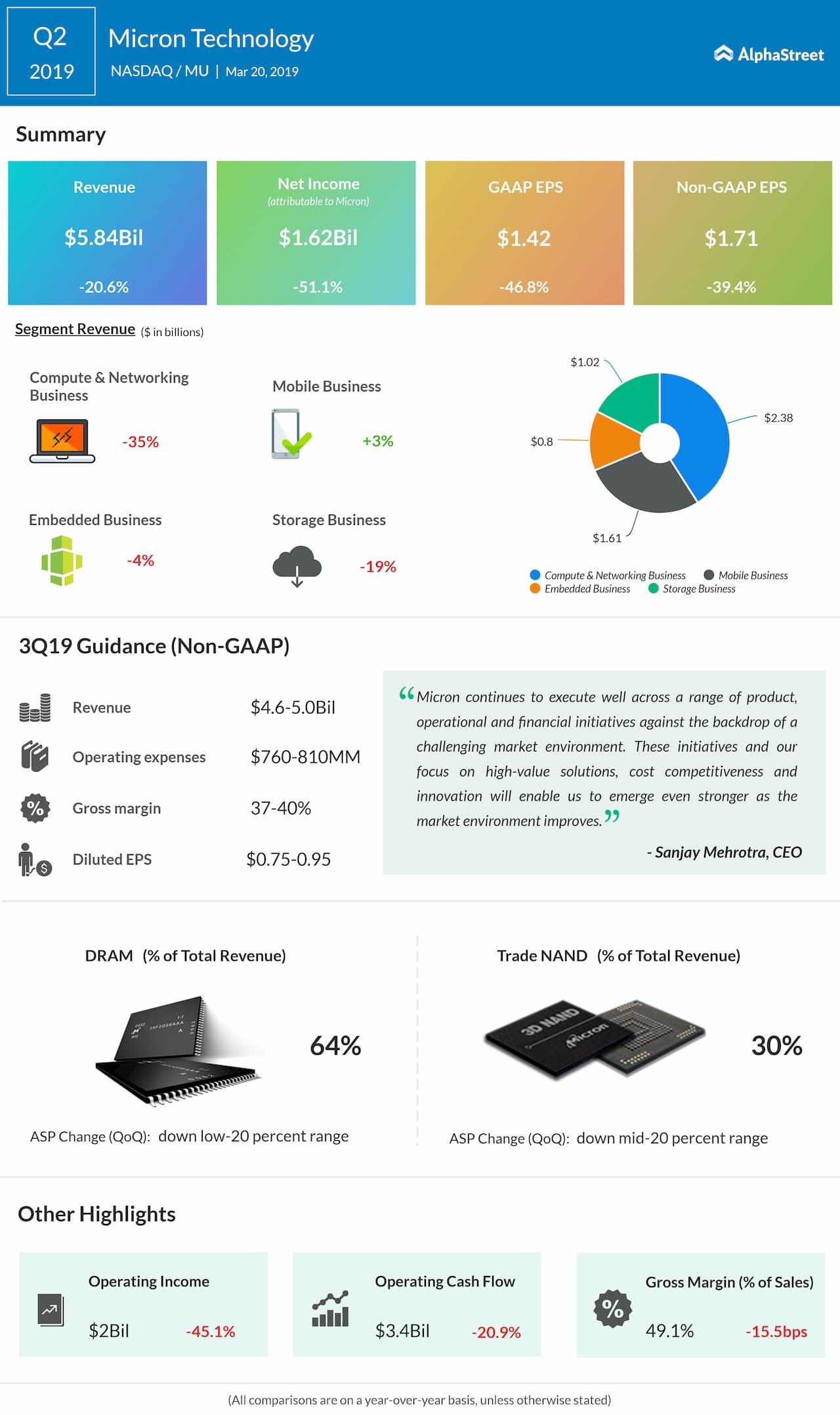

had reported disappointing quarterly results, where revenues fell 20% and

earnings plunged 40%. The declines were driven by worse-than-expected pricing trends in DRAM and NAND,

seasonality as well as investor adjustments by some important customers.

The company had also announced third-quarter guidance below the street view, which sent the stock into the red zone. However, the management had said that it expects demand to pick up in the second half of the year, besides seeing an improvement in inventory levels.

The chances of a seeing a recovery as break though, based on

what we have been seeing so far. Competitor Broadcom recently said that

customers are rampantly reducing inventory levels, leading to higher demand

volatility. Weakness in smartphone sales and stagnation in cloud hardware

spending are also yet to show signs of recovery.

Micron’s increased exposure in the Chinese market is a

separate risk facing the stock. It suspended its shipments to Huawei, which

accounts for approximately 13% of its total revenues, mid last month,

responding to the sanctions set by the US government. This could lead to

further declines in chip sales.

If this is the case, it is unlikely that Micron’s third-quarter results be any different than its second quarter.

Estimates

As the Boise, Idaho-based chipmaker announces third-quarter results on Tuesday, June 25, after the closing bell, Wall Street will be looking at how much of recovery actually happened so far. Analysts have projected another disappointing quarter, with a 39% decline in sales to $4.77 billion and 74% fall in earnings to 83 cents per share.

The earnings estimate has been slashed twice the trailing 90,

suggesting rising pessimism of the market. Meanwhile, Micron has a remarkable

history beating earnings estimate – it has done so in all of the trailing four

quarters.

Outlook will also be a key determining factor in the post-earnings stock movement. The market currently expects fourth-quarter earnings of 78 cents per share on revenues of $4.9 billion. If Micron guides below this level, the market could react aggressively.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.