Going by the recent trend, the actual results might exceed the expectations and brighten investor confidence. The analysts have maintained the current estimate for over a month now, with the majority of them recommending buy rating on the stock. The others mostly recommend hold. The earnings event will be closely followed by the entire semiconductor industry, looking for signs of improvement in the bearish conditions that crushed most of the chipmakers.

The event will be closely followed by the semiconductor industry, looking for signs of improvement in the bearish conditions

Nevertheless, Micron has managed to withstand the recent volatility and maintain its revenue and earnings growth to some extent. Though the market remains bullish about the company’s prospects, encouraged by its resilience to some of the market headwinds, the stock continues to face downward pressure.

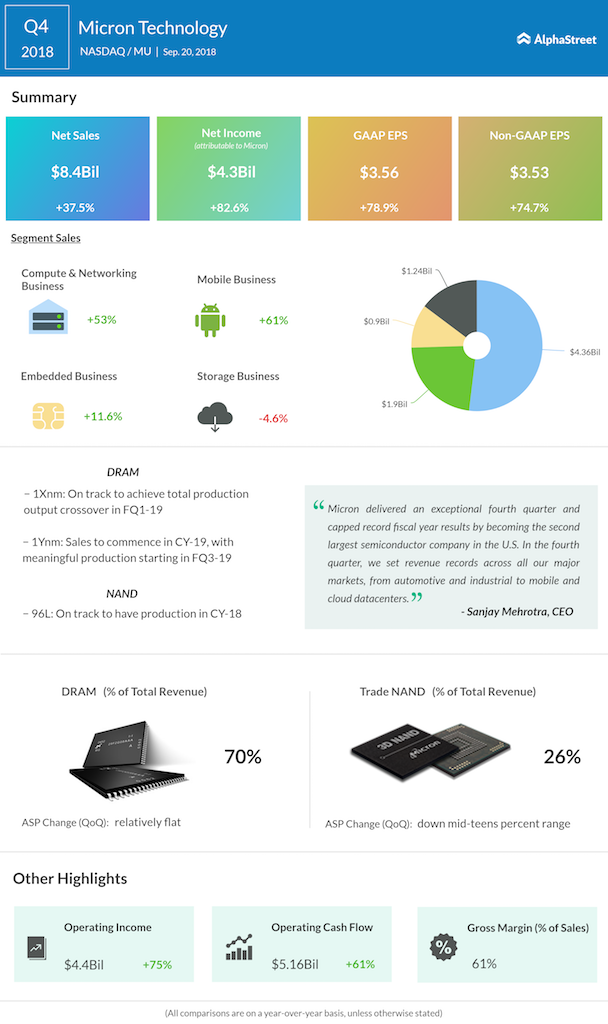

In the fourth quarter of 2018, earnings of the Boise, Idaho-based company rose to $3.53 per share from $2.02 per share in the preceding year, supported by a 38% growth in revenues to $8.44 billion, a record high.

Also See: Micron Technology Q4 2018 Earnings Conference Call Transcript

Market watchers are of the view that the semiconductor industry could be heading for a not-so-exciting 2019, considering the negative outlook for the DRAM and NAND prices. Adding to its woes, market leaders like Intel (INTC) and AMD (AMD) are witnessing a drop in orders from Apple (AAPL), one of their major business partners, reflecting the scaling down of iPhone production.

Intel is slated to report its fourth-quarter results on January 24 after the bell, while AMD will be announcing results for the most recent quarter on January 23 after the market closes.

Micron shares have fallen 44% since they reached a peak in May. The stock closed the last trading session sharply lower and lost further in the early trading hours Monday.