The high demand for cloud solutions and growing consumption of online content have helped most technology companies overcome the virus-induced slowdown. When technology titan Microsoft Corp. (NASDAQ: MSFT) unveiled its latest quarterly numbers this week, all eyes were on the Azure cloud business.

Also see: Microsoft Q1 2021 Earnings Call Transcript

With the majority of information technology firms staying resilient to the pandemic, the prospects of the whole sector look upbeat and Microsoft is no exception. Analysts see the company’s market value growing by a fifth in the next twelve months. The stock has remained an investors’ favorite for long, offering handsome returns.

New Opportunity

Like many others in the tech industry, Microsoft is riding the digital transformation wave, with the COVID-related movement restrictions forcing enterprises to shift their operations to digital platforms. The company’s diversified offerings, ranging from search service to cloud computing, gives it an advantage as far as beating the crisis is concerned.

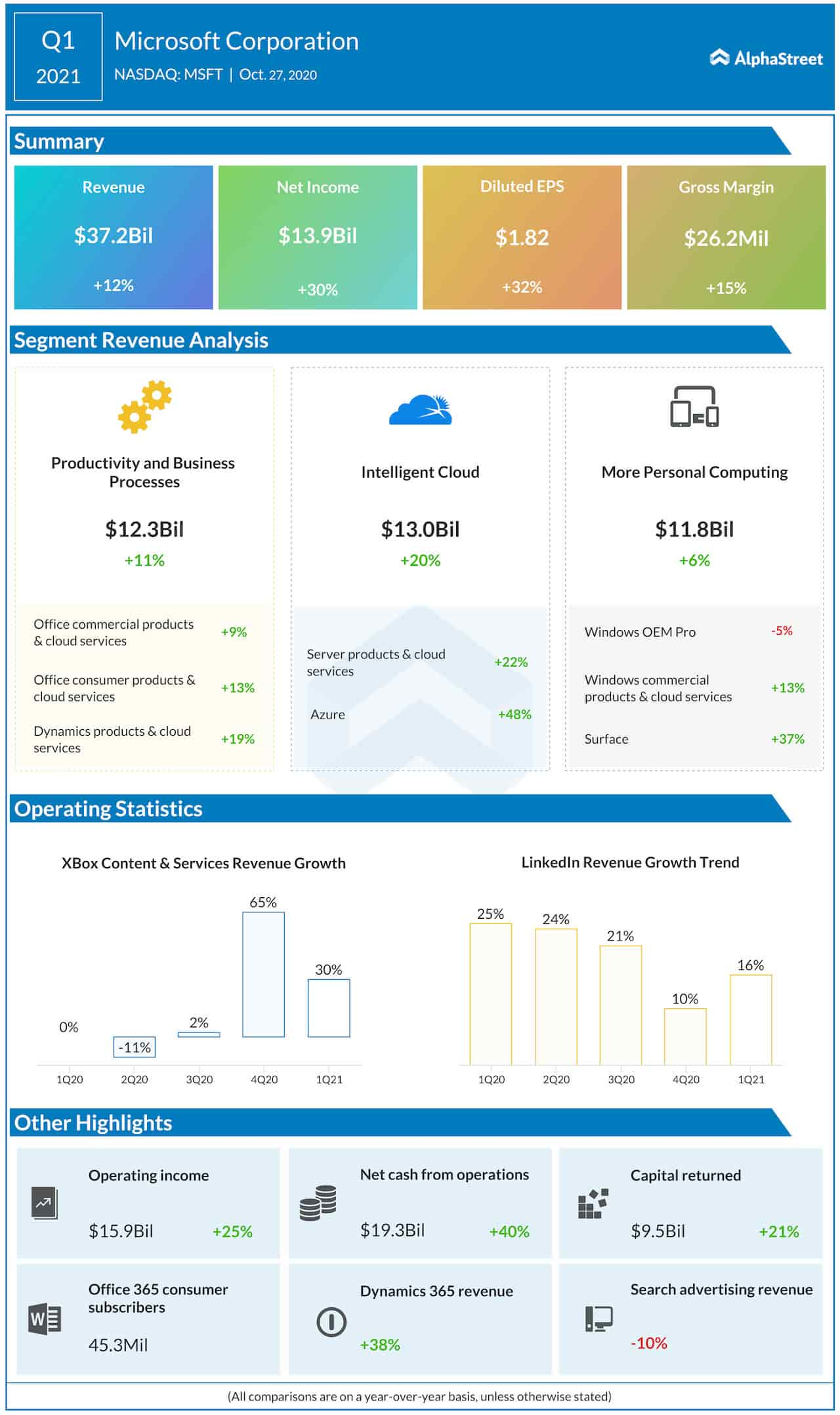

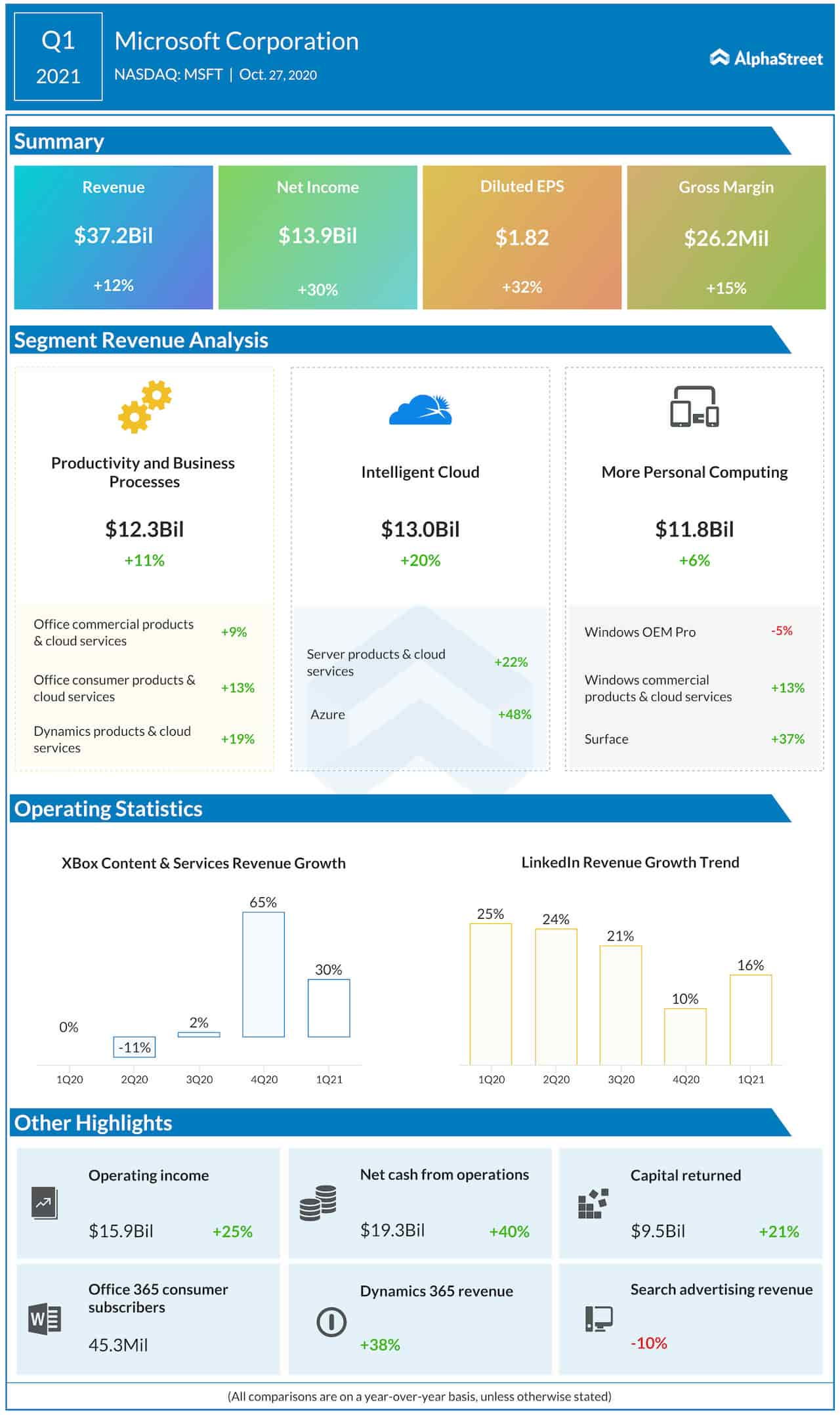

In the first quarter, employment site LinkedIn and gaming business Xbox also performed exceptionally well, besides the Surface laptop business that emerged a surprise winner. It is estimated that, in particular, Azure and Office 365 will continue to drive revenue growth going forward, at least for the rest of the year.

Growth Strategy

It goes without saying that the management would need to invest more in the growth areas to keep the momentum going and to retain the growing client base, which might hurt margins in the near term. Microsoft Cloud for Healthcare, the firm’s first industry-specific cloud, is expected to be unveiled this week.

Meanwhile, falling advertising spend will weigh on the company’s search business in the coming months, after contracting in the last two quarters. The downtrend could be a concern for Google (GOOG, GOOGL), which generates the lion’s share of its revenue from the search business.

From Microsoft’s first-quarter earnings conference call:

“We are off to a strong start in fiscal 2021, driven by the continued strength of our commercial cloud, which surpassed $15 billion in revenue, up 31% year-over-year. The next decade of economic performance for every business will be defined by the speed of their digital transformation. We are innovating across the full modern tech stack to help customers in every industry improve time to value, increase agility, and reduce costs.”

Broad-based Growth

In the first three months of fiscal 2021, Microsoft’s top-line maintained an uptrend and grew 12% to about $37 billion. The broad-based revenue growth, with all the main business segments performing well, translated into a 32% increase in earnings to $1.82 per share. Revenue growth for cloud platform Azure accelerated modestly from the prior quarter, after slowing down in the previous quarters.

Search advertising and Windows licensing were the main weak areas in the September-quarter, with revenues dropping 10% and 5% year-over-year respectively. While the stronger-than-expected results brought cheer to the stakeholders, the weak second-quarter guidance took the sheen off it.

Read management/analysts comments on quarterly results

“In Windows commercial products and cloud services, we expect healthy annuity billings growth driven by the continued demand for our advanced security solutions. However, growth will be materially impacted by a lower mix of multi-year agreements that carry higher in-quarter revenue recognition primarily due to the declining expiry base and a large deal in the prior year,” said Microsoft’s chief financial officer Amy Hood while interacting with analysts.

Stock Performance

Despite the results beating estimates, Microsoft’s shares dropped after the announcement as investor sentiment was hit by the weaker-than-expected outlook. After reaching a record high last month, the stock changed course and pared a part of the earlier gains. The shares opened Wednesday’s trading at $207.67 and traded lower throughout the session.