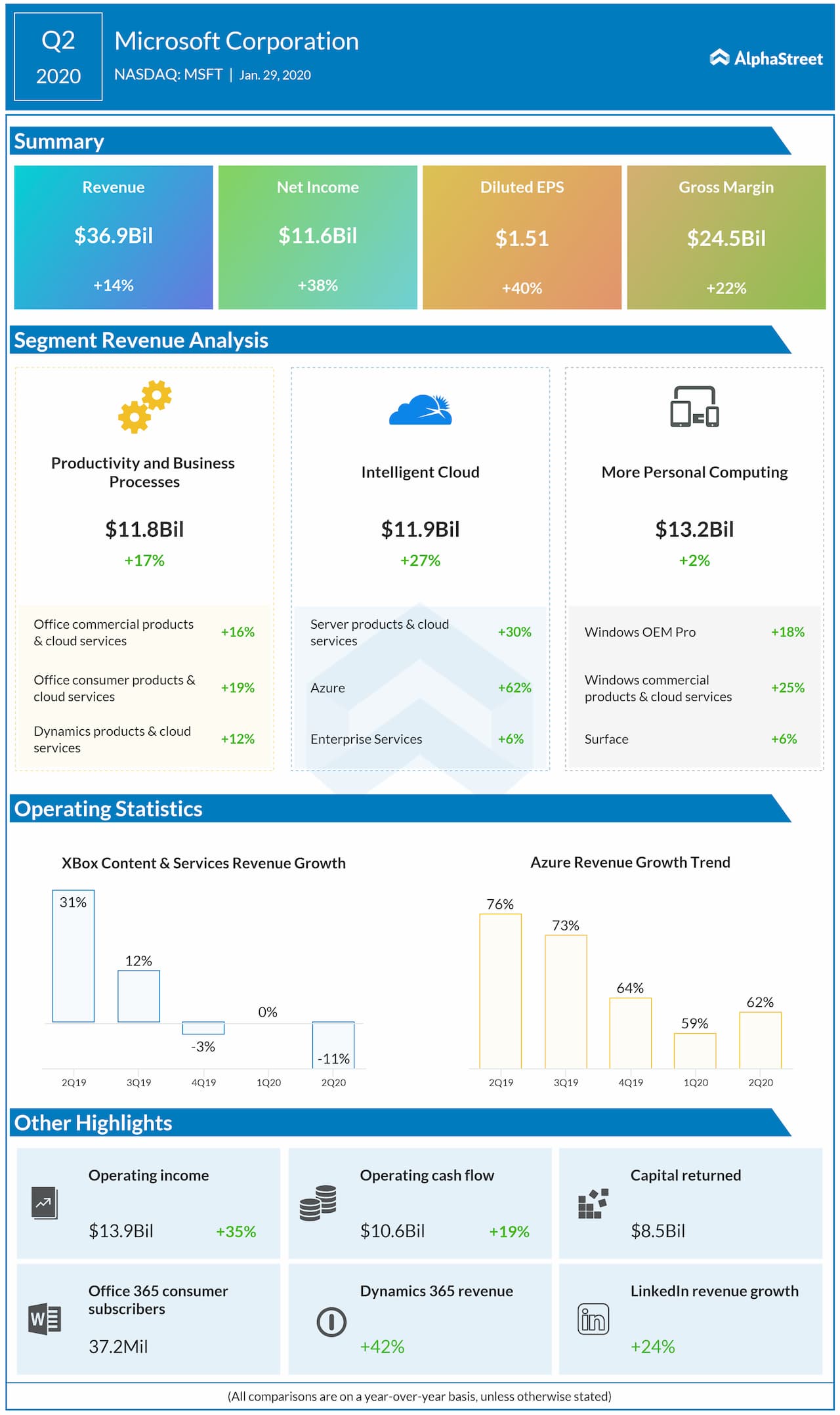

Microsoft Corporation (NASDAQ: MSFT) beat revenue and earnings estimates for the second quarter of 2020, allowing shares to gain 2% in aftermarket hours on Wednesday.

Total revenue rose 14% year-over-year to $36.9 billion, surpassing forecasts of $35.6 billion.

GAAP net income increased 38% to $11.6 billion and EPS

increased 40% to $1.51. Analysts had projected earnings of $1.32 per share.

Revenue in Productivity and Business Processes increased 17%

to $11.8 billion in the quarter. The company saw double-digit increases in

Office Commercial and Consumer products and cloud services. LinkedIn revenue

increased 24%.

“Strong execution from our sales teams and partners drove Commercial Cloud revenue to $12.5 billion, up 39% year over year,” said Amy Hood, EVP and CFO.

Also read: McDonald’s Q4 2019 Earnings Report

In the Intelligent Cloud segment, revenue rose 27% to $11.9 billion, driven by growth in Server products and cloud services as well as Enterprise Services. Azure revenue grew 62% year-over-year.

Revenue in More Personal Computing grew 2% to $13.2 billion with growth across all divisions except Xbox content and services which decreased 11%.

Microsoft returned $8.5 billion to shareholders in the form of share repurchases and dividends in the second quarter of 2020.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions