What is probably even more interesting about this company is that it licenses the AIMEE software to consumer brands, in turn, creating a tech vertical, besides the core consumer business. In an interview with AlphaStreet, Mohawk Group co-founder and CEO Yaniv Sarig said this smaller unit is starting to see traction once again after the pandemic-driven slowdown.

We are providing a technology platform for consumer brands that want to go from B2B to B2C approach. So right now, we are dealing with medium-sized clients. The challenge here is that we need a lot more of the CPG companies to shift their mindset for there to be a very large appetite for fulfilling licensing deals. And this might take some time.

Strong Q2 results and stock rally

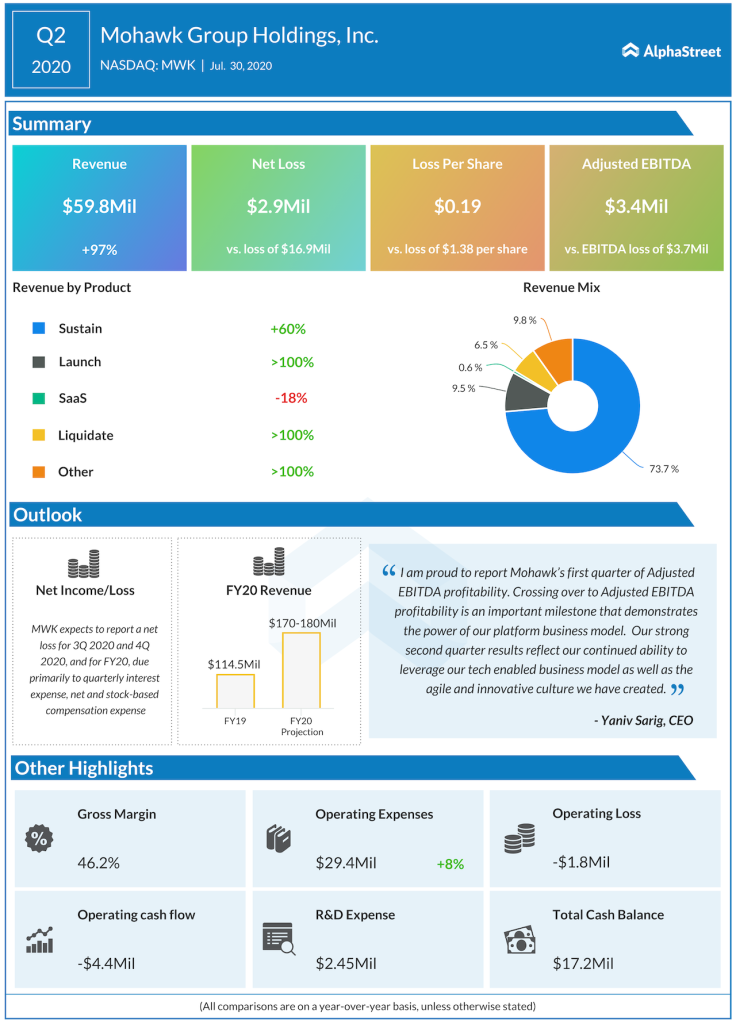

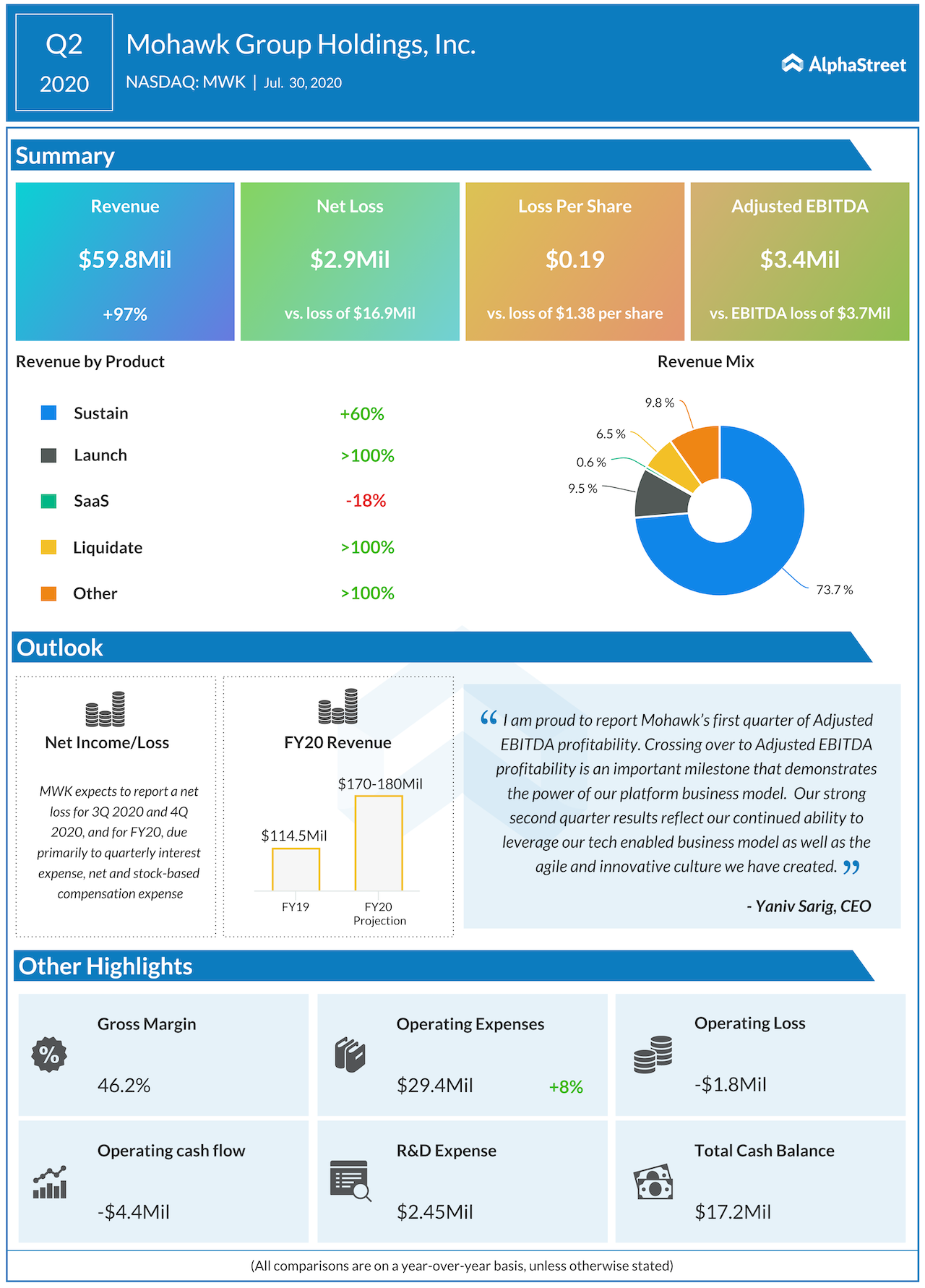

Last week, the New York-based firm delivered quarterly earnings that were narrower than anticipated on revenues that doubled year-over-year. Notably, the quarter also marked Mohawk’s first quarter of adjusted EBITDA profitability. Investors have sent the stock up almost 40% so far this year.

The CEO believes the shift from offline to online by more retailers could partly be offset by the weakness in the economy and reduced consumer spending. The company has guided sales in the latter half of the year in similar lines as the first half, which falls slightly on the conservative side.

The quarter also saw an increased demand for low-margin PPE products, and the management expects this trend to continue into Q3. Meanwhile, Sarig stated that he doesn’t believe this should have any material impact on the overall margins.

Dependence on Amazon

The company depends primarily on Amazon and Walmart (NYSE: WMT) to sell products from its four brands – Home, Vremi, Xtava, and RIF6. While this exposes the firm to the changes in seller policies of these two retail giants to some extent, Mohawk management feels their ecosystem offers it the best opportunity to connect with customers.

Responding to Amazon CEO Jeff Bezos’s recent comments that it may have used third-party seller data for the development of private labels, Sarig said imitations are not a concern as long as its products get acceptability and strongly favorable consumer reviews.

“Our market a $300 billion pie today. So even if Amazon is going to want a bigger piece of this pie, there’s still so much business out there for us to be the second biggest. Selling products on Amazon behind Amazon is still an enormous opportunity. Apart from that, there are abundant opportunities in international markets, such as Flipkart in India or Tmall in China.”

ADVERTISEMENT

According to the CEO, Mohawk’s international expansion timelines have been stretched by the disruption caused by COVID-19. Once the dust settles, the firm has numerous regions including India, China, Japan, and Europe on its radar.

Analysts are quite bullish about this company, with an average 12-month price target that is almost 90% above Monday’s closing price. The stock carries an average Strong Buy rating.

______

For more updates on Mohawk Group, read the latest earnings transcript.