Net Profit

Meanwhile, unadjusted profit attributable to shareholders decreased to RMB731.8 million ($106.6 million) or RMB3.33 per ADS from RMB750.2 million or RMB3.55 per ADS in the second quarter of 2018. The bottom-line was negatively impacted by share-based compensation expenses related to certain share options granted to the founders of the Tantan subsidiary, which recently faced an investigation by the government.

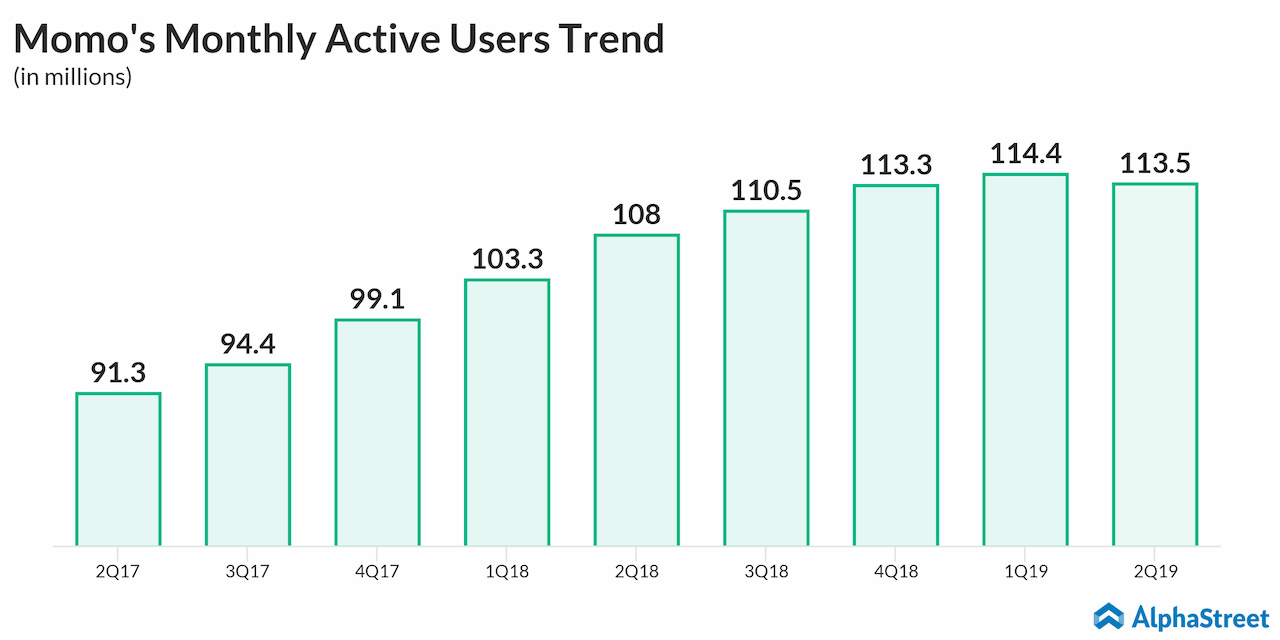

During the quarter, net revenues climbed 32% year-over-year to RMB4.15 billion ($604.9 million), beating the estimates. At the end of the quarter, the company had 113.5 million monthly active users, which is up 5% from last year. Currently, Tantan has 4.1 million paying users.

Segment-wise Revenue

Live video service revenues advanced 18% annually, helped by the increase in paying users and improved pricing. Value-added service revenues more than doubled during the quarter, aided by the continued growth of the virtual gift business. Mobile marketing revenues dropped 46%, hurt by a decline in advertisement properties on the platform. There was a 33% drop in mobile games revenues.

Also read: Ulta Beauty set to charm the market with solid Q2 results

“We continued to deliver strong financial results and make progress across all of our strategic priorities. Since the full restoration of its download and payment service in mid-July, Tantan has been recovering with robust momentum across different user and revenue metrics. It demonstrated the strong demand for online dating service in China and Tantan’s unique position in this sector,” said CEO Yan Tang.

Outlook

Buoyed by the positive results, the management forecasts a 17-19% growth in its third-quarter net revenues, to the range of RMB4.25 billion to RMB4.35 billion.

Shares of Momo gained about 3% early Tuesday, after closing the previous session higher. The stock has gained 32% since the beginning of the year.