Stock Rallies

The valuation is favorable considering the innovation-focused business model and the company’s ability to create long-term shareholder value, though the stock is expected to trade sideways in the near future. The positive top-line performance in recent quarters indicates that revenues are stabilizing after a period of volatility, which adds to the stock’s prospects as a safe investment.

Net income, excluding one-off items, jumped to $0.56 per share in the most recent quarter from $0.20 per share a year earlier, far exceeding Wall Street’s projection. Earnings beat estimates for the fourth consecutive quarter and were broadly on line with the record high of last quarter.

Solid Results

On a reported basis, including special items, it was a net loss of $54.2 million or $0.77 per share, compared to a loss of $77.3 million or $1.14 per share last year. The bottom line benefitted from a 29% year-over-year increase in revenues to $368.3 million. The latest number also topped expectations. The company attributed the surge in revenues to some major customer wins, including China Mobile which migrated a key service from Oracle to MongoDB.

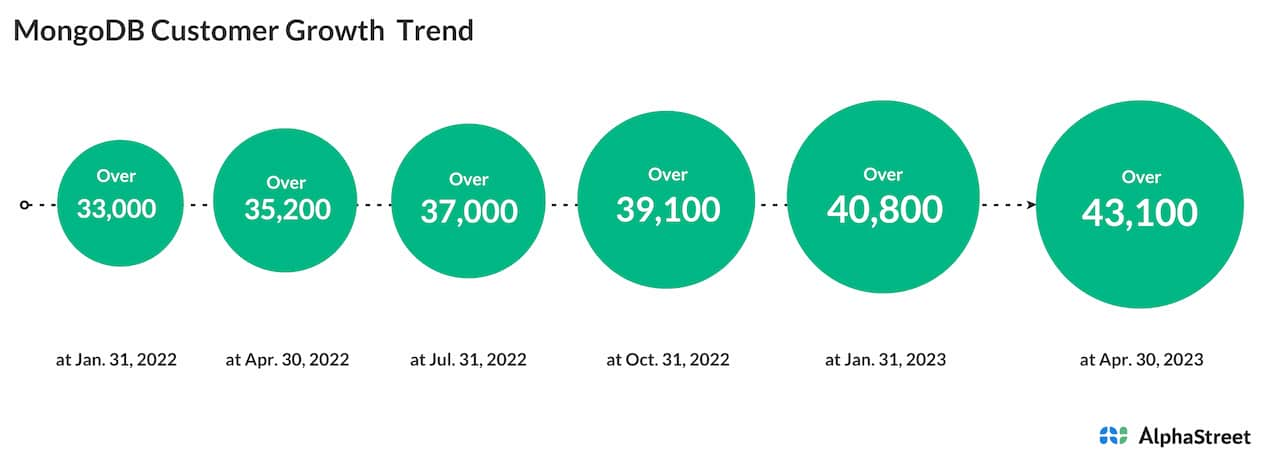

MongoDB added 2,300 new customers in the April quarter, taking the total number to more than 43,100 which also came in above the consensus estimates. Free cash flow, at the end of the quarter, was $53.73 million, which represents a three-fold increase from the prior-year period.

From MongoDB’s Q1 2024 earnings conference call:

“Our customers ranging from the largest companies in the world to cutting-edge startups use our developer data platform to develop and run mission-critical applications. As these applications become successful, customers spend more with MongoDB. In other words, their spend on our platform is directly aligned with the usage of their underlying application, therefore, the value they derive from it. While the growth rate of existing applications can vary based on a number of factors including macro conditions, the relationship between application usage and growth – application usage growth and MongoDB spend has remained consistent.”

Outlook

In a move that could drive long-term revenue growth, the company extended its strategic partnership with Alibaba through 2027, to further integrate its cloud services to serve customers better. Buoyed by the positive developments, the management raised its full-year 2024 revenue guidance to $1.522 billion to $1.542 billion and increased the forecast for adjusted earnings to $1.42-1.56 per share. For the second quarter, the company expects revenue to be in the range of $388 million to $392 million, and earnings per share between $0.43 and $0.46.

MDB opened Monday’s session at $376.30 and made steady gains in the early hours. Currently, the stock is at its highest level in more than a year.