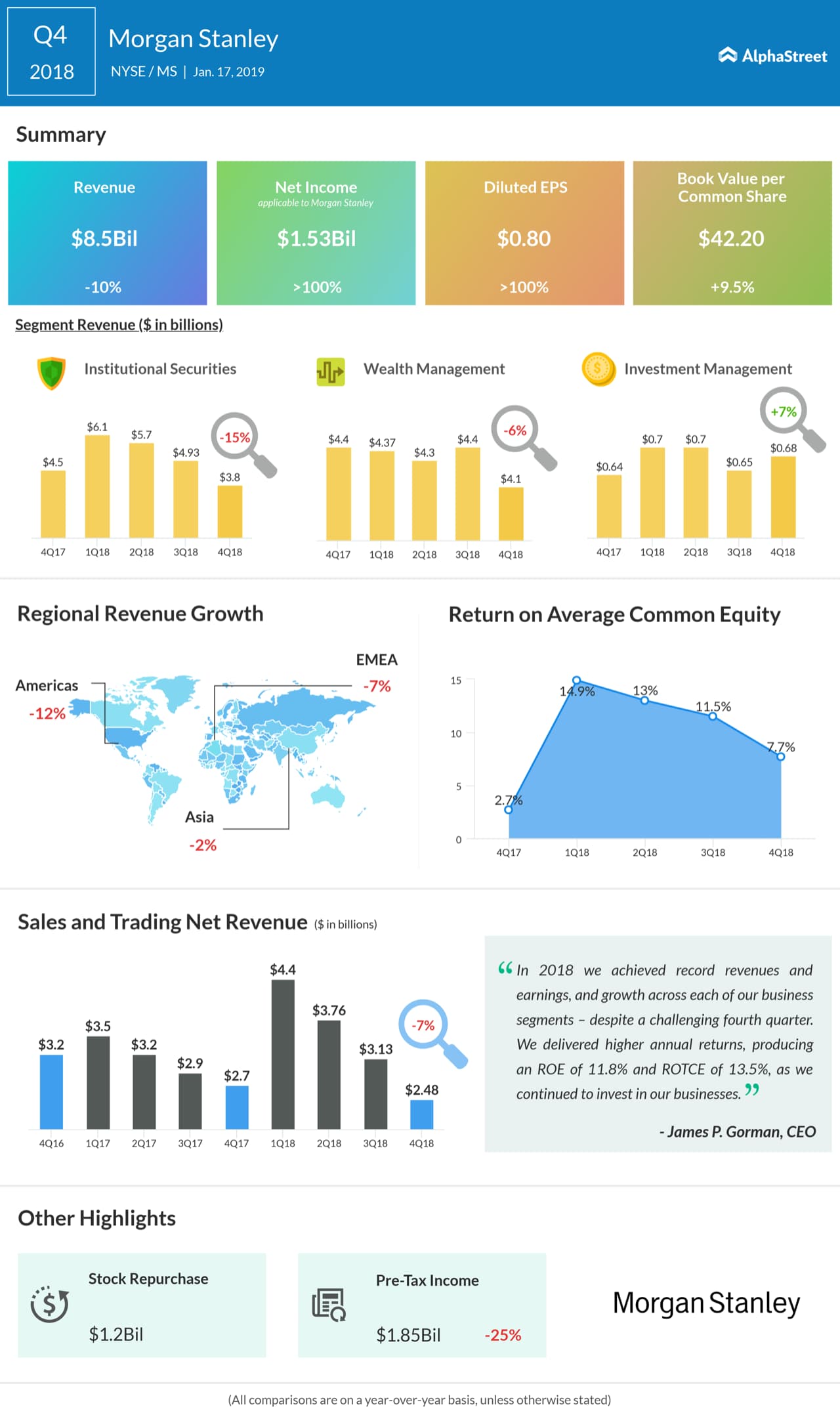

For the quarter, net income applicable to Morgan Stanley was $1.5 billion or $0.80 per diluted share, up from $643 million or $0.26 per diluted share.

Analysts expected earnings of $0.90 per share on revenue of $9.61 billion.

In the three-month period, Morgan Stanley recorded an intermittent net discrete tax benefit of $111 million or $0.07 per diluted share, regarding the resolution of multi-jurisdiction tax examinations. While in the same period a year ago, an intermittent net discrete tax provision of $1.0 billion or a loss of $0.58 per diluted share affected the results due to the Tax Cuts and Jobs Act.

Compensation expense was $3.8 billion for the quarter, down from $4.3 billion a year ago on lower net revenues. Non-compensation expenses were $2.9 billion, up from $2.8 billion a year ago.

The annualized return on average common equity was 7.7% and the annualized return on average tangible common equity was 8.8% in the current quarter.

CEO James P. Gorman said “we delivered higher annual returns, producing an ROE of 11.8% and ROTCE of 13.5%, as we continued to invest in our businesses. While the global environment remains uncertain, our franchise is strong and we are well positioned to pursue growth opportunities and serve our clients.”