Volatile global market environment pushed fourth-quarter revenue and profit of Morgan Stanley (MS) below Street expectations, as the financial giant reported its results before the market opened on Thursday, January 17.

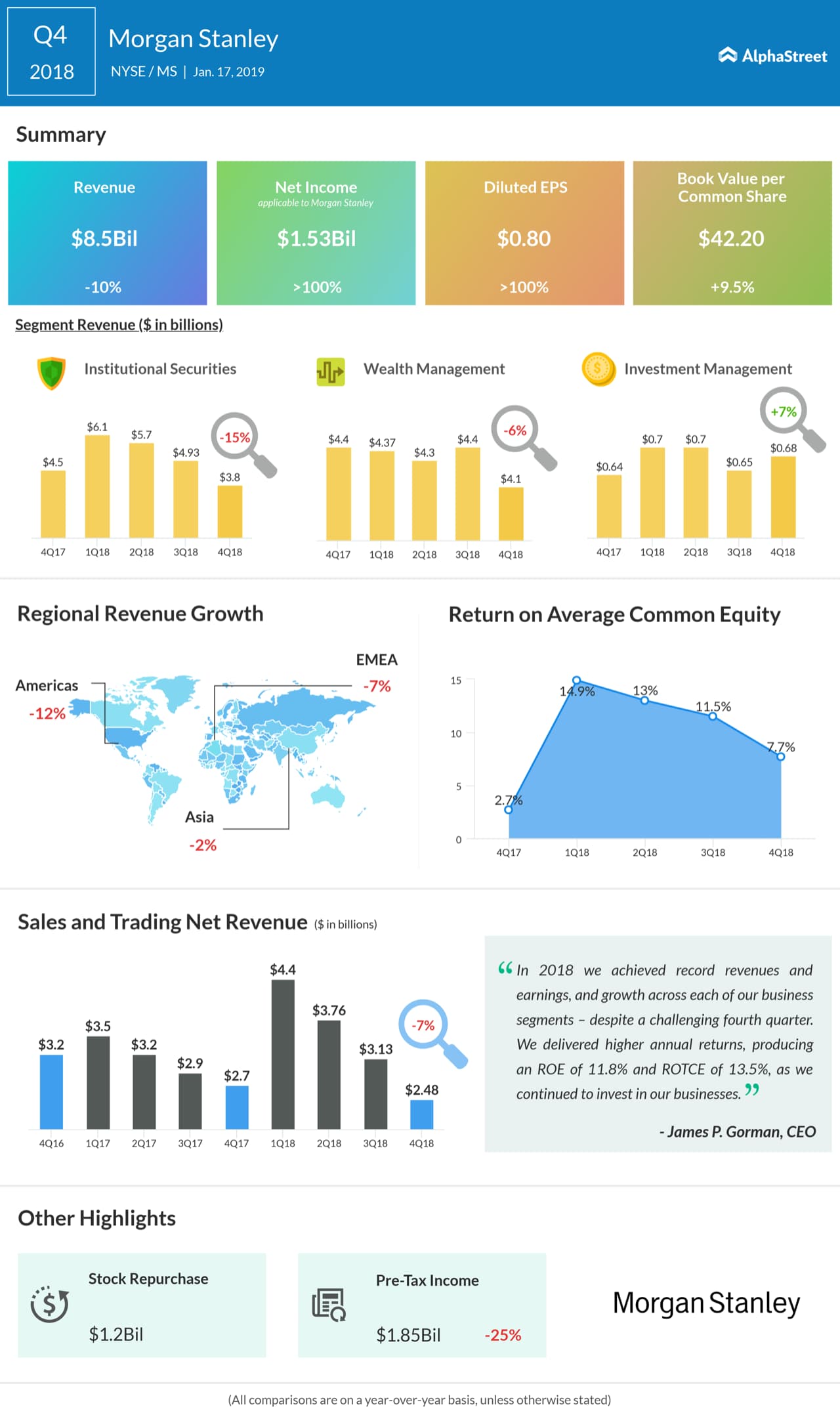

The company saw net revenues fall to $8.5 billion for the fourth quarter, down from $9.5 billion a year ago.

For the quarter, net income applicable to Morgan Stanley was $1.5 billion or $0.80 per diluted share, up from $643 million or $0.26 per diluted share.

Analysts expected earnings of $0.90 per share on revenue of $9.61 billion.

In the three-month period, Morgan Stanley recorded an intermittent net discrete tax benefit of $111 million or $0.07 per diluted share, regarding the resolution of multi-jurisdiction tax examinations. While in the same period a year ago, an intermittent net discrete tax provision of $1.0 billion or a loss of $0.58 per diluted share affected the results due to the Tax Cuts and Jobs Act.

Compensation expense was $3.8 billion for the quarter, down from $4.3 billion a year ago on lower net revenues. Non-compensation expenses were $2.9 billion, up from $2.8 billion a year ago.

The annualized return on average common equity was 7.7% and the annualized return on average tangible common equity was 8.8% in the current quarter.

CEO James P. Gorman said “we delivered higher annual returns, producing an ROE of 11.8% and ROTCE of 13.5%, as we continued to invest in our businesses. While the global environment remains uncertain, our franchise is strong and we are well positioned to pursue growth opportunities and serve our clients.”