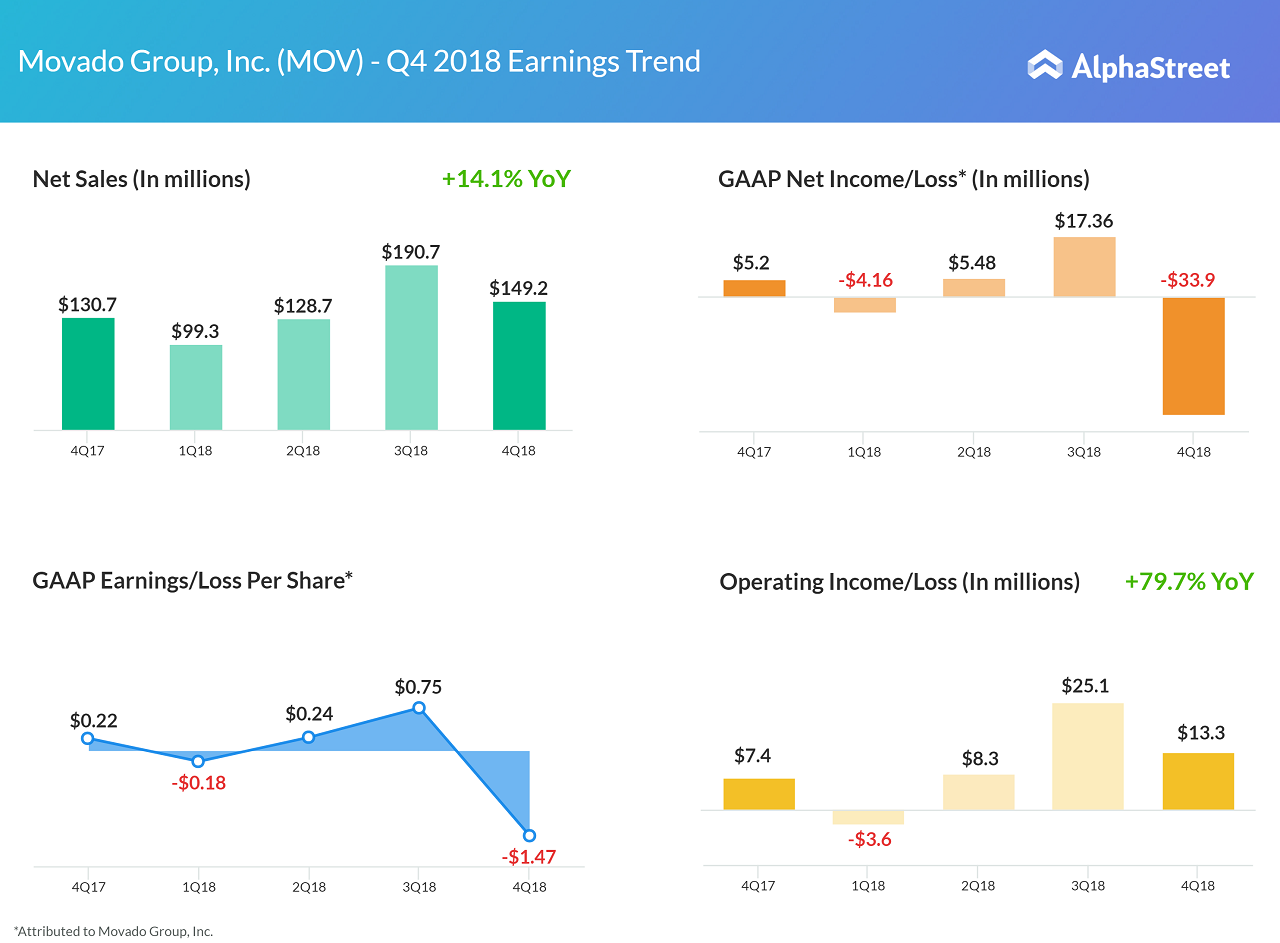

Watchmaker Movado Group’s (MOV) revenue and adjusted profit for fourth quarter 2018 beat analyst expectations. However, the company swung to a loss on a GAAP basis, impacted by expenses and amortization related to the Olivia Burton brand acquisition and the tax expense related to the 2017 Tax Act. Sales jumped 14.1% to $149.2 million, while the company incurred a net loss of $33.9 million or $1.47 per share compared to a profit of $5.2 million or $0.22 a share in the same period in 2017. On an adjusted basis, EPS more than doubled to $0.52.

The company recorded a 6.4% increase in comparable sales for its Movado Company Stores. Movado increased its dividend for the quarter by 53% to $0.20 per share.

Outlook

Movado expects net sales for fiscal 2019 to be in the range of $605 million to $615 million and operating income to be about $68 million to $71 million. Net income is expected to be about $50.5 million to $52.8 million, or $2.15 to $2.25 per diluted share. The guidance excludes about $3 million of amortization of the acquired intangible assets related to the Olivia Burton brand for fiscal 2019.