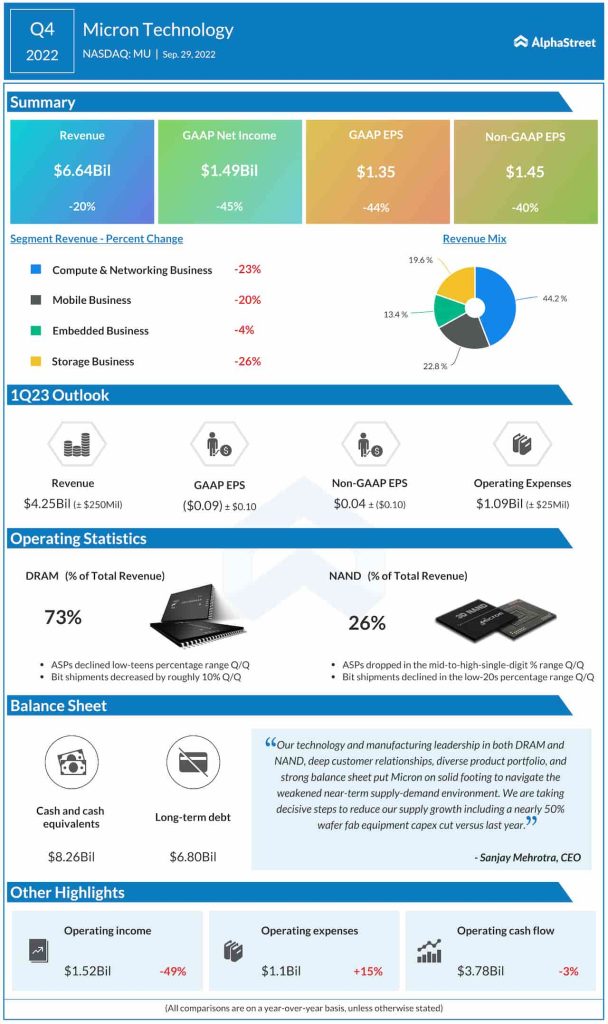

On an adjusted basis, fourth-quarter profit dropped to $1.45per share from $2.42 per share a year ago. Unadjusted net income was $1.50 billion or $1.35 per share, compared to $2.72 billion or $2.39 per share in the fourth quarter of 2021.

The bottom line was negatively impacted by a 20% fall in revenues to $6.64 billion. Revenues also missed expectations.

Check this space to read management/analysts’ comments on Micron’s Q4 earnings

“We are taking decisive steps to reduce our supply growth including a nearly 50% wafer fab equipment capex cut versus last year, and we expect to emerge from this downcycle well positioned to capitalize on the long-term demand for memory and storage,” said Micron’s CEO Sanjay Mehrotra.