Expansion

The tech firm is currently building what it calls the Megafab in New York, spending about $100 billion. Touted as the largest semiconductor fabrication facility in the US, the factory is expected to give the company a significant edge over rivals. It is expected that the total addressable market for memory and storage chips would grow to a record high in the next two years, outpacing the larger semiconductor industry.

“Our expectations for calendar 2023 industry bit demand growth have moderated to approximately 5% in DRAM and low-teens presentation range in NAND, which are well below the expected long-term CAGAR of mid-teens percentage range in DRAM and low 20s percentage range in NAND. The reduction in calendar 2023 demand from our prior forecast is driven by an assessment of customer inventories as well as some degradation in end market demand. We expect that improving customer inventories will support sequential bit demand growth for DRAM and NAND through the calendar year,” said Micron’s CEO Sanjay Mehrotra in a recent statement.

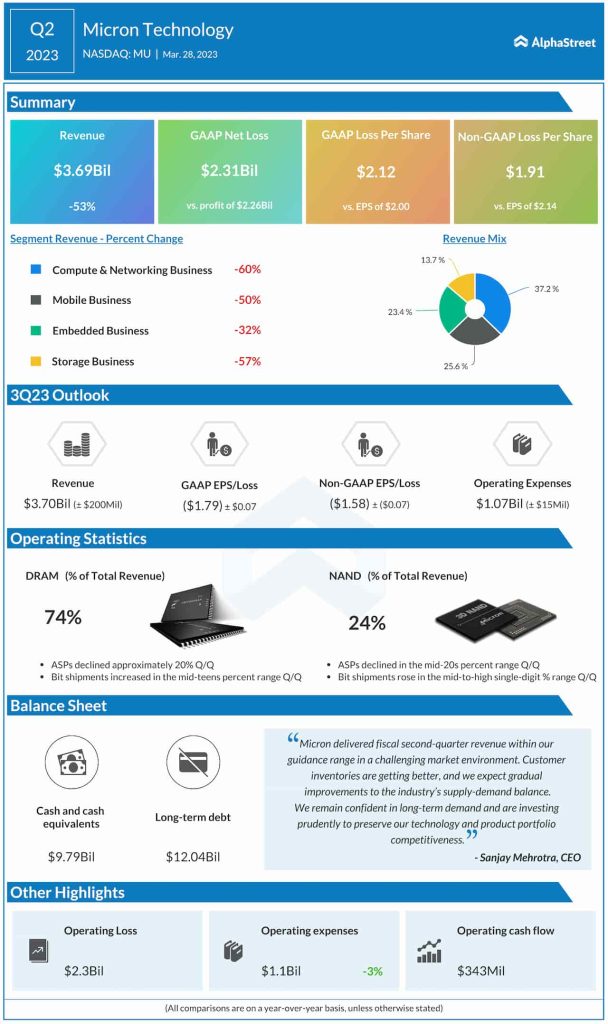

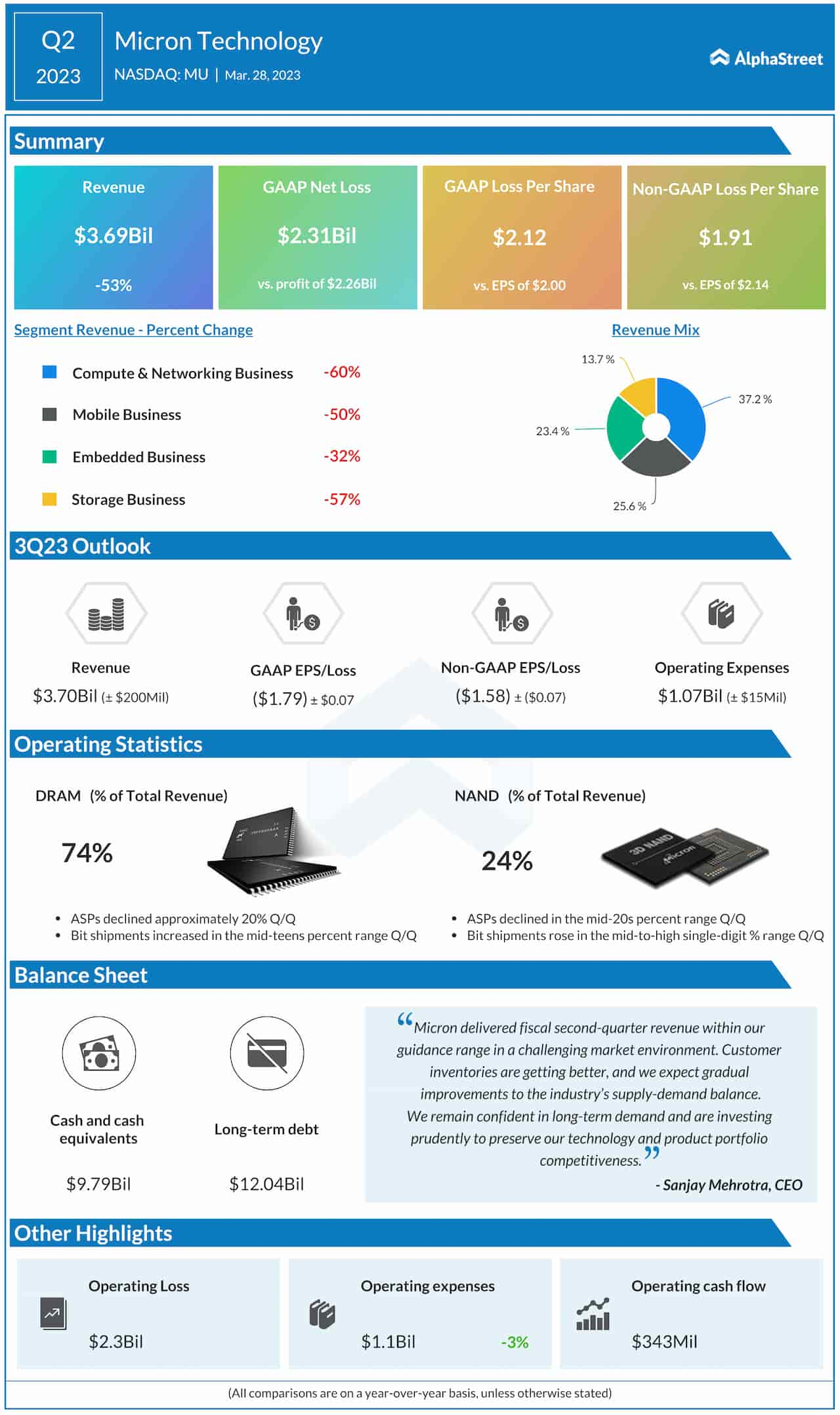

Weak Q2

In a dismal show, all four operating segments contracted in double digits in the second quarter of 2023 when total revenues dropped 53% year-over-year to $3.69 billion. That was in line with the management’s guidance. As a result, the company slipped into a loss, marking the second consecutive negative earnings. The bottom line also missed estimates, as it did in the prior quarter, reversing the long-term trend of regular beats. On an adjusted basis, the net loss was $1.91 per share, compared to earnings of $2.14 per share in the prior-year quarter.

Meanwhile, Micron executives are of the view that customer inventories and the industry’s supply-demand balance would improve in the coming months. On Tuesday, Micron’s shares declined in early trading and hovered slightly below the long-term average. They are up 16% since the beginning of the year.