“Mylan’s first quarter demonstrates continued execution of our long-term plan. Our diversity and durability are what allow us to absorb evolving industry dynamics and natural market volatility, while at the same time accelerate our mission of providing access to high-quality medicine”, said Heather Bresch, CEO.

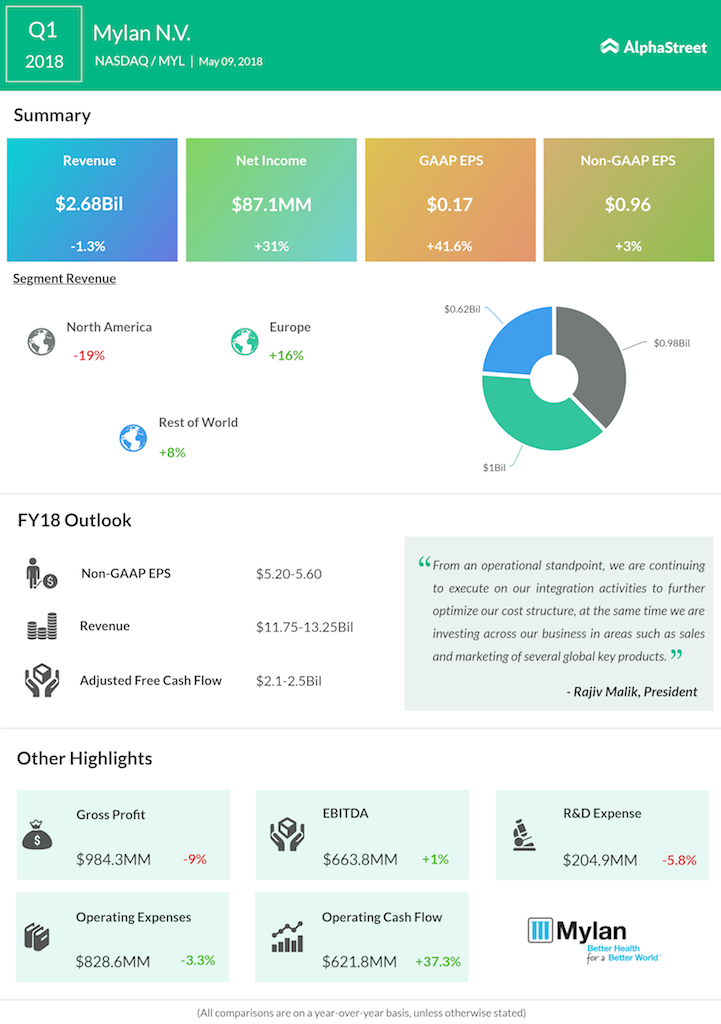

On a segment basis, Mylan is continuing to see softness in its North America markets as the volatility continues to flow into 2018. The performance in the area was mainly hurt by the loss of exclusivity on the olmesartan products, declining branded product sales and the effect of the adoption of new accounting standards. However, the company reported strong sales results for its Europe and Rest of World regions, with Europe sales jumping 16.3% and Rest of World sales increasing 7.9%.

Though the future looks bleak for US markets, but Mylan’s strong product pipeline and its big line of product pending approval could offset the declining sales of EpiPen. Mylan is also looking forward to a tentative approval of generic Restasis with the action date expected in July of this year.

The generic drug maker has also been proactive in keeping its R&D costs low. Recently, the company adopted a partnership approach with Indian pharmaceutical companies to support this plan. In line with expectations, R&D expense declined 5.7% for the quarter to $204.9 million, helped by these initiatives and the reprioritization of global programs.

Over the last one year, Mylan stock had declined more than 7%, with the stock declining as much as 12% in the last one month. Post earnings, however, the stock gained 1% pre-market trading, despite reporting a miss on revenue and earnings estimates.

For fiscal 2018, Mylan reaffirmed its guidance and business outlook, including total revenue range of $11.75 billion to $13.25 billion, adjusted earnings per share in the range of $5.20 to $5.60 and adjusted free cash flow in the range of $2.1 billion to $2.5 billion.