FY20 results

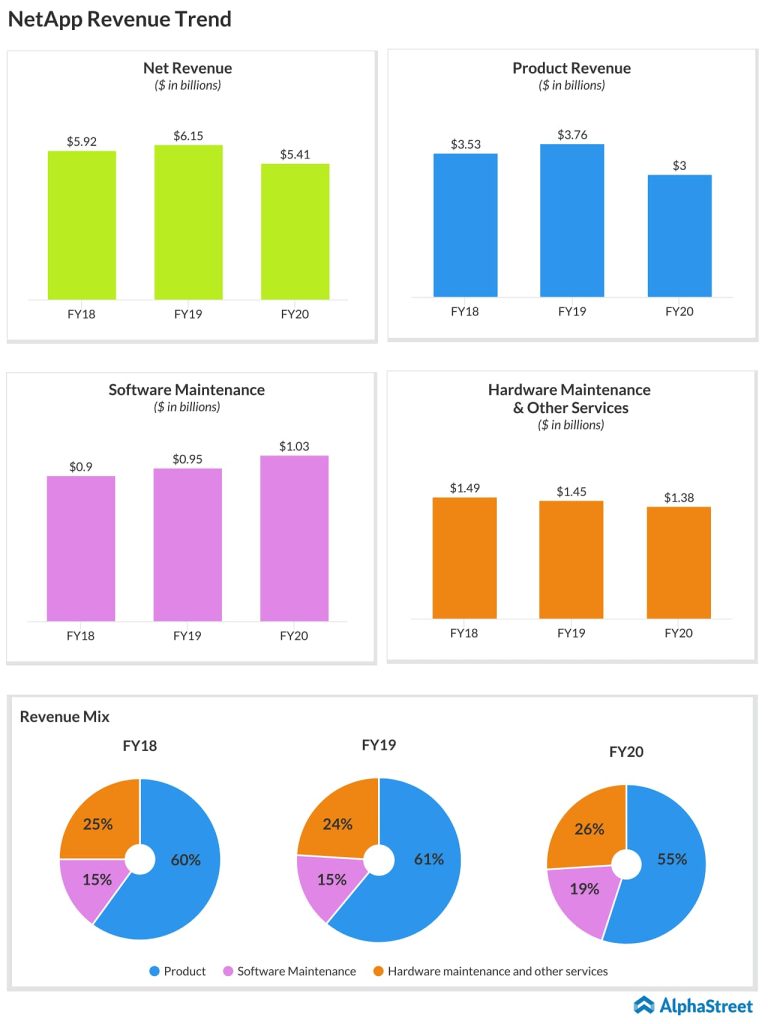

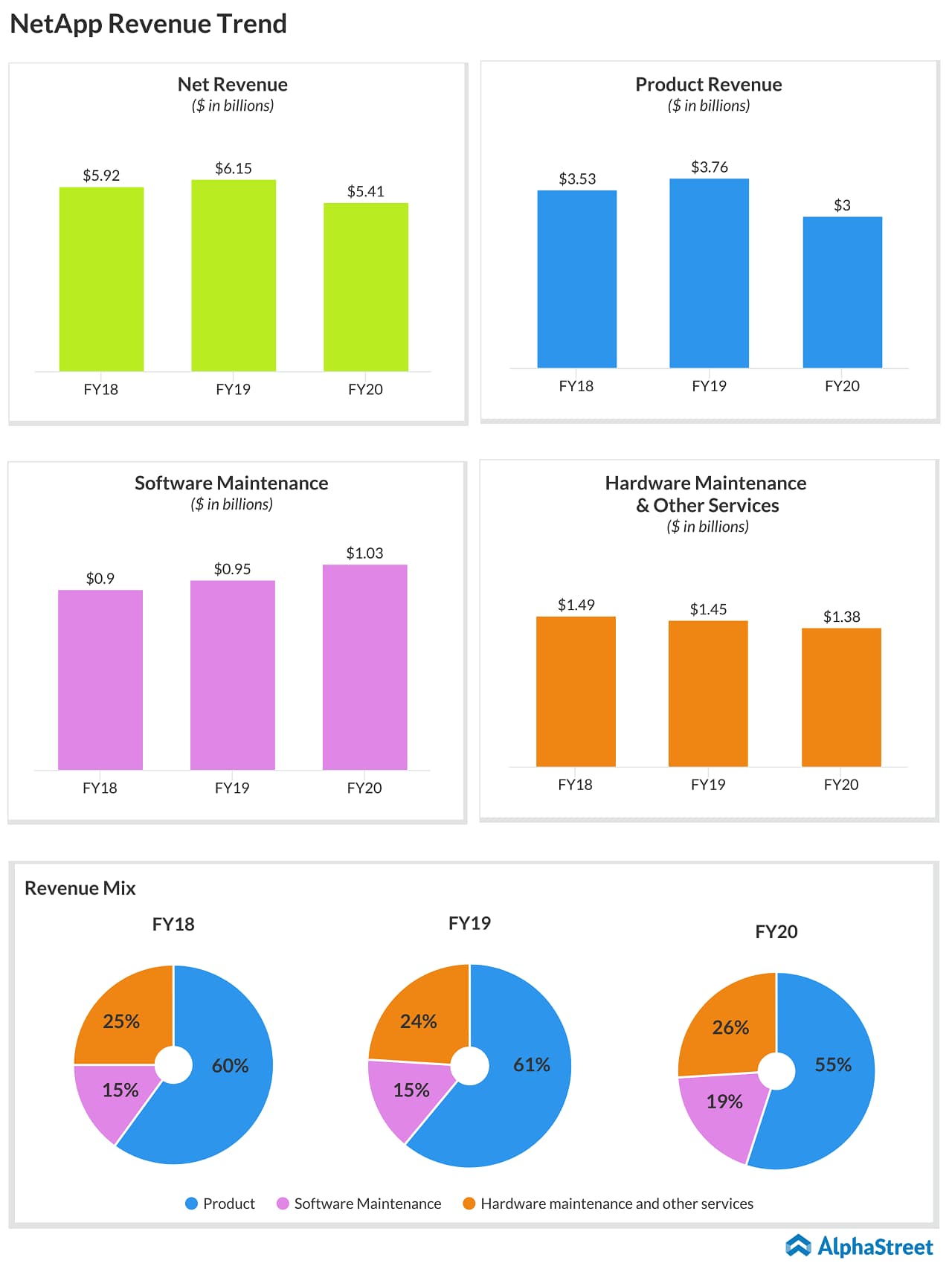

The decline in NetApp’s product revenue was primarily due to the

unfavorable macroeconomic conditions and lower enterprise IT spending

throughout fiscal 2020. Also, the increasing macroeconomic uncertainty caused

by the global pandemic contributed to demand weakness in the final quarter of

2020, while associated logistical challenges led to interrupted deliveries of

products and services to certain customers.

While the product revenue declined in FY20 due to the COVID-19 impact, you can see an increase in revenue from software maintenance as Cloud Data Services gained momentum.

Expenses

Operating expenses for FY20 decreased slightly to $2.68 billion from $2.72 billion in the prior year. In an email communication to AlphaStreet, NetApp spokesperson reiterated that as of now the company has not decided to make any significant structural changes to its expense base until it gets better visibility into the duration and magnitude of the current downturn. The company added that the situation is expected to remain fluid over the next two to three quarters.

[irp posts=”62798″]

Acquisitions

In the fiscal year ended April 24, 2020, NetApp acquired Cognigo Research, which deals with data discovery and next-generation software-defined storage solutions provider Talon Storage Solutions. At the end of April 2020, NetApp acquired Cloud Jumper, a provider of virtual desktop infrastructure and remote desktop services solutions. Early this month, the company acquired Spot, a provider of computing management and cost optimization services on the public clouds. These acquisitions bolster the company’s strategic roadmap, particularly within the Cloud Data Services business.

Competition

To beat the rivals, NetApp has been working continuously on new product releases like MAX Data and Project Astra. The company spokesperson said that Project Astra, the application data management software, is currently now in Alpha phase and general availability is planned for later in the year. NetApp competes against Dell Technologies (NYSE: DELL), Hewlett Packard Enterprise (NYSE: HPE), Hitachi Vantara, and International Business Machines (NYSE: IBM), as well as Pure Storage (NYSE: PSTG), Nutanix (NASDAQ: NTNX), and other smaller players.

COVID-19 impact

The COVID-19 pandemic has negatively impacted NetApp’s business

in many ways, resulting in:

- Reduced demand for the company’s products and services

- Delayed and deferred purchases

- Restriction of sales, marketing and distribution efforts

- Supply chain disruption

- Disruption of the suppliers, customers and partners

NetApp expects these disruptions to negatively impact its future

sales and results of operations for an uncertain duration and with an unknown

level of magnitude.

Long-term view

The company’s net revenue declined year-over-year in FY20, mainly because of the reduction in product revenue. However, rising software maintenance revenue is an encouraging sign. Once the critical situation ends, product revenue is also expected to increase for NetApp. As more and more companies opt for digital transformation, the Cloud Data Services business is expected to add more value to NetApp in the future.

[irp posts=”62852″]

More than 80% of the analysts covering NetApp recommends either to “Buy” or “Hold” the stock. After hitting a 52-week high ($65.38) in January this year, NTAP stock plunged to yearly low ($34.66) on March 23. With the growing strength in Cloud Data Services, market watchers expect NetApp stock to benefit long-term investors.

DISCLAIMER: This article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.