However, it may be noted that despite the record growth in

paid net adds, the stock plunged following the Q1 announcement on weaker-than-expected

outlook, suggesting that the stock has grown beyond the status of a “one-metric

mover.”

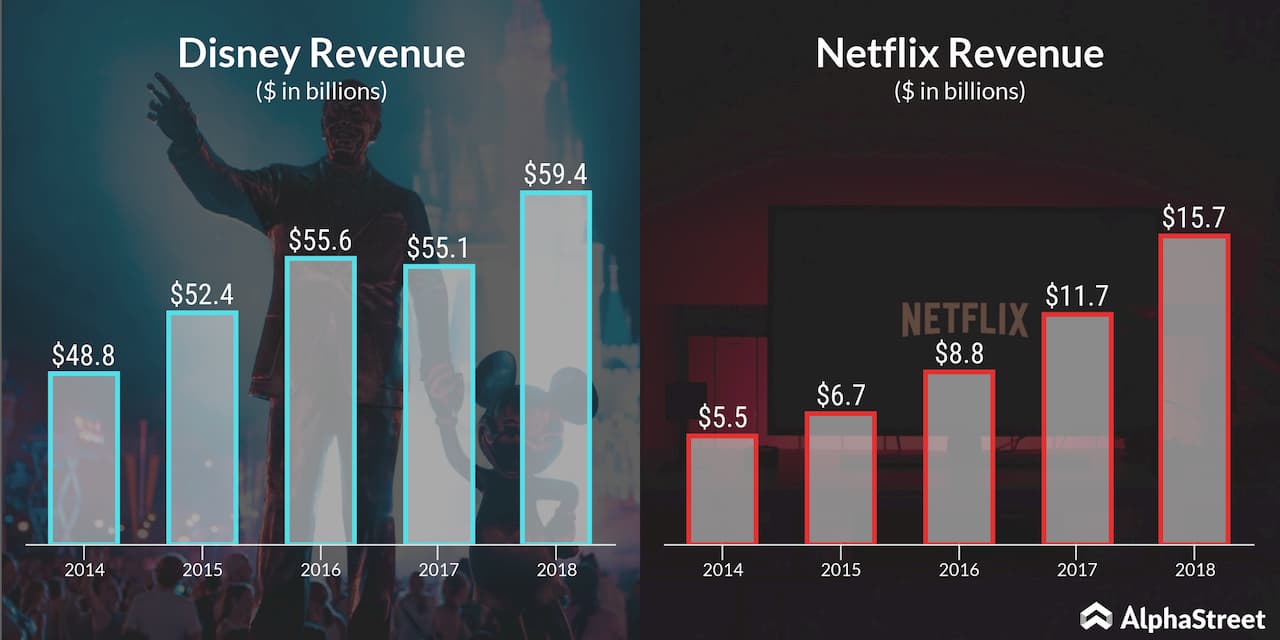

Both the management and the street expect Q2 revenues of $4.93 billion, 26% higher than a year ago. The revenue growth will be driven by its expanding paid membership base, which jumped 25% to 148.9 million at the end of last quarter, as well as a hike in subscription fees in multiple markets.

LISTEN TO: Netflix IncQ1 2019 earnings conference call

ADVERTISEMENT

During the second quarter, Netflix hiked subscription fees in Brazil and Mexico. Separately, a part of the fee hike in the US, which was announced in January, took place in the second quarter. This will help boost the average revenue per user (ARPU) in Q2.

Meanwhile, Wall Street expects net income to decline to $0.56

per share, a cent higher the management projection, from $0.85 per share a year

ago. This will be primarily due to higher taxes the company has to pay towards

corporate restructuring. The taxes will come down in the long term.

Netflix has surpassed earnings estimates in the past three quarters by big margins.

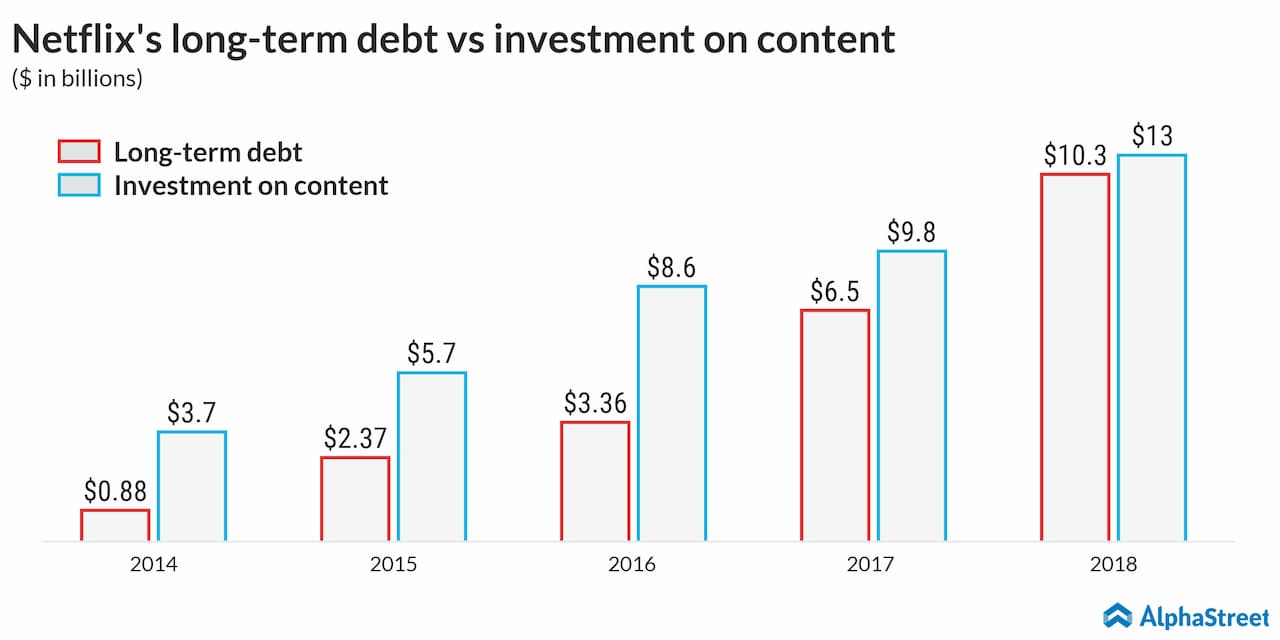

Cash flows

Cash flow is Netflix’s most hated metric. So far, investors

have largely ignored this, but this might not be the case going forward. There

is Disney (NYSE: DIS)

and Apple (NASDAQ:

AAPL) with superior cash positions, ready to take on the streaming market.

Both are likely to offer services at discounted subscriber prices to lure

customers away from Netflix. This is an impending problem facing the company.

Losing popular shows Friends and The Office will force Netflix to rethink its growth strategy. How much of original-content spend is too much? The company had earlier announced plans to cut down spending on shows that don’t have the expected level of viewership.

But it also has some original shows of its own, like Stranger Things, which had

record viewership for season 3. Despite bad reviews, its movie production Murder Mystery starring Adam Sandler and

Jennifer Aniston also had record viewership. Hence it will be a tricky business

finding the balance.

The management is likely to talk in depth about the same. Earlier, Netflix CEO Reed Hastings had welcomed the idea of Disney and Apple joining the race. It would be interesting to see his response towards the competition after a gap of a few months. In all likelihood, this response could hold the key to Netflix’s future in the streaming space.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions