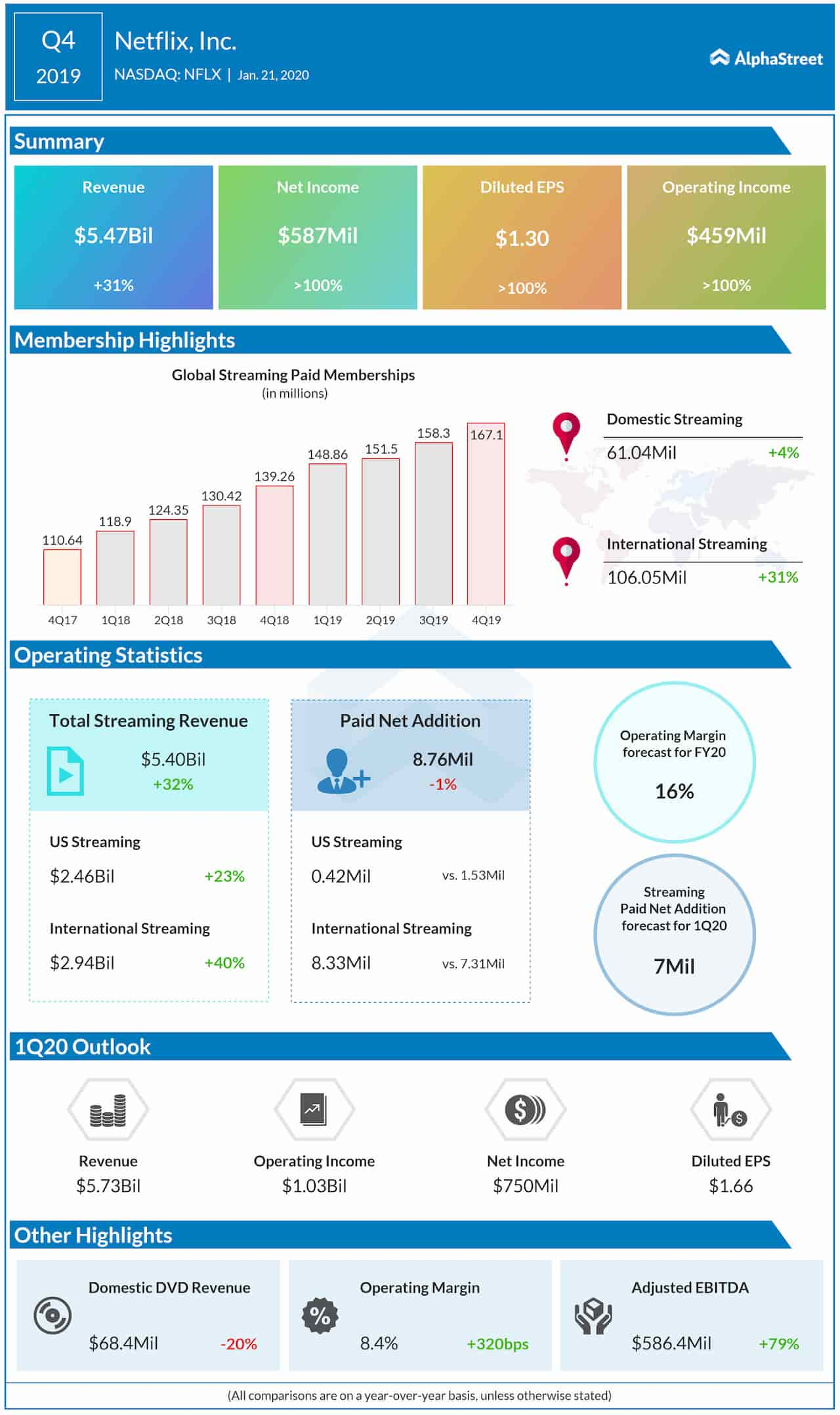

Supported by another strong growth in subscriptions, Netflix, Inc. (NASDAQ: NFLX) reported a 31% increase in fourth-quarter revenues, which also surpassed the estimates. Consequently, net profit rose sharply and topped the Street view. The stock dropped during Tuesday’s after-hours session, immediately after the announcement, as the video streamer’s first-quarter guidance fell short of expectations.

Netflix had around 167 million paid members at the end of the quarter, which is up 20% from last year. The solid subscriber addition translated into a 31% increase in revenues to $5.47 billion. Analysts had forecast a slightly slower top-line growth.

ARPU up 9%

There was a 9% increase in average revenue per user and a 21% rise in average streaming paid memberships. During the quarter, the company surpassed 100 million paid memberships outside of the US.

At 0.42 million, paid net additions in the US remained weak in the final months of 2019 and missed the forecast, continuing the recent trend. Global paid net additions were 8.8 million in the fourth quarter, which exceeded the expectations.

Earnings Surge

Net income was $587 million or $1.30 per share, compared to $134 million or $0.30 per share in the fourth quarter of 2018. The results also came in above the market’s projection. The company said it has paid US corporate taxes for the full year, inclusive of certain adjustments.

Mixed Outlook

For the first quarter of 2020, the management expects global paid net adds to be 7 million, which represents a decline from the year-ago period. The weak guidance reflects higher churn levels in the US and the recent price changes. In the whole of fiscal 2020, operating margin is expected to be 16%, up 300 basis points from last year.

Netflix shares have been on the recovery path, after losing momentum towards the end of last year. This week, they stayed almost at the levels seen a year earlier. The stock closed Tuesday’s regular session lower.