Subscription Slowdown

Also read: Disney + is strong but Walt Disney needs its theme parks

The factors that affected customer addition in the most recent quarter might persist during the remainder of the year. It needs to be noted that in the first three quarters of the current fiscal year, the subscriber base expanded more than it did in the whole of 2019. The management expects the retention rate to improve going forward and a clearer trend to emerge as the crisis eases. Ever since the shift to remote work began, there has been a marked uptick in engagement levels across the streaming space. That is expected to continue, catalyzing the retention rate.

From Netflix’s Q3 2020 earnings report:

“The state of the pandemic and its impact continues to make projections very uncertain, but as the world hopefully recovers in 2021, we would expect that our growth will revert back to levels similar to pre-COVID. In turn, we expect paid net adds are likely to be down year over year in the first half of 2021 as compared to the big spike in paid net adds we experienced in the first half of 2020.”

Outlook

Once the business loss from the disruption in production is factored in, it seems net growth has not deviated much from the target that was set before the virus outbreak. It goes without saying that production delays, due to the movement restrictions, would remain a hassle as far as meeting the targets is concerned, though operations have resumed almost in all countries. After completing just 50 productions during the shutdown period so far, the management is looking to complete 150 productions before the year-end.

Some of the promising releases that are currently in the pipeline include Old Guard, Extraction, and animation movies like Over the Moon and Klaus. A better-organized content team, after the recent restructuring drive and executive shake-up, and the strong cash position would create the right backdrop for taking forward the projects.

“We’re not yet sustainably free cash flow positive, we are ready to call that, but we’re rapidly closing in. And so given the more than $8 billion of cash on the balance sheet, we are at a point where at least you probably pretty safely say that we can self finance our growth without needing to access the capital markets, but we’re still obviously based on our guidance, probably a couple of years away at least from sustainably being free cash flow positive.”

Spencer Wang, vice president of finance and corporate development at Netflix

ADVERTISEMENT

Q3 Earnings Miss

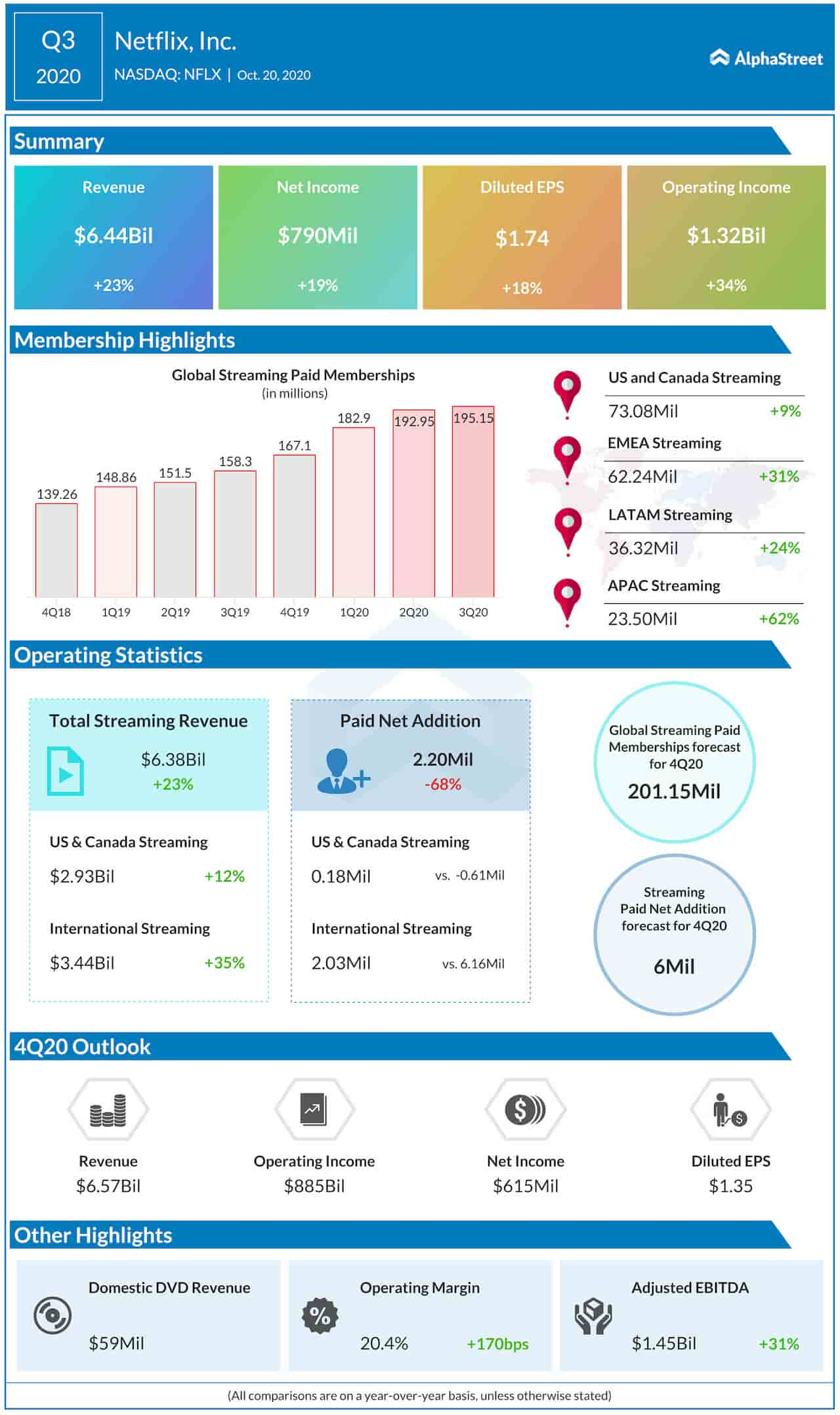

In the September-quarter, paid subscriptions grew at the slowest pace in several years and fell short of estimates. While earnings rose in double digits to $1.74 per share, there was disappointment in the market as the expectation was for a bigger gain. A 23% growth in revenues to $6.43 billion – slightly above the forecast — was not enough to bring cheer to shareholders. At the end of the quarter, the streaming business had about 195.15 million paid subscribers, up 23%.

Read management/analysts comments on Netflix’s Q3 2020 earnings

Though Netflix’s stock withdrew from the highs seen in recent months, it managed to hover near the peak all along. The shares suffered a big loss this week after the weak third-quarter numbers triggered a sell-off. They opened Wednesday’s session down 4%, after gaining steadily since the beginning of the year.