Netflix (NASDAQ: NFLX) has for long been the undisputed king of the streaming space. The streaming industry is seeing massive growth with several new players entering the field. It also received a huge fillip during the COVID-19 pandemic period as people streamed their favorite shows while sheltering at home.

Despite concerns of the pandemic-related growth surge moderating and the rising competition in the streaming space, Netflix appears well-positioned to hold its ground and continue its momentum. Here’s why:

User base

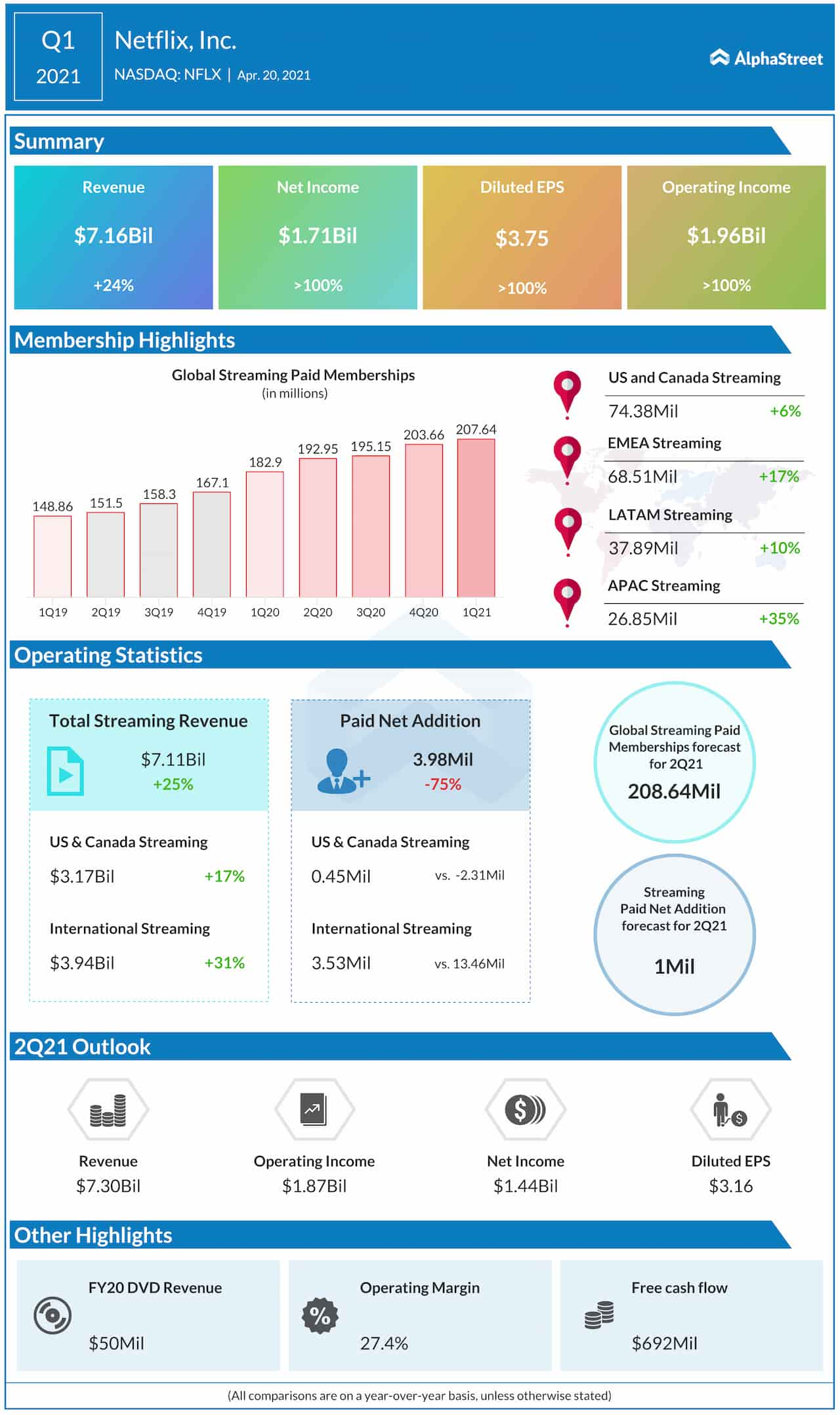

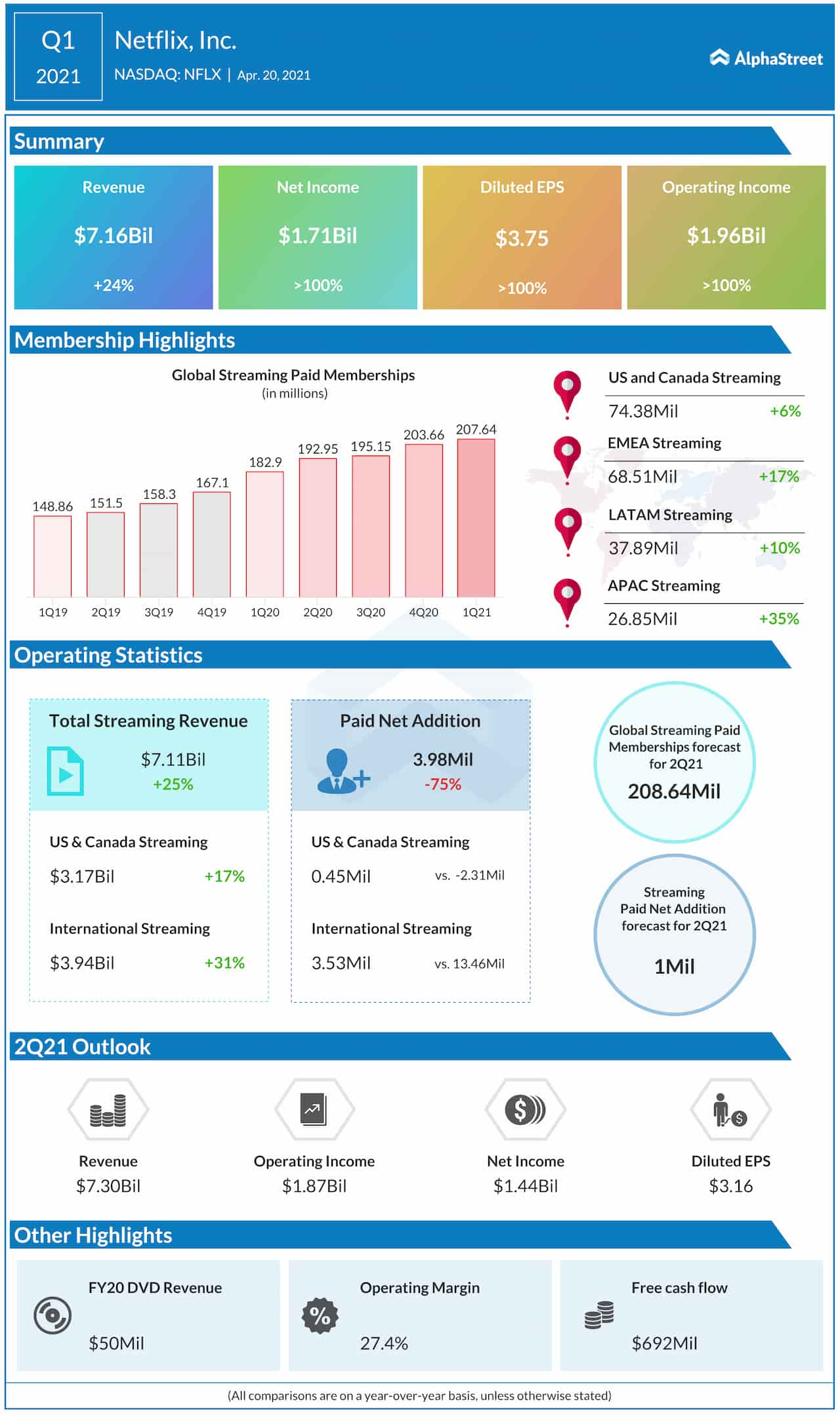

Netflix has the largest user base compared to its rivals with 208 million paid subscribers at the end of the first quarter of 2021. The number reflected a 14% growth versus the prior-year period. Its biggest competitor Disney+ had 104 million paid subscribers at the end of its most recent quarter while others like HBO Max and Discovery + are yet to cross the 100-million subscriber mark.

The streaming giant’s rivals are deploying various strategies to gain an edge over it, with Disney (NYSE: DIS) doubling down on its streaming investments and AT&T (NYSE: T) and Discovery (NASDAQ: DISCA) merging their streaming services. Netflix’s subscriber base is expected to continue growing albeit at a slower rate. The company has guided for paid memberships to grow 8% YoY to nearly 209 million in Q2 2021.

Content

Netflix’s wide range of original content is another advantage. Its strategy of reducing its dependence on licensed content as well as investing more in regional content is paying off well. Shows like Bridgerton, Lupin and Cobra Kai have become immensely popular garnering growth for the company. Netflix aims to spend over $17 billion on content this year with more original shows than last year. It will also see several of its franchises return during the second half of the year after pandemic-related delays.

Expansion opportunity

Netflix has vast expansion opportunities in international markets. The company is investing and seeing success in countries like Korea, Japan and India. It has partnered with the mobile network operator Jio in India to offer its service with mobile plans and this strategy is working well. The company plans to release 40 new films and series in India and it is also looking to invest significantly in Korea. These regions, as well as countries like Brazil and Mexico, provide vast growth potential.

Alternative revenue streams

Netflix’s entry into gaming and ecommerce provide it with alternative revenue streams which will help drive growth. Last week, the company unveiled Netflix.shop, its online retail outlet that will offer collectibles based on its shows. The company will roll out streetwear and action figures based on anime series Yasuke and Eden as well as apparel and decorative items inspired by Lupin.

These factors will help Netflix retain a strong position in the market as well as drive further growth in the coming years. Shares of Netflix have gained 17% in the past 12 months.