Peloton Interactive (NASDAQ: PTON) reported strong fourth quarter 2020 results yesterday as the stay-at-home environment resulted in a 172% growth in the company’s revenue. The interactive fitness platform swung to a profit in its final quarter of 2020. The better-than-expected Q4 results and the strong outlook lifted the PTON stock more than 10% in the pre-market trading hours today.

Q4 results

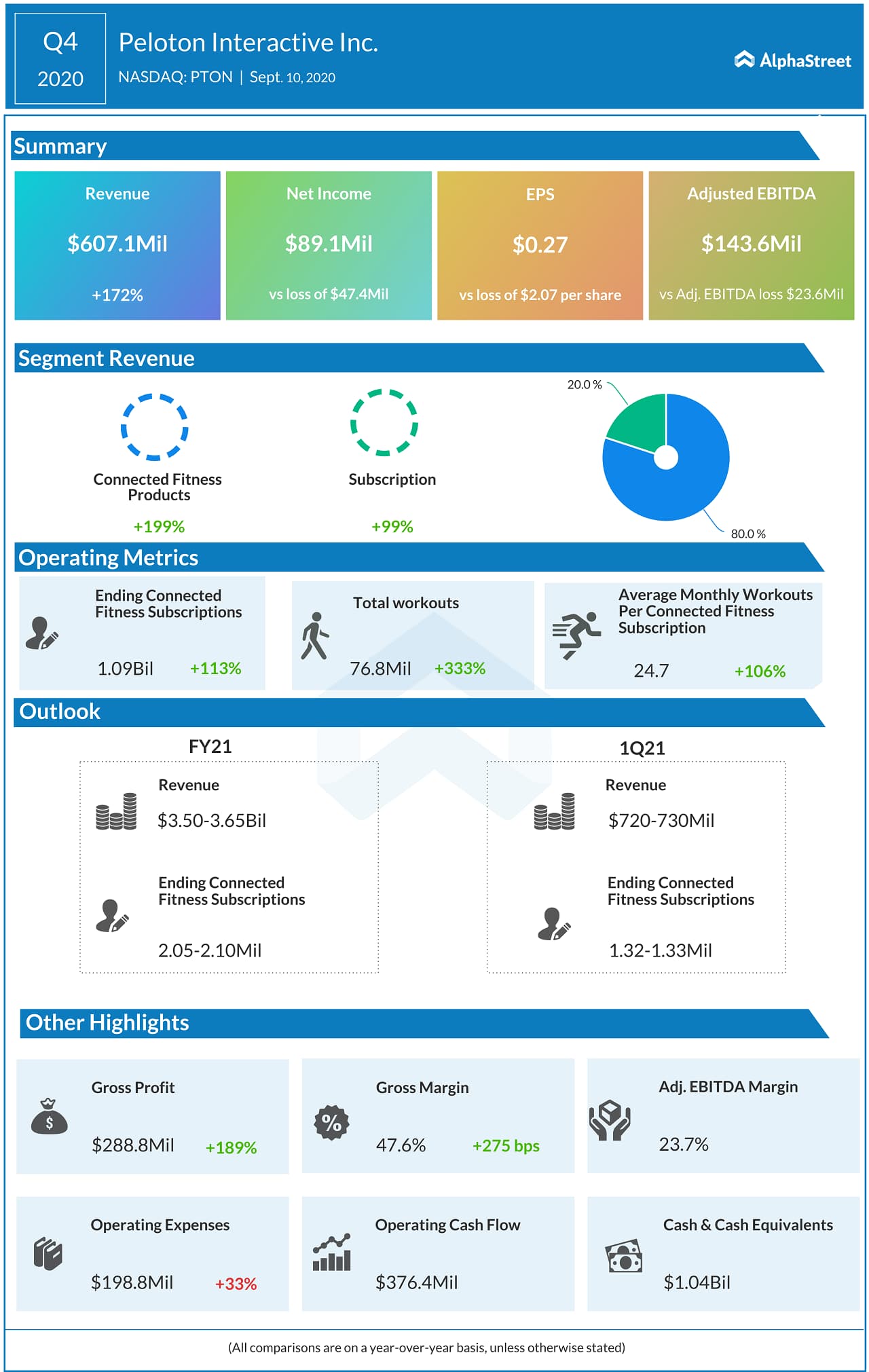

The New-York based firm, which became a public company a year ago, reported a net income of 0.27 per share compared to a loss of $2.07 per share in Q4 2019. Revenue surged 172% year-over-year to $607 million. In Q4, Peloton witnessed strong momentum in Connected Fitness subscriber and revenue growth due to COVID-19 related shelter-at-home orders. As a result of the pandemic, the company halted the majority of its media spend and most of the showrooms were closed during the quarter.

Outlook

For the first quarter of fiscal 2021, Peloton expects revenue to be between $720 million and $730 million, representing 218% growth at the midpoint. Connected Fitness Subscriptions are expected to be in the range of 1.32 million to 1.33 million.

For the full fiscal year 2021, Peloton expects revenue to be between $3.50 billion and $3.65 billion, representing a growth of 96% at the midpoint. Connected Fitness Subscriptions are expected to be in the range of 2.05 million to 2.10 million.

Also read: Peloton: Carving a niche in the virtual fitness space

The company entered into the first quarter of fiscal 2021 with a backlog of $230 million Bike deliveries in all geographies. Sales continue to surpass expectations in the first two months of Q1. Peloton expects demand to moderate in Q1 with the unexpected resurgence of COVID-19 cases in many states resulting in an imbalance of supply and demand in many geographies.

Stock performance

Peloton stock, which reached a new high ($98.61) yesterday, is expected to cross the three-digit mark today. PTON stock had surged above 200% since the beginning of this year.