Disney +, for one, is a rival with a huge library of content

which can, going forward, poach more subscribers from Netflix. The same holds true

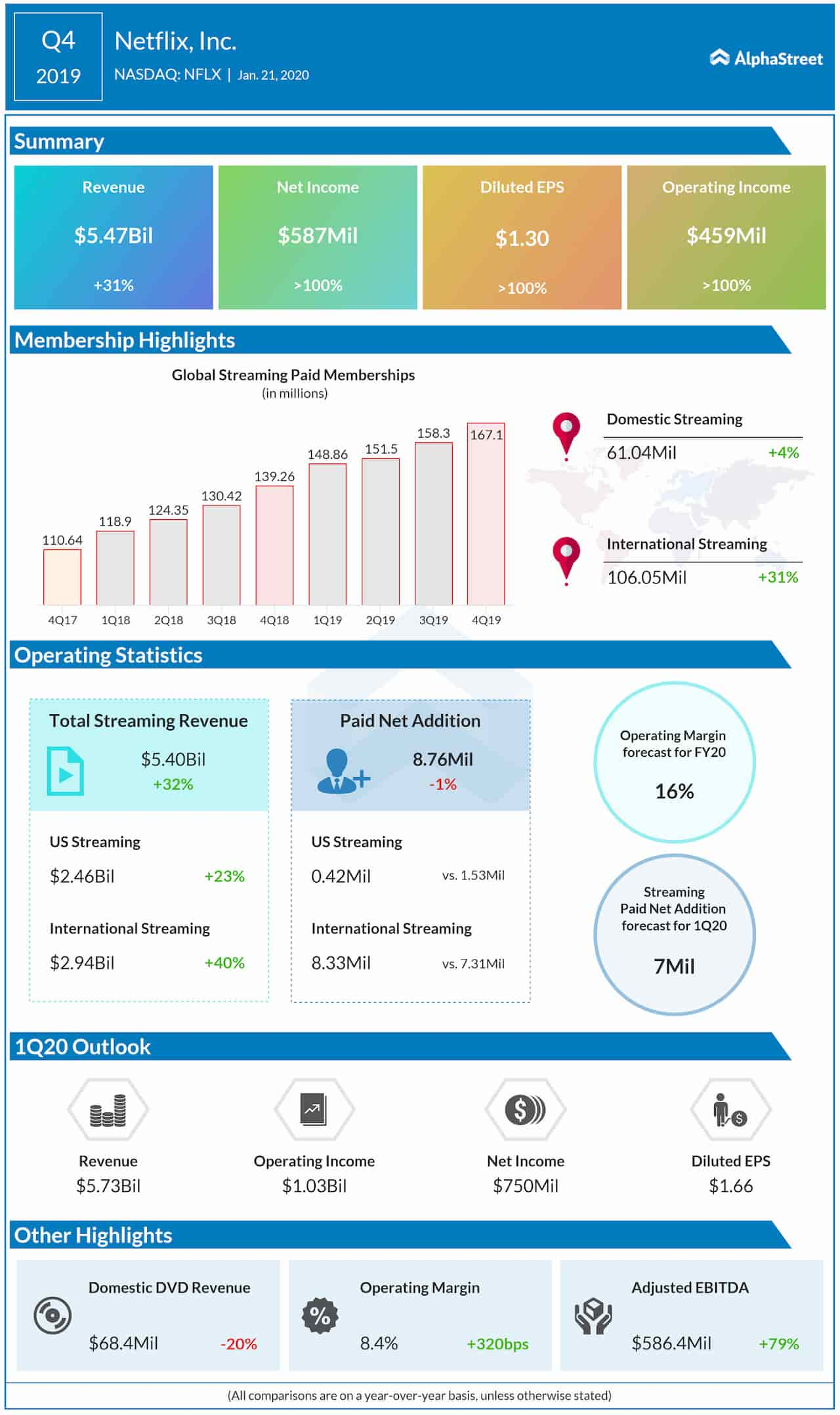

for HBO Max. Although net adds in the US and Canada region were down from the

year-ago period at 0.55 million, Netflix said it saw growth in net adds across

all the other regions – EMEA, Latin America and Asia-Pacific.

Netflix also changed the way it reports viewership. The

company will now calculate views based on users watching the content for two

minutes. Most analysts are not pleased with this move and believe this is

likely to distort the viewership metrics going forward.

Netflix continues to believe in its strategy of investing in original content and will go on increasing its investments in this area. This will continue to increase its debt load which is another cause of concern. All in all, it appears that going forward we might see a tiny dent in Netflix’s foundation as the competition increases.