Let’s take a look at what impacted Q2 sales and why the company disappointed investors, which dragged shares lower in after-hours trading.

Netflix added 10.1 million subscribers in the June quarter

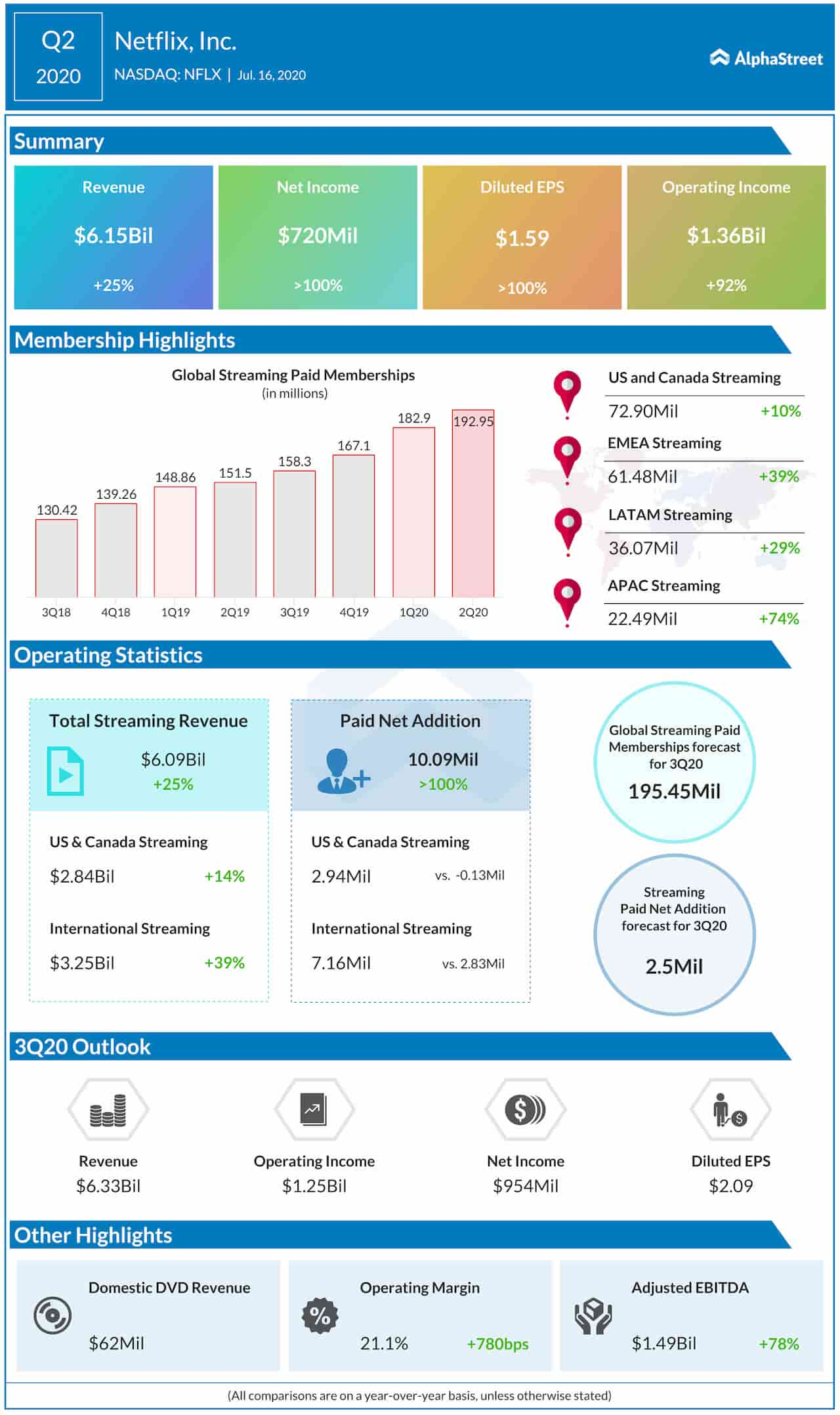

Netflix confirmed that it added 10.1 million paid subscribers in the second quarter, compared to the 2.7 million figure in the prior-year period. This was the company’s top performing second quarter in terms of subscriber additions and above its forecast of 7.5 million. In the first six months of 2020, Netflix had added 26 million paid subscribers, compared to 28 million for the whole of 2019 and 12 million in the first six months of 2019.

While the COVID-19 pandemic has decimated most sectors, Netflix continues to benefit as entertainment options are limited and a large portion of the global populace is largely stuck at home.

This growth in subscribers drove company sales higher by 24.9% year-over-year in Q2, compared to sales of $4.92 billion in the second quarter of 2019. Adjusted earnings rose 165% in this period.

Subscriber growth is expected to decline

While Netflix managed to exceed its own subscriber forecasts in the first two quarters of 2020, it expects growth to decelerate in the second half of 2020. The company estimated to add just 2.5 million subscribers in Q3 taking its total count to 195.45 million at the end of the September quarter.

Netflix added 6.8 million subscribers in the third quarter of 2019. The company said, “We’re expecting paid net adds will be down year over year in the second half as our strong first half performance likely pulled forward some demand from the second half of the year.”

Netflix forecast third quarter sales at $6.33 billion, a growth of 20.7% year-over-year with adjusted EPS of $2.09, or 42% higher compared to Q3 of 2019. Comparatively, analysts expected the streaming heavyweight to post sales of $6.39 billion and EPS of $2.00 in Q3.

Netflix’s tepid subscriber growth forecast for Q3 did not impress investors, driving the stock lower in after-hours trading.

Related: Netflix Q2 2020 Earnings Call Transcript

Operating margin and cash flow

During the company’s earnings call, Netflix claimed it is targeting an operating margin of 16% for 2020 and 19% for 2021. The company’s free cash flow profile continues to improve and is driven higher in part due to operating margin expansion as well as its move into original content production that requires more upfront capital compared to licensed content.

Further, the temporary halt in content production has pushed cash expenditure into the second half of 2020 and into 2021. This will help the company breakeven in terms of free cash flow for 2020 compared to its prior forecast of -$1 billion in cash flow. However, Netflix will again report a cash flow deficit in 2021 as content production spending continues to gain momentum.

Netflix also reported the appointment of Ted Sarandos as Co-CEO as well as on the Board of Directors. Current CEO Reed Hastings stated, “Ted has been my partner for decades. This change makes formal what was already informal — that Ted and I share the leadership of Netflix.”

Related: Is Netflix a buy after rising 50% in 2020?

What next for investors?

Netflix stock has been one of the top-performing companies for quite some time. It has gained 46% in 2020 and is up over 320% in the last five years after accounting for the after-hours decline on July 16. Long-term investors can view the 10% fall in Netflix stock as an opportunity to buy a top-quality stock at a lower valuation.

____

For more insights about Netflix, read the full transcript here.