Revenue

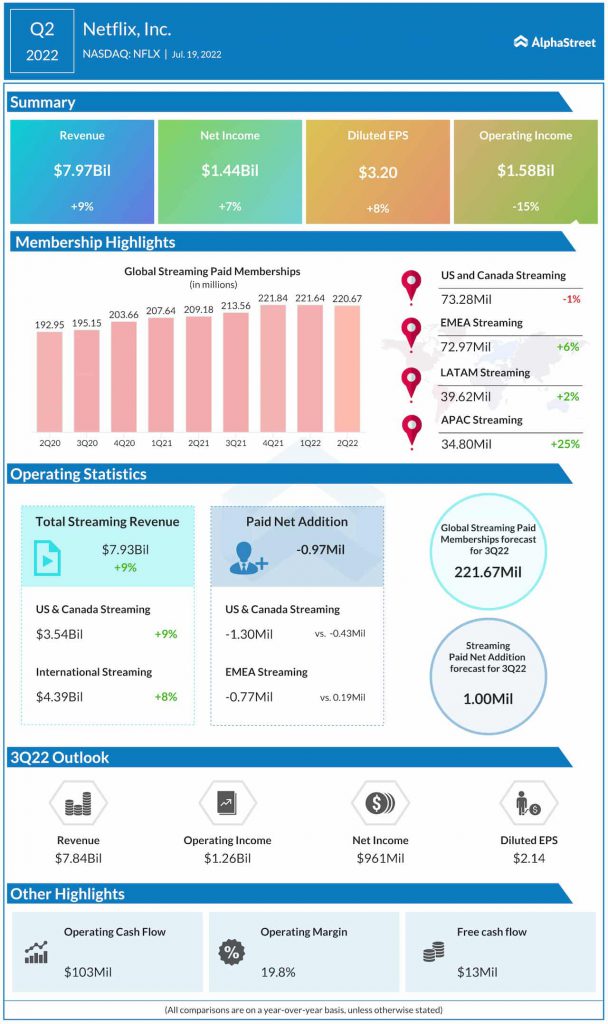

The Q3 estimated revenue growth rate is much slower than the 16.3% YoY growth recorded in Q3 2021 and the 8.6% growth posted in Q2 2022. Netflix’s revenue growth rate continues to slow down and the company has attributed this to factors like tough competition, account sharing and other macroeconomic factors.

Profitability

Netflix expects net income to be $961 million, or $2.14 per share, in Q3 2022. This compares to $1.4 billion, or $3.19 per share, reported in Q3 2021. In Q2 2022, the company reported $1.4 billion, or $3.20 per share. Analysts are predicting EPS of $2.12.

The streaming giant has guided for operating income to be $1.25 billion and operating margin to be 16% for the third quarter of 2022. This compares to operating income of $1.75 billion in Q3 2021 and $1.57 billion in Q2 2022. Operating margin was 23.5% in last year’s third quarter and 19.8% in the second quarter.

Netflix generates around 60% of its revenue from outside the US and therefore fluctuations in currency tend to impact operating profit meaningfully. Excluding currency impacts, operating profit would be down 3% YoY as opposed to the estimated 29%, while operating margin would be 20%.

User growth

This is a metric that everyone has their eyes on. Over the past two quarters, Netflix gave investors bitter pills to swallow as it reported subscriber losses, although last quarter, the company lost only 970,000 subscribers as opposed to the estimated 2 million, which was a bit of a relief. This quarter, Netflix has a more positive outlook as it expects to gain 1 million subscribers. Still, this number is lower than the 4.38 million subs it added in the year-ago period.

The company estimates paid memberships at the end of the third quarter to be 221.67 million, reflecting a YoY growth of 3.8%. Paid memberships totaled 213.56 million in the year-ago period and 220.67 million last quarter.

Netflix’s biggest rival is Disney (NYSE: DIS), with the latter surpassing it in total subscribers last quarter. Netflix continues to produce original content as well as regional content tailored to suit its various international markets in order to compete with Disney’s popular franchises. It remains to be seen how long this strategy will pay off.

Click here to read the full transcript of Netflix’s Q2 2022 earnings conference call