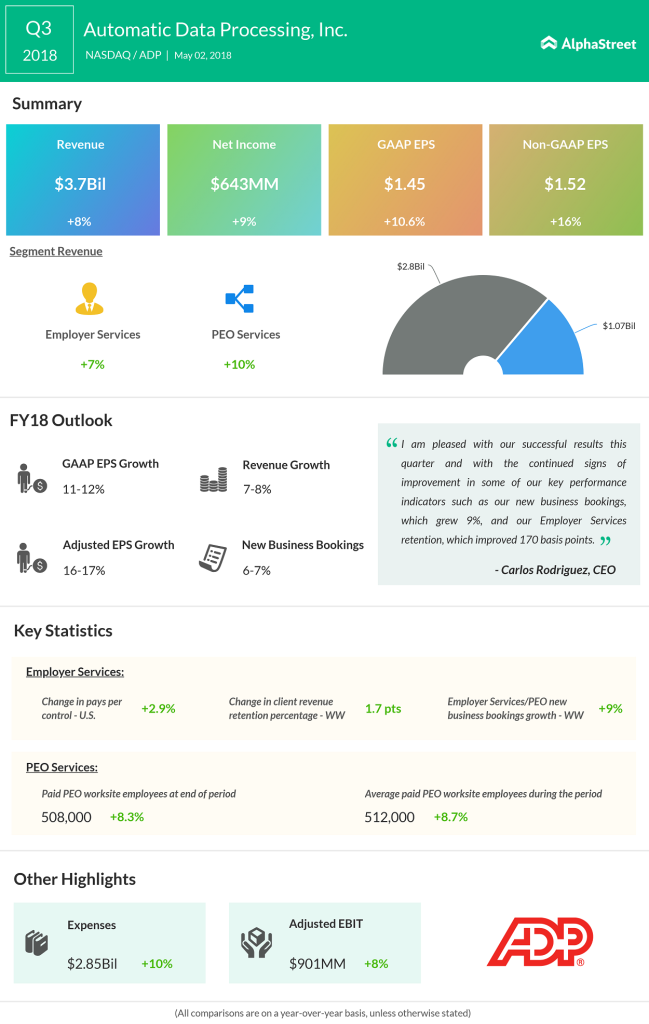

Adjusted earnings jumped 16% to $1.52 per share on revenues of $3.69 billion, which saw 8% growth. EBIT, on an adjusted basis, improved 8% to $901 million, but margins were down 20 basis points to 24.4% due to the impact from pass-through revenues and acquisitions.

Employee Services division, which used to provide HR management solutions, saw 7% growth in revenues. Client retention improved 170 basis points and the number of people served by ADP in the US improved 2.9% due to the stable labor market. Co-employment division PEO Services saw 10% revenue growth primarily driven by 9% increase in the number of people paid by the company.

For fiscal 2018, ADP expects the earnings to grow in the range of 11% to 12% on a GAAP basis and 16% to 17% on an adjusted basis, and maintains the revenue growth forecast to be between 7% and 8%. New business bookings are expected to be up in the range of 6% to 7% compared to previous guidance of 5% to 7%.