On its earnings conference call, Nio said the auto industry

is experiencing softness and EV sales, in particular, dropped over 35%

year-on-year during the second-half of 2019 due to the reduction in EV

subsidies.

Nio continues to invest in its power swap technology, which

allows users to upgrade the battery and allows the company to offer Battery as

a Service. The company is optimistic about the growth potential of this system.

The company has been undertaking several cost reduction

efforts which helped reduce SG&A expenses by 18% and R&D expenses by

21%.

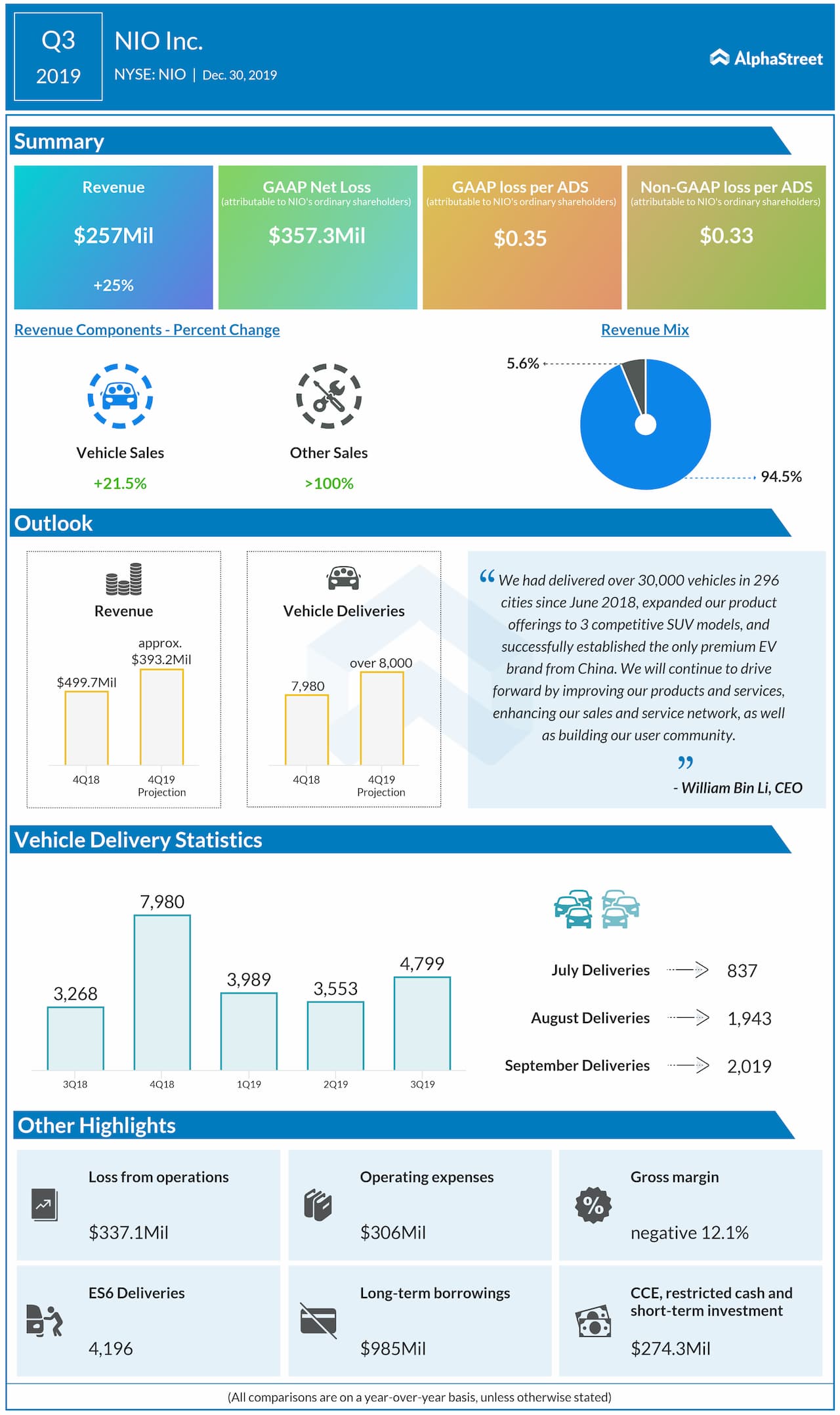

For the fourth quarter of 2019, Nio expects total revenues to be approx. $393.2 million, up approx. 53% from the third quarter. Total vehicle deliveries are expected to be over 8,000 units, up over 66.7% from the third quarter.