In an interview with AlphaStreet, Alteryx CFO Kevin Rubin said he sees the challenging customer buying cycle witnessed so far this year to drag on till the end of the fiscal year. “We have pretty good visibility into customer conversations and pipeline and those things. And I would just simply go back to the guidance we set when we set it,” he said.

Meanwhile, the CFO stated that the hike in server costs rolled out earlier this year did not have any material impact on the revenues. It may be noted that this was the first pricing change over the past years, despite adding multiple new features and functionalities.

“Renewals were up around the time the price change went into effect. And so there was a small population of customers that we worked with around pricing. But on the whole, we haven’t seen any real negative impact from adjusting the price of server.”

Dealing with contract duration

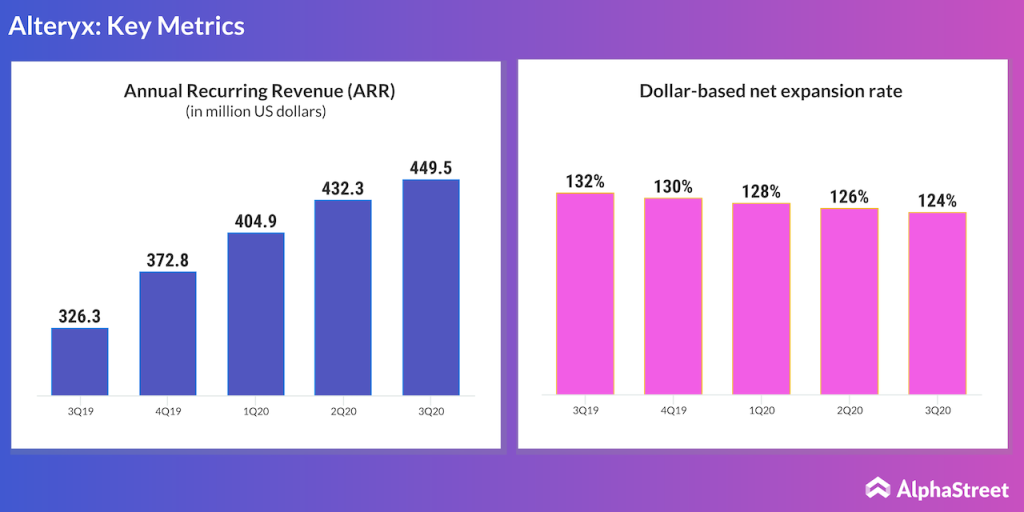

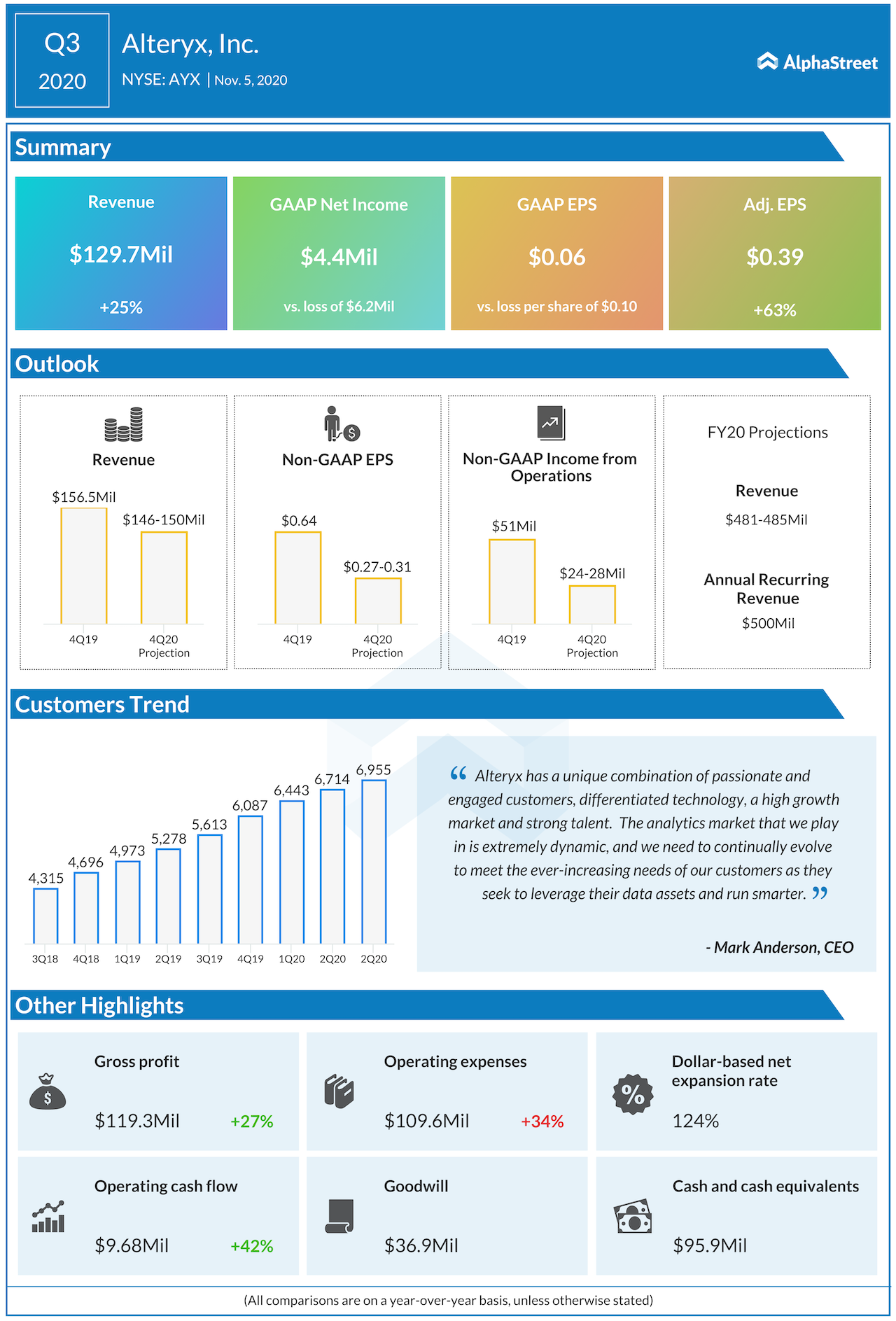

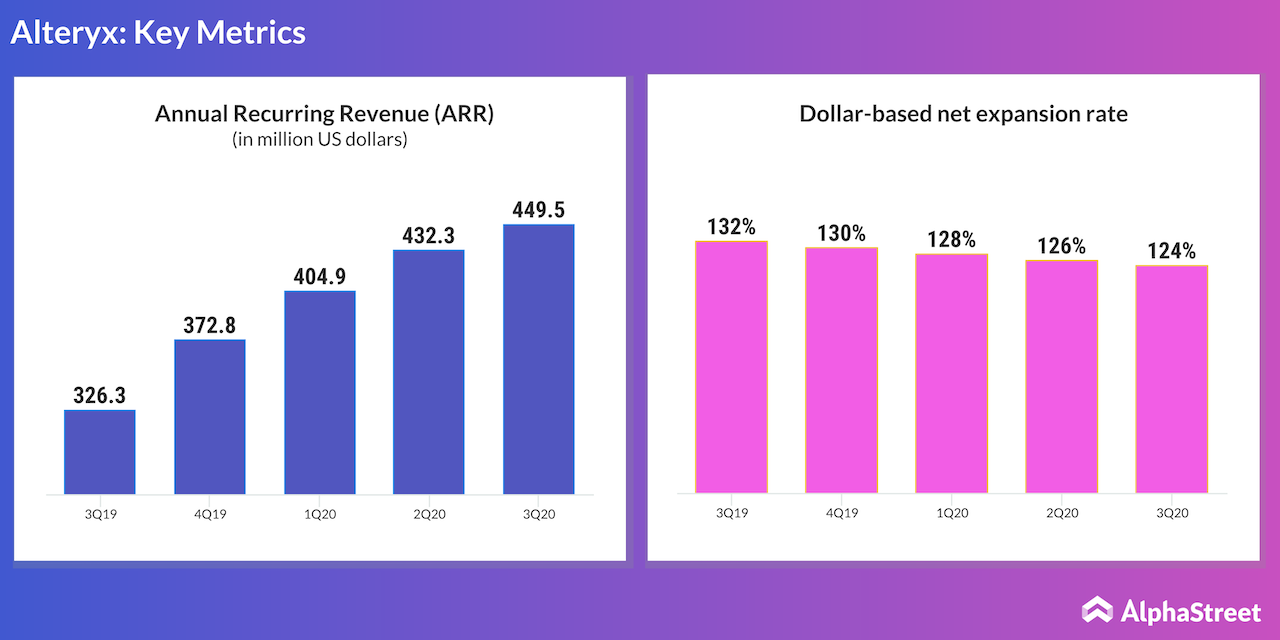

The pandemic had forced some of Alteryx’s clients to choose short-term contracts over multi-year ones. Since the company records about a third of the total contract value upfront, the shorter-duration deals had a squeezing impact on the revenues. In fact, many investors look at the company’s annual recurring revenue (ARR) for a more balanced understanding of top-line performance.

Asked about the management’s strategy on encouraging clients to opt for long-duration contracts, Rubin said the incentive program is designed in a way to put the sales rep in a neutral position. “That being said, our compensation plans are purposely designed to provide different behaviors and incentives and they have always included components around multi-year duration,” the executive added.

Since the beginning of the year, Alteryx shares have gained 13%. The stock has a 12-month average price target of $162, which is at a 36% upside from the trading price on Thursday.

______

For more insights into Alteryx Inc, read the latest earnings call transcript for free.