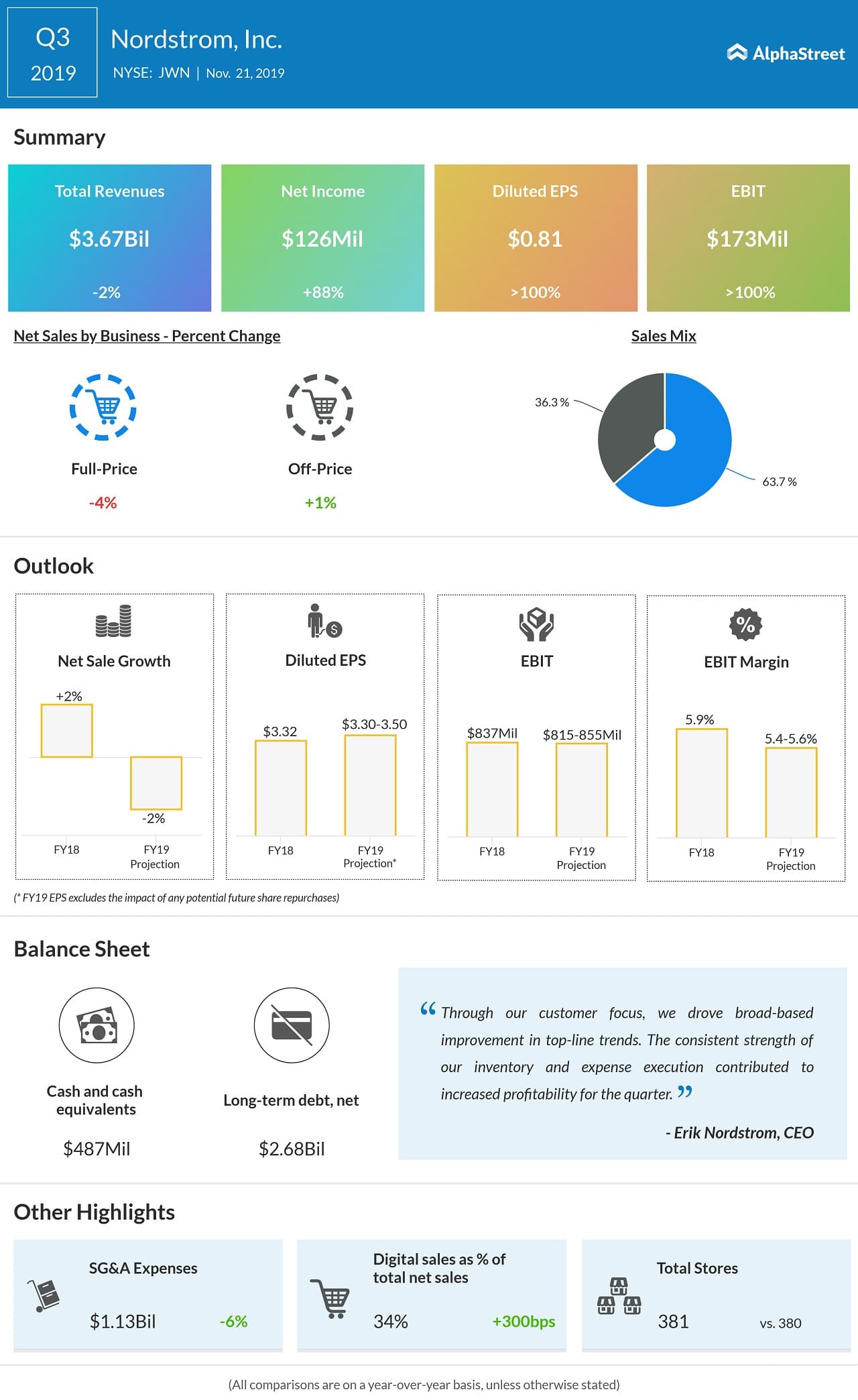

Nordstrom Inc. (NYSE: JWN) reported a 2% decline in third-quarter total revenue to $3.67 billion, in line with analysts’ prediction. Consolidated digital sales grew 7% and represented 34% of the business.

Meanwhile, net income of 81 cents per share was higher than the Wall Street prediction of 64 cents per share.

Shares soared over 7.8% in the aftermarket hours on Thursday. The

stock has tanked 27% since the beginning of this year.

For the full year of 2019, the company raised the lower leg of its EPS outlook to come in the range of $3.30-3.50. EBIT margin for this period is currently expected to be $815 to $855 million, versus the earlier estimate of $805 to $855 million.

READ: Boxlight President Michael Pope on its products, marketing strategy and the stock

ADVERTISEMENT

“Our third-quarter earnings exceeded expectations, demonstrating substantial progress in the delivery of our strategy and the strength of our operating discipline. Through our customer focus, we drove broad-based improvement in top-line trends,” Nordstrom president Erik Nordstrom said.

Nordstrom aims to gain market share by increasing customer engagement through services and leveraging inventory in its most important markets. The combination of Nordstrom’s physical and digital assets is expected to add a significant sales lift in this market in the coming quarters.