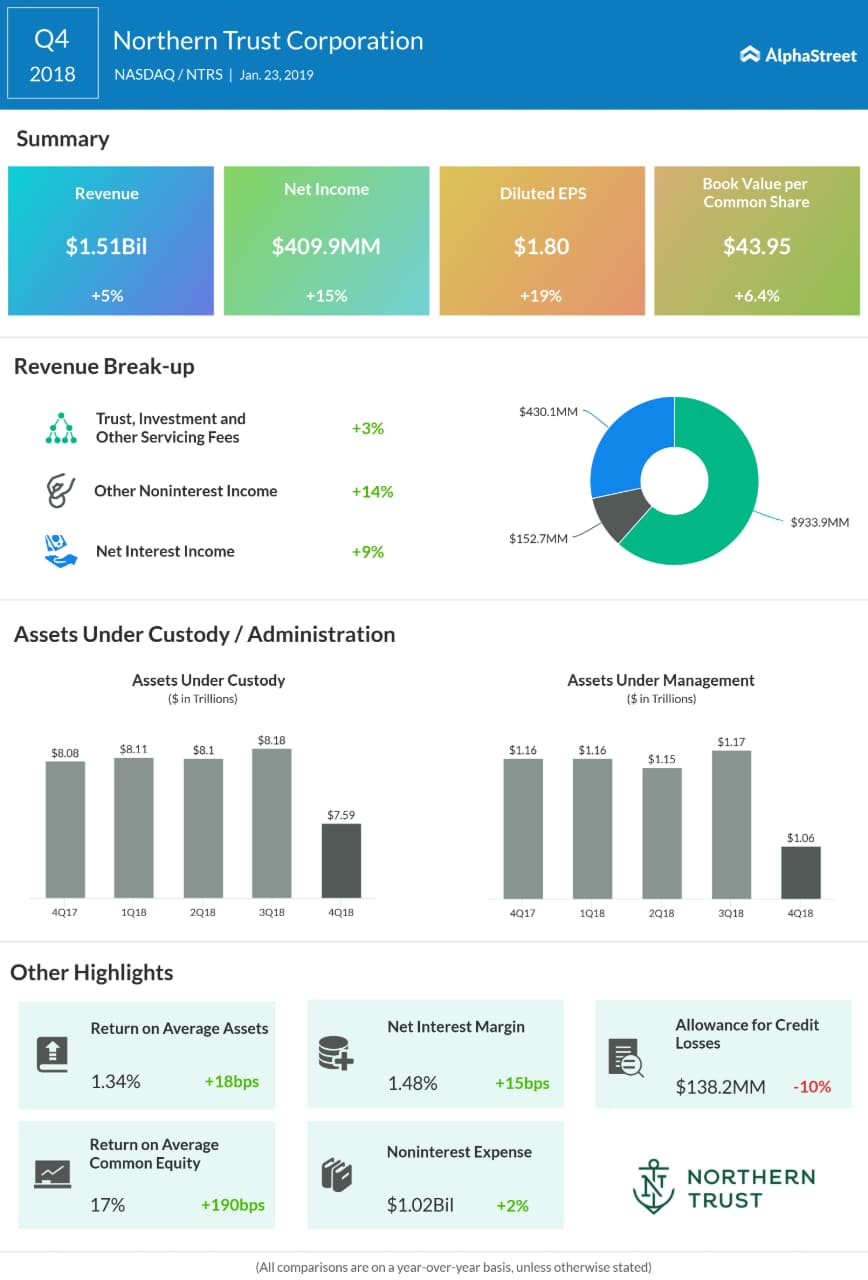

Net income grew 15% to $409.9 million and EPS grew 19% to $1.80 compared to the prior-year period.

Total assets under custody/administration dropped 6% to $10.1 trillion while total assets under management decreased 8% to $1.1 trillion.

Total consolidated trust, investment and other servicing fees grew 3% to $933.9 million in the quarter. Total C&IS trust, investment and other servicing fees remained flat versus the previous year. Custody and fund administration fees grew mainly due to new business while investment management fees and securities lending fees fell due to outflows and lower loan volumes and spreads.

Also see: Northern Trust Q4 2018 Earnings Conference Call Transcript

Total wealth management fees rose 6% year-over-year, helped by increases across all divisions, driven by new business and favorable markets.

Total other noninterest income grew 14% versus the prior-year quarter helped by increases in foreign exchange trading income and other operating income. Net interest income, on an FTE basis, grew 9% mainly due to a higher net interest margin. Total noninterest expense grew 2% year-over-year.

During the quarter, Northern Trust declared cash dividends of $5.9 million for preferred stockholders and $123.6 million for common stockholders. The company also repurchased shares worth $234.6 million in the period.