NovoCure also has under development, Maxpoint, a software system aimed at optimizing tumor treating field dose.

Business opportunity

In an interview with AlphaStreet, NovoCure CFO Ashley Cordova said the fact that their mode of treatment is complementary to other treatments, and that there are no major side effects from its use besides mild skin irritation, act as a major USP among potential clients. The treatment is currently approved by the FDA for glioblastoma and mesothelioma, but the company sees its application on a wide range of solid tumors. The CFO explained:

Tumor Treating Fields is intended to be used in combination with whatever the underlying standard of care is, to show a statistically significant extension in overall survival. That is exactly how we run our clinical trials and it’s how we position ourselves in the commercial business.

ADVERTISEMENT

NovoCure does not see glioblastoma, being a rare form of cancer, as its biggest opportunity; rather it’s seen as a gateway to more common solid tumors. Outside glioblastoma, the St. Helier, Jersey-based firm has demonstrated successful phase two data in lung cancer, ovarian cancer, and pancreatic cancer.

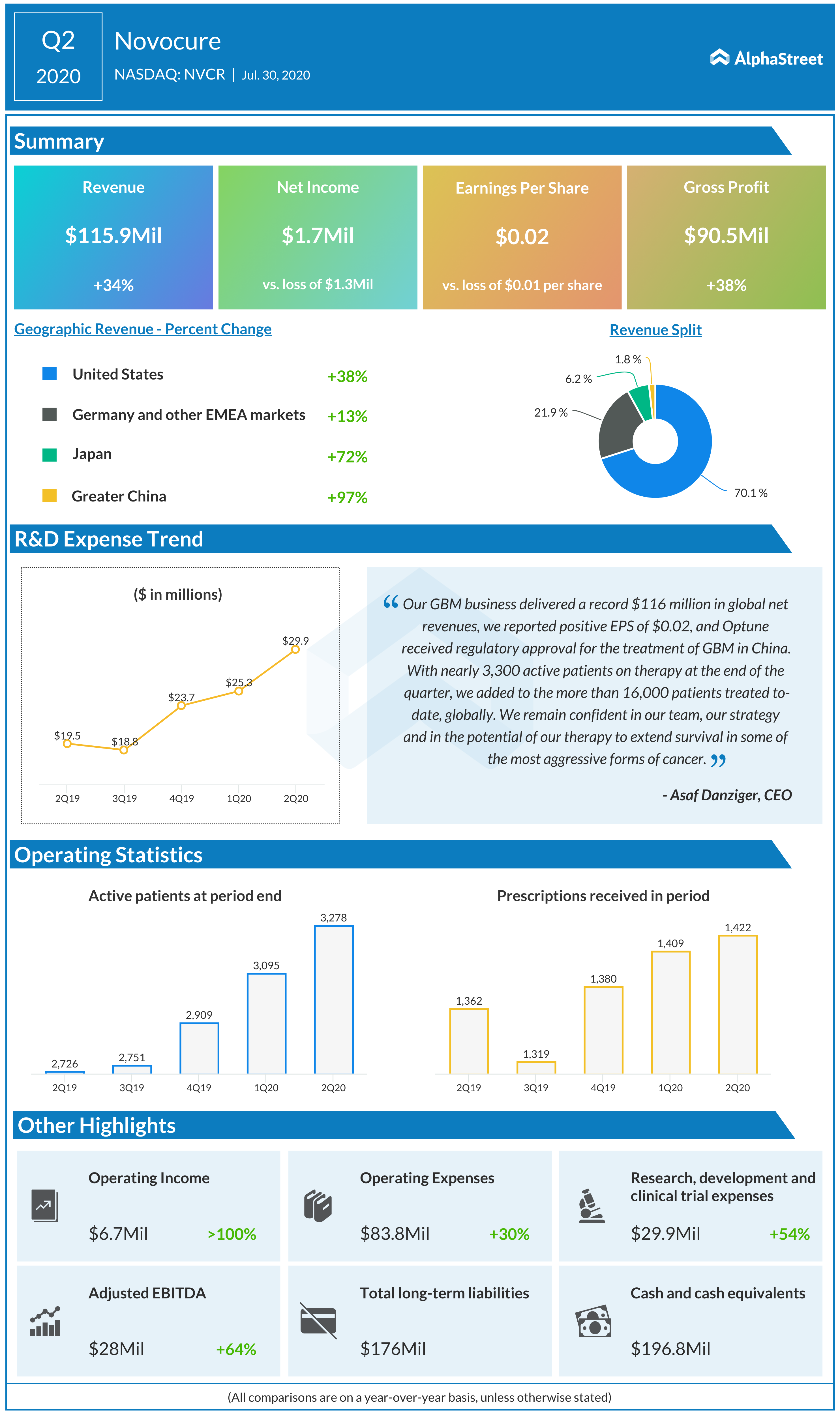

Interestingly, the profits generated from the glioblastoma side are pumped back into the firm to drive the R&D expenses, reducing dependence on external funding, unlike many other biotech firms.

Partnerships and global presence

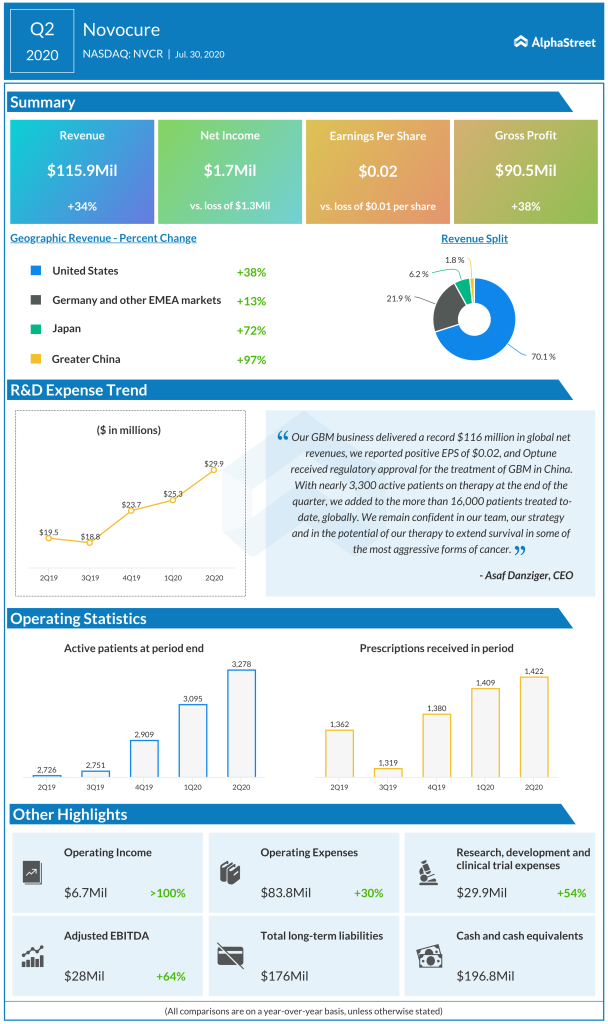

NovoCure generates revenues from four major regions – US, EMEA, Japan and China (see infographic), and considers all these markets underpenetrated. The CFO estimates its current penetration into existing markets at around 30%, leaving plenty of room for expansion over the next few years.

In China, the company has partnered with biopharmaceutical firm Zai Lab (NASDAQ: ZLAB) to streamline distribution and accelerate clinical trial enrollment. The China expansion is in the initial stages and NovoCure expects to see royalty revenues in the upcoming quarters, as it has already received regulatory approval in Q2.

Back in the US, the company has partnered with pharmaceutical giant Merck (NYSE: MRK) to study Keytruda in combination with its bioelectric treatment in first-line stage three non-small cell lung cancer. Cordova commented:

“We believe we have an incredible opportunity in hand with tumor treating fields, and I do think these partnerships will become more exciting to many counterparties as they see the results of the Merck trial.”

NVCR stock has jumped 16% since the beginning of this year and is currently trading around $90. As on Monday, September 14, NovoCure had a market cap of $9.33 billion.

_____

For more insights into NovoCure, read the latest earnings call transcript here.