Stock Peaks

In recent quarters, the GPU giant’s revenues and profit more than doubled year-over-year, driven by the growing demand for its AI chips. For the quarter that ended in October 2024, market watchers project adjusted earnings of $0.74 per share, which represents a year-over-year increase of 100%. The consensus revenue estimate for the third quarter is $32.94 billion, compared to 18.12 billion in Q3 2024. The report is slated for publication on Wednesday, November 20, at 4:20 pm ET.

Trendsetter

Nvidia’s AI chip development program has been eliciting significant interest among stakeholders in the technology industry due to its potential to revolutionize processes like the training and deployment of AI-powered applications. As a key supplier to major tech companies like Alphabet, Meta, and Amazon, Nvidia’s financial performance can serve as an indicator of the AI industry’s growth trajectory.

From Nvidia’s Q2 2025 earnings call:

“We plan to launch new Spectrum-X products every year to support demand for scaling compute clusters from tens of thousands of GPUs today to millions of DPUs in the near future. Spectrum-X is well on track to begin a multibillion-dollar product line within a year. Our sovereign AI opportunities continue to expand as countries recognize AI expertise and infrastructure at national imperatives for their society and industries. Japan’s National Institute of Advanced Industrial Science and Technology is building its AI Bridging Cloud Infrastructure 3.0 supercomputer with NVIDIA.”

Stellar Results

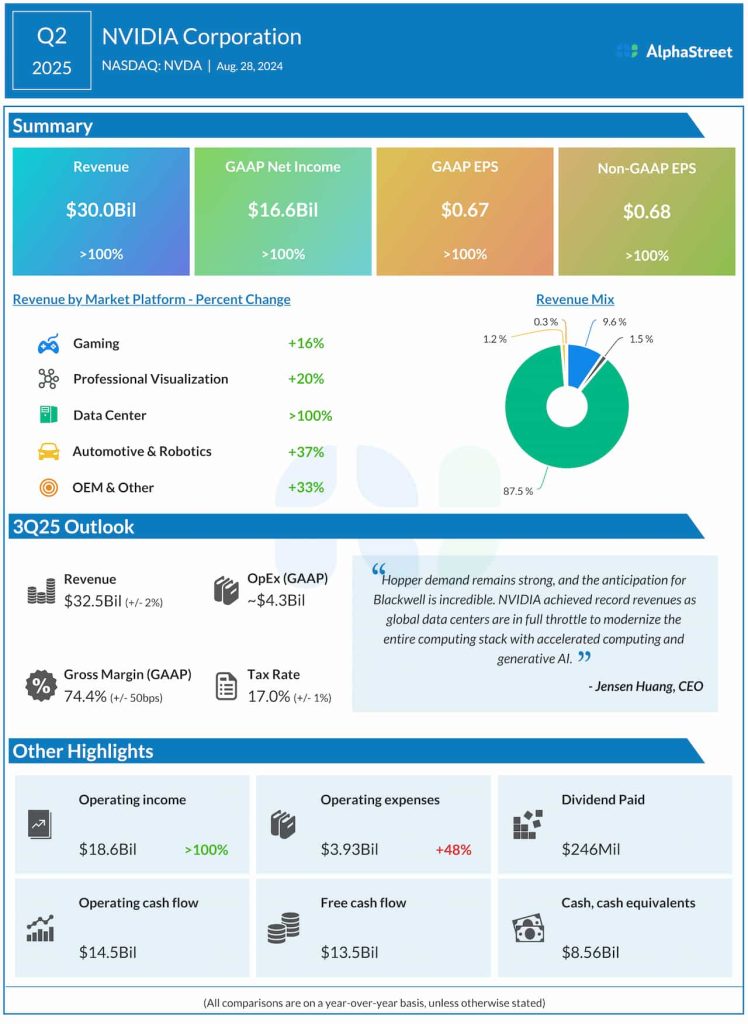

In the second quarter, the tech firm’s revenues climbed to $30.0 billion from $13.5 billion a year earlier, mainly reflecting strong performance by the Data Center and Gaming segments. Adjusted profit rose sharply to $0.68 per share in Q2 from $0.27 per share a year earlier. Unadjusted net income was $16.6 billion or $0.67 per share in Q2, compared to $6.19 billion or $0.25 per share in Q2 2024. The company’s quarterly revenue and profit consistently exceeded estimates for about two years.

On Tuesday, Nvidia’s shares opened at $146.78 and traded up 2% in the afternoon. That is sharply above the 52-week average price of $95.93.