Revenue plunged by 24% to $2.21 billion. The results were hurt by a decline in Gaming. Gaming revenues dropped 45% on weakness in gaming GPUs and a decline in shipments of SOC modules for gaming platforms.

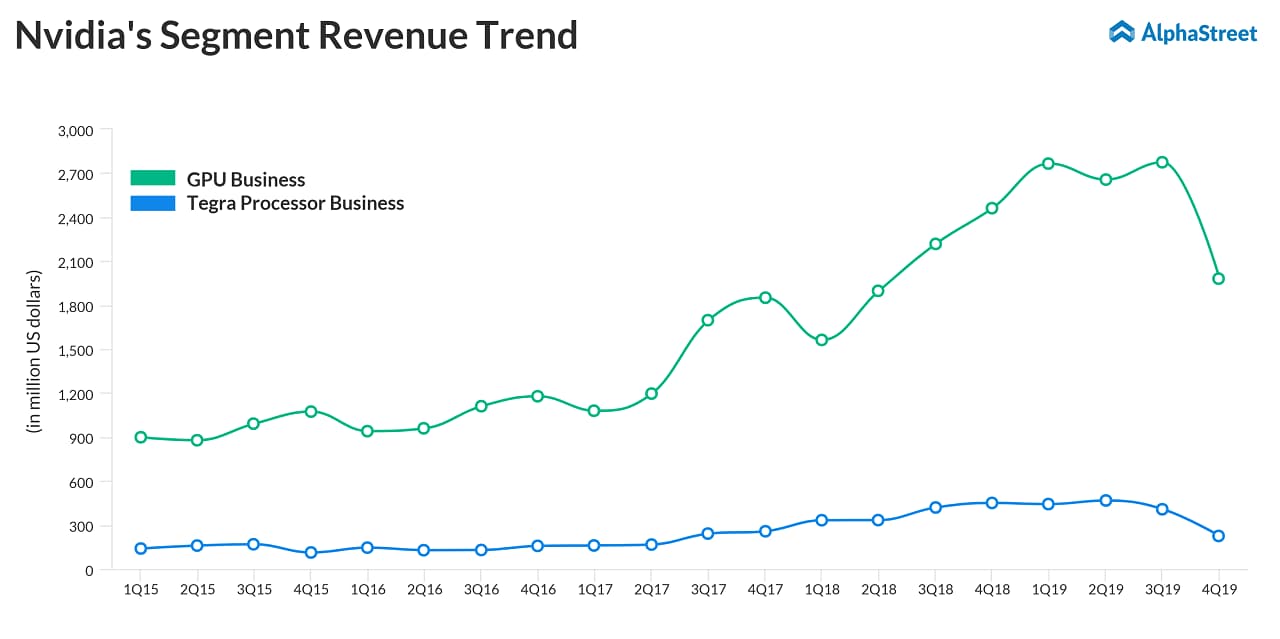

GPU business revenue declined by 20% primarily reflecting declines in gaming GPUs. Tegra Processor business revenue plunged 50% due to a fall in shipments of SOC modules for gaming platforms. OEM and IP revenue fell by 36% due to the absence of crypto-currency mining GPU sales.

However, Professional Visualization revenue increased by 15% driven by the strength across both desktop and mobile workstation products. Datacenter revenue rose by 12% on growth in sales of Volta architecture products, including Nvidia Tesla V100 and DGX systems. Automotive revenue grew by 23% on growth in infotainment modules, production DRIVE platforms, and development agreements with automotive companies.

Looking ahead into the first quarter of 2020, the company expects revenue to be $2.20 billion, plus or minus 2%, and gross margin to be 58.8%, plus or minus 50 basis points. Adjusted gross margin was predicted to be 59%, plus or minus 50 basis points. For fiscal 2020, revenue is expected to be flat to down slightly.

For the first quarter, operating expenses are anticipated to be about $930 million and adjusted operating expenses are predicted to be $755 million. The sequential change in operating expenses reflects an increase in stock-based compensation. Capital expenditures are expected to be about $150 million to $170 million.

In fiscal 2019, the company returned $1.95 billion to shareholders through a combination of $1.58 billion in share repurchases and $371 million in quarterly cash dividends. After returning $700 million through share repurchases during the fourth quarter, the company plans to return the balance $2.30 billion by the end of fiscal 2020.

Nvidia will pay its next quarterly cash dividend of $0.16 per share on March 22, 2019, to all shareholders of record on March 1, 2019.

Shares of Nvidia ended Thursday’s regular session up 1.08% at $154.53 on the Nasdaq. Following the earnings release, the stock inched up 7.60% in the after-market session.