Full-year 2025 performance

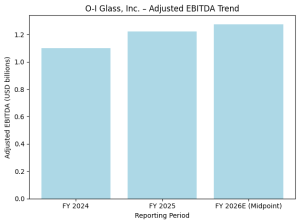

For full-year 2025, O-I Glass reported net sales of $6.43 billion, broadly stable compared with $6.53 billion in 2024. Despite relatively flat volumes, profitability improved meaningfully. Adjusted EBITDA rose to $1.22 billion from $1.10 billion in the prior year, lifting the adjusted EBITDA margin to 19.0% from 16.8%.

Adjusted earnings per share (aEPS) doubled to $1.60 from $0.81 in 2024. Free cash flow turned positive at $168 million, compared with a negative $128 million in the prior year. Net debt leverage improved to 3.5x from 3.9x, reflecting stronger cash generation and disciplined capital allocation.

The company said its “Fit to Win” program delivered $300 million of savings in 2025, exceeding the $250 million target. O-I also increased the three-year cumulative savings target to at least $750 million, from a prior target of at least $650 million.

Q4 2025 results

In the fourth quarter, net sales were $1.50 billion, slightly lower than $1.53 billion a year earlier, as sales volumes declined about 6.5% year on year on a comparable basis. Despite the volume decline, profitability improved. Adjusted EPS increased to $0.20, compared with a loss of $0.05 in Q4 2024.

Segment operating profit rose 30% year on year to $177 million, with improvement in both the Americas and Europe segments. Segment operating profit margins expanded to 11.9% from 9.1% a year earlier, reflecting operating cost actions and Fit to Win benefits.

Segment performance

In FY25, the Americas segment recorded net sales of $3.64 billion, with segment operating profit of $549 million, translating to a margin of 15.1%. The Europe segment reported net sales of $2.69 billion and segment operating profit of $297 million, with a margin of 11.0%. Management highlighted that operating cost reductions more than offset pricing and volume pressures across regions.

Cash flow, capex and balance sheet

Free cash flow improved by nearly $300 million year on year in 2025, driven by higher earnings and tighter working capital control. Capital expenditure declined by about 30% year on year, supporting cash generation. The company ended 2025 with net debt leverage of 3.5x, moving closer to its medium-term target range.

O-I said it continues to prioritize debt reduction, disciplined capital spending and selective investments aligned with customer demand and sustainability initiatives.

2026 outlook

For 2026, O-I Glass guided adjusted EBITDA of $1.25 billion to $1.30 billion, adjusted EPS of $1.65 to $1.90, and free cash flow of about $200 million. Management expects Fit to Win savings to continue to accrue, supporting margin expansion, even as net price headwinds and energy contract resets in Europe weigh on near-term comparisons.

The company reaffirmed its 2027 Investor Day targets, including adjusted EBITDA of at least $1.45 billion, free cash flow of at least 5% of sales, and net debt leverage of 2.5x or lower.

Summary

O-I Glass delivered a marked improvement in earnings and cash flow in 2025, driven by cost savings under its Fit to Win program and disciplined capital management, despite relatively stable revenue and softer volumes. Fourth-quarter profitability improved across regions, and management expects further progress in 2026 as cost initiatives continue and leverage trends lower.